Geo Capital Gestora de Recursos Ltd lessened its stake in shares of Novo Nordisk A/S (NYSE:NVO - Free Report) by 8.2% in the 1st quarter, according to its most recent disclosure with the SEC. The institutional investor owned 65,515 shares of the company's stock after selling 5,826 shares during the period. Novo Nordisk A/S comprises approximately 6.3% of Geo Capital Gestora de Recursos Ltd's investment portfolio, making the stock its 7th biggest holding. Geo Capital Gestora de Recursos Ltd's holdings in Novo Nordisk A/S were worth $4,549,000 at the end of the most recent reporting period.

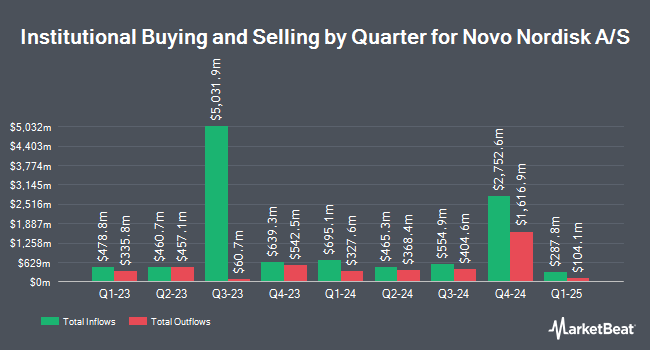

Other large investors also recently bought and sold shares of the company. Copeland Capital Management LLC raised its stake in Novo Nordisk A/S by 184.8% in the first quarter. Copeland Capital Management LLC now owns 393 shares of the company's stock worth $27,000 after buying an additional 255 shares in the last quarter. North Capital Inc. purchased a new position in Novo Nordisk A/S in the first quarter worth $27,000. Park Square Financial Group LLC purchased a new position in Novo Nordisk A/S in the fourth quarter worth $29,000. Stone House Investment Management LLC purchased a new stake in Novo Nordisk A/S in the first quarter valued at $30,000. Finally, Transce3nd LLC purchased a new stake in Novo Nordisk A/S in the fourth quarter valued at $33,000. Institutional investors own 11.54% of the company's stock.

Novo Nordisk A/S Price Performance

Shares of NVO traded up $1.4410 during mid-day trading on Friday, hitting $56.8910. 17,869,499 shares of the company were exchanged, compared to its average volume of 29,123,660. Novo Nordisk A/S has a 1-year low of $45.05 and a 1-year high of $139.74. The company has a debt-to-equity ratio of 0.52, a quick ratio of 0.56 and a current ratio of 0.78. The company has a 50 day moving average of $62.57 and a 200-day moving average of $69.45. The stock has a market cap of $254.02 billion, a price-to-earnings ratio of 15.63, a price-to-earnings-growth ratio of 1.93 and a beta of 0.63.

Novo Nordisk A/S (NYSE:NVO - Get Free Report) last announced its quarterly earnings data on Wednesday, August 6th. The company reported $0.97 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.93 by $0.04. Novo Nordisk A/S had a net margin of 35.60% and a return on equity of 78.64%. The company had revenue of $11.69 billion during the quarter, compared to analysts' expectations of $77.51 billion. Analysts expect that Novo Nordisk A/S will post 3.84 EPS for the current fiscal year.

Novo Nordisk A/S Cuts Dividend

The firm also recently disclosed a semi-annual dividend, which will be paid on Tuesday, August 26th. Investors of record on Monday, August 18th will be paid a dividend of $0.4119 per share. This represents a yield of 240.0%. The ex-dividend date of this dividend is Monday, August 18th. Novo Nordisk A/S's dividend payout ratio is currently 22.53%.

Wall Street Analysts Forecast Growth

NVO has been the subject of a number of analyst reports. Barclays reiterated an "equal weight" rating on shares of Novo Nordisk A/S in a research report on Wednesday, July 30th. Hsbc Global Res downgraded shares of Novo Nordisk A/S from a "strong-buy" rating to a "hold" rating in a research report on Thursday, July 31st. Zacks Research downgraded shares of Novo Nordisk A/S from a "hold" rating to a "strong sell" rating in a research report on Wednesday. Dbs Bank downgraded shares of Novo Nordisk A/S to a "sell" rating in a research report on Friday, April 25th. Finally, UBS Group downgraded shares of Novo Nordisk A/S from a "buy" rating to a "neutral" rating in a research report on Tuesday, August 5th. Three research analysts have rated the stock with a Buy rating, eleven have assigned a Hold rating and two have given a Sell rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Hold" and a consensus target price of $81.00.

Get Our Latest Stock Analysis on NVO

Novo Nordisk A/S Company Profile

(

Free Report)

Novo Nordisk A/S, together with its subsidiaries, engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally. It operates in two segments, Diabetes and Obesity Care, and Rare Disease.

Read More

Before you consider Novo Nordisk A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novo Nordisk A/S wasn't on the list.

While Novo Nordisk A/S currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.