Northwest & Ethical Investments L.P. lifted its position in shares of Atlassian Corporation PLC (NASDAQ:TEAM - Free Report) by 208.0% in the 1st quarter, according to its most recent disclosure with the SEC. The fund owned 4,466 shares of the technology company's stock after acquiring an additional 3,016 shares during the period. Northwest & Ethical Investments L.P.'s holdings in Atlassian were worth $946,000 as of its most recent filing with the SEC.

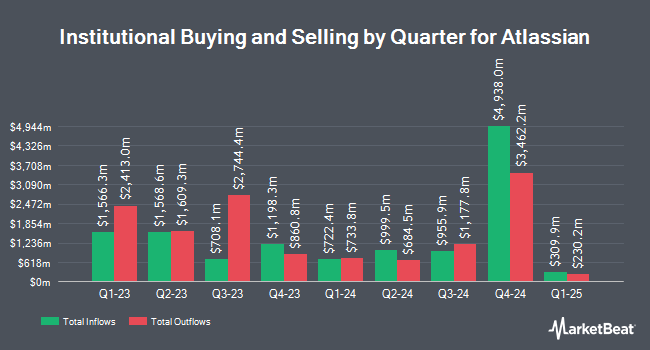

Several other institutional investors have also modified their holdings of the company. Raymond James Financial Inc. grew its position in shares of Atlassian by 113.5% during the first quarter. Raymond James Financial Inc. now owns 82,703 shares of the technology company's stock worth $17,550,000 after acquiring an additional 43,960 shares during the last quarter. American Century Companies Inc. grew its position in shares of Atlassian by 35.2% during the first quarter. American Century Companies Inc. now owns 242,794 shares of the technology company's stock worth $51,523,000 after acquiring an additional 63,221 shares during the last quarter. Ethic Inc. grew its position in shares of Atlassian by 13.6% during the first quarter. Ethic Inc. now owns 7,054 shares of the technology company's stock worth $1,527,000 after acquiring an additional 845 shares during the last quarter. Aberdeen Group plc grew its position in shares of Atlassian by 122.4% during the first quarter. Aberdeen Group plc now owns 101,741 shares of the technology company's stock worth $21,590,000 after acquiring an additional 55,993 shares during the last quarter. Finally, Azimuth Capital Investment Management LLC grew its position in shares of Atlassian by 58.8% during the first quarter. Azimuth Capital Investment Management LLC now owns 47,237 shares of the technology company's stock worth $10,024,000 after acquiring an additional 17,500 shares during the last quarter. Institutional investors own 94.45% of the company's stock.

Analysts Set New Price Targets

Several research firms recently weighed in on TEAM. BMO Capital Markets reduced their price objective on shares of Atlassian from $225.00 to $200.00 and set an "outperform" rating for the company in a report on Friday, August 8th. Capital One Financial downgraded shares of Atlassian from an "overweight" rating to an "equal weight" rating and set a $211.00 price objective for the company. in a report on Wednesday, July 16th. Stephens reduced their price objective on shares of Atlassian from $221.00 to $202.00 and set an "equal weight" rating for the company in a report on Monday, August 11th. UBS Group reaffirmed a "hold" rating on shares of Atlassian in a report on Monday, July 7th. Finally, Wells Fargo & Company reduced their price objective on shares of Atlassian from $330.00 to $315.00 and set an "overweight" rating for the company in a report on Friday, May 2nd. One equities research analyst has rated the stock with a Strong Buy rating, eighteen have assigned a Buy rating and six have assigned a Hold rating to the company. According to data from MarketBeat.com, Atlassian currently has a consensus rating of "Moderate Buy" and an average price target of $256.90.

Read Our Latest Stock Analysis on Atlassian

Insider Activity at Atlassian

In other Atlassian news, CEO Michael Cannon-Brookes sold 7,665 shares of the company's stock in a transaction dated Wednesday, August 20th. The shares were sold at an average price of $166.30, for a total transaction of $1,274,689.50. Following the completion of the sale, the chief executive officer directly owned 206,955 shares of the company's stock, valued at approximately $34,416,616.50. This represents a 3.57% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Scott Farquhar sold 7,665 shares of the company's stock in a transaction dated Wednesday, August 20th. The shares were sold at an average price of $166.30, for a total value of $1,274,689.50. Following the completion of the transaction, the director owned 206,955 shares in the company, valued at $34,416,616.50. This represents a 3.57% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 510,134 shares of company stock valued at $99,681,446. Corporate insiders own 38.55% of the company's stock.

Atlassian Trading Up 3.8%

TEAM stock traded up $6.20 during mid-day trading on Friday, reaching $170.79. 1,724,901 shares of the stock traded hands, compared to its average volume of 2,876,878. The company has a current ratio of 1.22, a quick ratio of 1.26 and a debt-to-equity ratio of 0.73. Atlassian Corporation PLC has a 52-week low of $154.07 and a 52-week high of $326.00. The company has a market cap of $44.83 billion, a P/E ratio of -172.51 and a beta of 0.96. The stock's fifty day moving average is $190.67 and its 200-day moving average is $218.11.

Atlassian (NASDAQ:TEAM - Get Free Report) last posted its quarterly earnings data on Thursday, August 7th. The technology company reported $0.98 EPS for the quarter, beating analysts' consensus estimates of $0.83 by $0.15. Atlassian had a negative net margin of 4.92% and a negative return on equity of 14.77%. The company had revenue of $1.38 billion during the quarter, compared to analyst estimates of $1.36 billion. During the same period in the prior year, the firm earned $0.66 earnings per share. The business's quarterly revenue was up 22.3% on a year-over-year basis. Atlassian has set its Q1 2026 guidance at EPS. FY 2026 guidance at EPS. As a group, sell-side analysts expect that Atlassian Corporation PLC will post -0.34 earnings per share for the current year.

Atlassian Profile

(

Free Report)

Atlassian Corporation, through its subsidiaries, designs, develops, licenses, and maintains various software products worldwide. Its product portfolio includes Jira Software and Jira Work Management, a project management system that connects technical and business teams so they can better plan, organize, track and manage their work and projects; Confluence, a connected workspace that organizes knowledge across all teams to move work forward; and Trello, a collaboration and organization product that captures and adds structure to fluid and fast-forming work for teams.

Further Reading

Before you consider Atlassian, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atlassian wasn't on the list.

While Atlassian currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report