Primecap Management Co. CA cut its position in Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH - Free Report) by 0.7% in the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 1,726,004 shares of the company's stock after selling 12,001 shares during the quarter. Primecap Management Co. CA owned about 0.39% of Norwegian Cruise Line worth $32,725,000 at the end of the most recent reporting period.

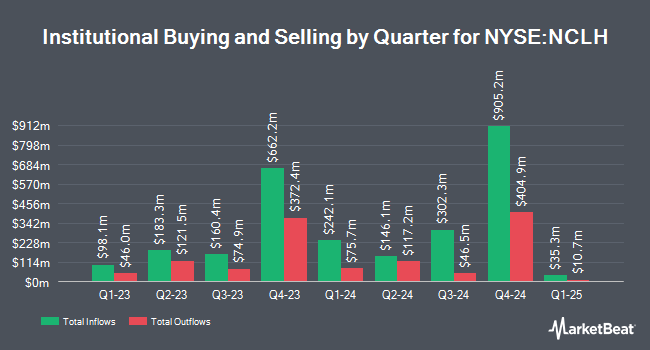

Several other institutional investors have also added to or reduced their stakes in the company. United Capital Financial Advisors LLC increased its holdings in Norwegian Cruise Line by 3.7% in the 4th quarter. United Capital Financial Advisors LLC now owns 13,928 shares of the company's stock worth $358,000 after purchasing an additional 498 shares in the last quarter. Scotia Capital Inc. increased its holdings in Norwegian Cruise Line by 0.5% in the 4th quarter. Scotia Capital Inc. now owns 113,778 shares of the company's stock worth $2,928,000 after purchasing an additional 540 shares in the last quarter. Quadrant Capital Group LLC increased its holdings in Norwegian Cruise Line by 35.0% in the 4th quarter. Quadrant Capital Group LLC now owns 2,524 shares of the company's stock worth $65,000 after purchasing an additional 654 shares in the last quarter. Burns Matteson Capital Management LLC increased its holdings in Norwegian Cruise Line by 4.0% in the 1st quarter. Burns Matteson Capital Management LLC now owns 17,618 shares of the company's stock worth $334,000 after purchasing an additional 677 shares in the last quarter. Finally, Allworth Financial LP increased its holdings in Norwegian Cruise Line by 19.1% in the 1st quarter. Allworth Financial LP now owns 4,690 shares of the company's stock worth $89,000 after purchasing an additional 753 shares in the last quarter. 69.58% of the stock is currently owned by institutional investors.

Norwegian Cruise Line Stock Down 1.5%

NYSE:NCLH traded down $0.37 on Monday, hitting $23.63. The stock had a trading volume of 3,943,736 shares, compared to its average volume of 14,170,075. The business's fifty day moving average is $21.48 and its 200 day moving average is $20.83. The company has a market cap of $10.68 billion, a PE ratio of 16.30, a P/E/G ratio of 1.09 and a beta of 2.24. The company has a quick ratio of 0.16, a current ratio of 0.18 and a debt-to-equity ratio of 8.05. Norwegian Cruise Line Holdings Ltd. has a 52 week low of $14.21 and a 52 week high of $29.29.

Norwegian Cruise Line (NYSE:NCLH - Get Free Report) last posted its earnings results on Thursday, July 31st. The company reported $0.51 earnings per share for the quarter, missing analysts' consensus estimates of $0.52 by ($0.01). Norwegian Cruise Line had a net margin of 7.52% and a return on equity of 59.88%. The company had revenue of $2.52 billion during the quarter, compared to the consensus estimate of $2.55 billion. During the same quarter in the prior year, the business earned $0.40 EPS. The firm's revenue for the quarter was up 6.1% compared to the same quarter last year. On average, equities research analysts expect that Norwegian Cruise Line Holdings Ltd. will post 1.48 EPS for the current fiscal year.

Analyst Ratings Changes

NCLH has been the subject of a number of recent research reports. Mizuho upped their target price on Norwegian Cruise Line from $26.00 to $29.00 and gave the stock an "outperform" rating in a report on Friday, August 1st. Melius Research raised Norwegian Cruise Line to a "strong-buy" rating in a report on Monday, April 21st. Barclays increased their price target on Norwegian Cruise Line from $25.00 to $31.00 and gave the company an "overweight" rating in a research note on Friday, August 1st. The Goldman Sachs Group decreased their price target on Norwegian Cruise Line from $31.00 to $20.00 and set a "buy" rating for the company in a research note on Wednesday, April 23rd. Finally, TD Cowen initiated coverage on Norwegian Cruise Line in a research note on Tuesday, July 22nd. They issued a "buy" rating and a $31.00 price target for the company. Nine research analysts have rated the stock with a hold rating, twelve have assigned a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, Norwegian Cruise Line has a consensus rating of "Moderate Buy" and an average target price of $27.20.

Get Our Latest Report on Norwegian Cruise Line

Norwegian Cruise Line Company Profile

(

Free Report)

Norwegian Cruise Line Holdings Ltd., together with its subsidiaries, operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally. The company operates through the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands. It offers itineraries ranging from three days to a 180-days calling on various ports, including Scandinavia, Northern Europe, the Mediterranean, the Greek Isles, Alaska, Canada and New England, Hawaii, Asia, Tahiti and the South Pacific, Australia and New Zealand, Africa, India, South America, the Panama Canal, and the Caribbean.

Recommended Stories

Before you consider Norwegian Cruise Line, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Norwegian Cruise Line wasn't on the list.

While Norwegian Cruise Line currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.