Nutshell Asset Management Ltd purchased a new stake in Amphenol Corporation (NYSE:APH - Free Report) in the first quarter, according to its most recent filing with the SEC. The fund purchased 19,000 shares of the electronics maker's stock, valued at approximately $1,246,000. Amphenol comprises 0.6% of Nutshell Asset Management Ltd's portfolio, making the stock its 25th biggest position.

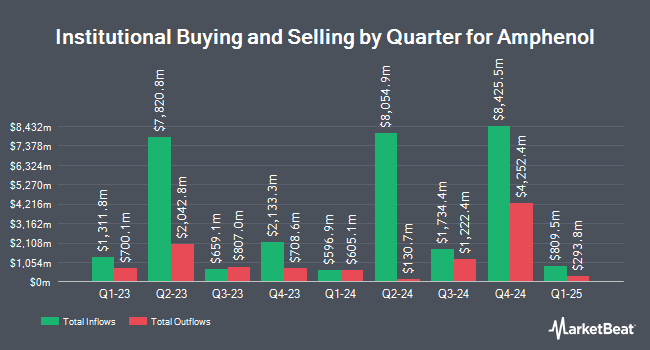

Other institutional investors have also made changes to their positions in the company. Perigon Wealth Management LLC lifted its holdings in shares of Amphenol by 29.4% in the first quarter. Perigon Wealth Management LLC now owns 17,438 shares of the electronics maker's stock valued at $1,144,000 after buying an additional 3,964 shares during the period. Raiffeisen Bank International AG purchased a new stake in Amphenol in the 4th quarter worth about $13,847,000. Cambridge Investment Research Advisors Inc. lifted its stake in Amphenol by 46.8% in the 1st quarter. Cambridge Investment Research Advisors Inc. now owns 69,958 shares of the electronics maker's stock worth $4,589,000 after acquiring an additional 22,293 shares in the last quarter. Transcend Capital Advisors LLC increased its position in Amphenol by 14.4% in the 1st quarter. Transcend Capital Advisors LLC now owns 4,504 shares of the electronics maker's stock worth $295,000 after purchasing an additional 568 shares during the last quarter. Finally, Assenagon Asset Management S.A. increased its position in Amphenol by 4.2% in the 1st quarter. Assenagon Asset Management S.A. now owns 61,920 shares of the electronics maker's stock worth $4,061,000 after purchasing an additional 2,514 shares during the last quarter. 97.01% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

APH has been the topic of a number of analyst reports. Truist Financial increased their price objective on Amphenol from $102.00 to $126.00 and gave the company a "buy" rating in a report on Thursday, July 24th. Citigroup raised their price objective on Amphenol from $115.00 to $125.00 and gave the stock a "buy" rating in a research report on Thursday, July 24th. KGI Securities started coverage on Amphenol in a research report on Thursday, June 26th. They set a "hold" rating on the stock. TD Securities boosted their price objective on Amphenol from $63.00 to $70.00 and gave the company a "hold" rating in a research report on Thursday, May 1st. Finally, UBS Group boosted their price objective on Amphenol from $115.00 to $120.00 and gave the company a "buy" rating in a research report on Thursday, July 24th. Four analysts have rated the stock with a hold rating and nine have issued a buy rating to the company. According to MarketBeat.com, Amphenol currently has an average rating of "Moderate Buy" and an average target price of $104.92.

Get Our Latest Research Report on Amphenol

Amphenol Trading Up 1.0%

APH stock traded up $1.12 during midday trading on Tuesday, hitting $110.93. 3,049,251 shares of the company's stock were exchanged, compared to its average volume of 8,469,801. The stock's fifty day moving average price is $99.46 and its 200-day moving average price is $81.21. The company has a debt-to-equity ratio of 0.61, a quick ratio of 1.46 and a current ratio of 2.02. The company has a market cap of $135.44 billion, a PE ratio of 44.22, a price-to-earnings-growth ratio of 1.79 and a beta of 1.13. Amphenol Corporation has a one year low of $56.45 and a one year high of $111.03.

Amphenol (NYSE:APH - Get Free Report) last posted its earnings results on Wednesday, July 23rd. The electronics maker reported $0.81 earnings per share for the quarter, topping the consensus estimate of $0.66 by $0.15. The firm had revenue of $5.65 billion for the quarter, compared to analyst estimates of $5.01 billion. Amphenol had a return on equity of 30.58% and a net margin of 16.90%. The company's revenue for the quarter was up 56.5% on a year-over-year basis. During the same period in the previous year, the company posted $0.44 earnings per share. Research analysts predict that Amphenol Corporation will post 2.36 earnings per share for the current fiscal year.

Amphenol Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, October 8th. Stockholders of record on Tuesday, September 16th will be issued a $0.165 dividend. This represents a $0.66 dividend on an annualized basis and a dividend yield of 0.6%. The ex-dividend date is Tuesday, September 16th. Amphenol's payout ratio is 26.29%.

Insider Transactions at Amphenol

In related news, insider William J. Doherty sold 160,000 shares of the company's stock in a transaction dated Friday, May 30th. The stock was sold at an average price of $89.54, for a total transaction of $14,326,400.00. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, VP Michael R. Ivas sold 40,000 shares of the company's stock in a transaction dated Thursday, May 29th. The stock was sold at an average price of $88.79, for a total value of $3,551,600.00. Following the sale, the vice president owned 152,412 shares in the company, valued at $13,532,661.48. The trade was a 20.79% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 586,000 shares of company stock valued at $52,935,980. 1.67% of the stock is currently owned by company insiders.

Amphenol Profile

(

Free Report)

Amphenol Corporation, together with its subsidiaries, primarily designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally. It operates through three segments: Harsh Environment Solutions, Communications Solutions, and Interconnect and Sensor Systems.

Recommended Stories

Before you consider Amphenol, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amphenol wasn't on the list.

While Amphenol currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report