Citigroup Inc. lifted its holdings in shares of Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH - Free Report) by 76.8% in the first quarter, according to its most recent filing with the SEC. The firm owned 638,137 shares of the company's stock after acquiring an additional 277,289 shares during the period. Citigroup Inc. owned approximately 0.14% of Norwegian Cruise Line worth $12,099,000 as of its most recent filing with the SEC.

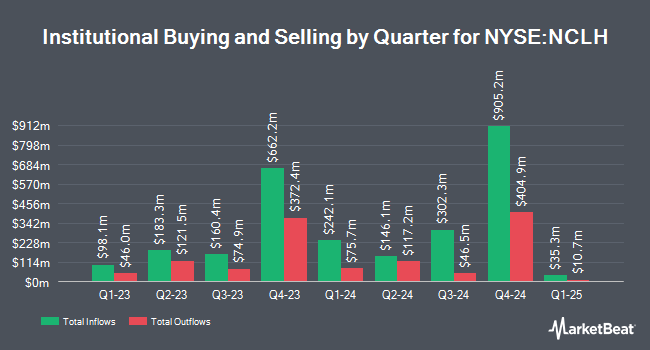

A number of other hedge funds and other institutional investors also recently made changes to their positions in NCLH. Capital International Investors lifted its holdings in shares of Norwegian Cruise Line by 11.2% during the 4th quarter. Capital International Investors now owns 55,194,672 shares of the company's stock worth $1,420,159,000 after acquiring an additional 5,557,951 shares during the period. Two Sigma Advisers LP increased its position in shares of Norwegian Cruise Line by 99.0% during the 4th quarter. Two Sigma Advisers LP now owns 7,689,200 shares of the company's stock worth $197,843,000 after purchasing an additional 3,824,600 shares in the last quarter. Voloridge Investment Management LLC increased its position in shares of Norwegian Cruise Line by 3,403.3% during the 4th quarter. Voloridge Investment Management LLC now owns 3,374,576 shares of the company's stock worth $86,828,000 after purchasing an additional 3,278,249 shares in the last quarter. Candlestick Capital Management LP acquired a new stake in shares of Norwegian Cruise Line during the 4th quarter worth about $44,650,000. Finally, Benchstone Capital Management LP acquired a new stake in shares of Norwegian Cruise Line during the 4th quarter worth about $42,138,000. 69.58% of the stock is owned by institutional investors.

Norwegian Cruise Line Trading Up 0.1%

Shares of NYSE:NCLH traded up $0.0150 during trading on Tuesday, hitting $24.5950. 2,522,516 shares of the company's stock were exchanged, compared to its average volume of 14,071,586. Norwegian Cruise Line Holdings Ltd. has a 1-year low of $14.21 and a 1-year high of $29.29. The firm has a 50-day moving average price of $22.14 and a two-hundred day moving average price of $20.68. The company has a current ratio of 0.18, a quick ratio of 0.16 and a debt-to-equity ratio of 8.05. The firm has a market cap of $11.12 billion, a P/E ratio of 16.96, a PEG ratio of 1.11 and a beta of 2.24.

Norwegian Cruise Line (NYSE:NCLH - Get Free Report) last issued its quarterly earnings results on Thursday, July 31st. The company reported $0.51 EPS for the quarter, missing the consensus estimate of $0.52 by ($0.01). Norwegian Cruise Line had a return on equity of 59.88% and a net margin of 7.52%.The business had revenue of $2.52 billion for the quarter, compared to analyst estimates of $2.55 billion. During the same quarter in the prior year, the firm earned $0.40 EPS. The firm's quarterly revenue was up 6.1% compared to the same quarter last year. Norwegian Cruise Line has set its Q3 2025 guidance at 1.140-1.140 EPS. FY 2025 guidance at 2.050-2.050 EPS. Equities analysts predict that Norwegian Cruise Line Holdings Ltd. will post 1.48 earnings per share for the current year.

Analyst Upgrades and Downgrades

NCLH has been the subject of a number of recent analyst reports. Stifel Nicolaus increased their target price on shares of Norwegian Cruise Line from $26.00 to $35.00 and gave the stock a "buy" rating in a research report on Friday, August 1st. The Goldman Sachs Group dropped their target price on shares of Norwegian Cruise Line from $31.00 to $20.00 and set a "buy" rating for the company in a research report on Wednesday, April 23rd. Melius Research upgraded shares of Norwegian Cruise Line to a "strong-buy" rating in a research report on Monday, April 21st. Macquarie dropped their target price on shares of Norwegian Cruise Line from $31.00 to $27.00 and set an "outperform" rating for the company in a research report on Friday, May 9th. Finally, Northcoast Research initiated coverage on shares of Norwegian Cruise Line in a research report on Friday, April 25th. They set a "buy" rating and a $21.00 target price for the company. Two analysts have rated the stock with a Strong Buy rating, twelve have assigned a Buy rating and eight have given a Hold rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $27.20.

View Our Latest Stock Report on NCLH

Norwegian Cruise Line Profile

(

Free Report)

Norwegian Cruise Line Holdings Ltd., together with its subsidiaries, operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally. The company operates through the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands. It offers itineraries ranging from three days to a 180-days calling on various ports, including Scandinavia, Northern Europe, the Mediterranean, the Greek Isles, Alaska, Canada and New England, Hawaii, Asia, Tahiti and the South Pacific, Australia and New Zealand, Africa, India, South America, the Panama Canal, and the Caribbean.

Featured Articles

Before you consider Norwegian Cruise Line, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Norwegian Cruise Line wasn't on the list.

While Norwegian Cruise Line currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.