Greenleaf Trust lowered its position in Nucor Corporation (NYSE:NUE - Free Report) by 36.1% during the second quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 5,217 shares of the basic materials company's stock after selling 2,949 shares during the quarter. Greenleaf Trust's holdings in Nucor were worth $676,000 as of its most recent filing with the Securities and Exchange Commission.

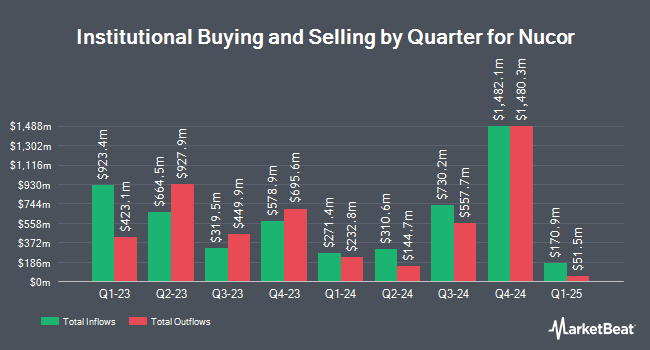

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Vanguard Group Inc. boosted its holdings in Nucor by 2.6% in the first quarter. Vanguard Group Inc. now owns 28,959,327 shares of the basic materials company's stock valued at $3,484,965,000 after acquiring an additional 745,671 shares during the last quarter. Price T Rowe Associates Inc. MD boosted its holdings in Nucor by 18.2% in the first quarter. Price T Rowe Associates Inc. MD now owns 2,309,452 shares of the basic materials company's stock valued at $277,920,000 after acquiring an additional 355,364 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its holdings in Nucor by 5.5% in the first quarter. Charles Schwab Investment Management Inc. now owns 1,772,831 shares of the basic materials company's stock valued at $213,342,000 after acquiring an additional 92,363 shares during the last quarter. Diamond Hill Capital Management Inc. acquired a new position in shares of Nucor during the first quarter worth about $194,804,000. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. lifted its stake in shares of Nucor by 16.3% during the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 1,610,933 shares of the basic materials company's stock worth $193,863,000 after purchasing an additional 226,343 shares in the last quarter. Institutional investors and hedge funds own 76.48% of the company's stock.

Nucor Trading Up 2.6%

NYSE:NUE opened at $138.96 on Friday. The company has a debt-to-equity ratio of 0.31, a quick ratio of 1.51 and a current ratio of 2.83. Nucor Corporation has a one year low of $97.59 and a one year high of $170.52. The business's 50-day simple moving average is $141.99 and its 200 day simple moving average is $128.95. The stock has a market cap of $31.90 billion, a price-to-earnings ratio of 25.08, a price-to-earnings-growth ratio of 0.93 and a beta of 1.76.

Nucor (NYSE:NUE - Get Free Report) last released its quarterly earnings results on Monday, July 28th. The basic materials company reported $2.60 EPS for the quarter, topping the consensus estimate of $2.54 by $0.06. Nucor had a return on equity of 6.65% and a net margin of 4.21%.The business had revenue of $8.46 billion for the quarter, compared to analysts' expectations of $8.47 billion. During the same quarter in the previous year, the firm posted $2.68 earnings per share. The company's revenue was up 4.7% compared to the same quarter last year. As a group, sell-side analysts predict that Nucor Corporation will post 7.64 earnings per share for the current fiscal year.

Nucor Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Monday, November 10th. Investors of record on Tuesday, September 30th will be issued a $0.55 dividend. This represents a $2.20 annualized dividend and a yield of 1.6%. The ex-dividend date of this dividend is Tuesday, September 30th. Nucor's payout ratio is currently 39.71%.

Wall Street Analysts Forecast Growth

A number of research analysts have commented on the company. The Goldman Sachs Group reduced their price objective on Nucor from $182.00 to $173.00 and set a "buy" rating on the stock in a research note on Monday, September 22nd. Morgan Stanley boosted their price objective on Nucor from $134.00 to $149.00 and gave the stock an "overweight" rating in a research note on Friday, June 20th. Bank of America boosted their price objective on Nucor from $150.00 to $165.00 and gave the stock a "buy" rating in a research note on Monday, September 15th. Jefferies Financial Group upgraded Nucor from a "hold" rating to a "buy" rating and boosted their price objective for the stock from $135.00 to $170.00 in a research note on Thursday, July 31st. Finally, Wells Fargo & Company reduced their price objective on Nucor from $146.00 to $140.00 and set an "equal weight" rating on the stock in a research note on Thursday, September 18th. Eight investment analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the company's stock. According to data from MarketBeat, Nucor presently has a consensus rating of "Moderate Buy" and a consensus target price of $156.60.

Get Our Latest Stock Report on NUE

Insider Transactions at Nucor

In related news, EVP Kenneth Rex Query sold 10,000 shares of the business's stock in a transaction dated Monday, August 18th. The stock was sold at an average price of $144.90, for a total value of $1,449,000.00. Following the completion of the sale, the executive vice president directly owned 84,080 shares of the company's stock, valued at $12,183,192. The trade was a 10.63% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, insider Michael D. Keller sold 6,088 shares of the business's stock in a transaction dated Friday, August 22nd. The shares were sold at an average price of $148.41, for a total value of $903,520.08. Following the completion of the sale, the insider directly owned 22,464 shares of the company's stock, valued at approximately $3,333,882.24. This represents a 21.32% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 31,309 shares of company stock valued at $4,553,771 in the last three months. Corporate insiders own 0.46% of the company's stock.

About Nucor

(

Free Report)

Nucor Corporation engages in manufacture and sale of steel and steel products. It operates in three segments: steel mills, steel products, and raw materials. The Steel Mills segment produces hot-rolled, cold-rolled, and galvanized sheet steel products; plate steel products; wide-flange beams, beam blanks, and H-piling and sheet piling structural steel products; bar steel products, such as blooms, billets, concrete reinforcing and merchant bars, and engineered special bar quality products; and engages in the steel trading and rebar distribution businesses.

See Also

Want to see what other hedge funds are holding NUE? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Nucor Corporation (NYSE:NUE - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Nucor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nucor wasn't on the list.

While Nucor currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report