Nuveen LLC purchased a new position in shares of Match Group Inc. (NASDAQ:MTCH - Free Report) during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund purchased 4,560,275 shares of the technology company's stock, valued at approximately $142,281,000. Nuveen LLC owned approximately 1.82% of Match Group as of its most recent filing with the Securities and Exchange Commission.

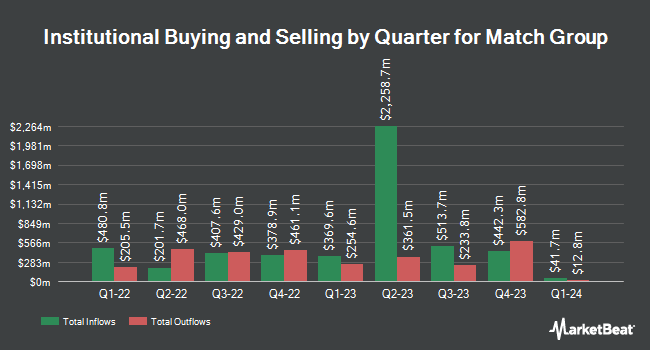

Several other hedge funds and other institutional investors have also recently bought and sold shares of MTCH. Applied Finance Capital Management LLC raised its position in shares of Match Group by 5.1% in the 1st quarter. Applied Finance Capital Management LLC now owns 6,880 shares of the technology company's stock valued at $215,000 after purchasing an additional 334 shares in the last quarter. Fulton Bank N.A. raised its position in shares of Match Group by 3.9% during the 1st quarter. Fulton Bank N.A. now owns 10,290 shares of the technology company's stock valued at $321,000 after acquiring an additional 388 shares in the last quarter. Ontario Teachers Pension Plan Board grew its stake in Match Group by 1.8% during the 4th quarter. Ontario Teachers Pension Plan Board now owns 23,149 shares of the technology company's stock worth $757,000 after buying an additional 415 shares during the last quarter. Assetmark Inc. grew its stake in Match Group by 14.1% during the 1st quarter. Assetmark Inc. now owns 3,464 shares of the technology company's stock worth $108,000 after buying an additional 429 shares during the last quarter. Finally, Penserra Capital Management LLC grew its stake in Match Group by 2.7% during the 1st quarter. Penserra Capital Management LLC now owns 17,515 shares of the technology company's stock worth $546,000 after buying an additional 455 shares during the last quarter. 94.05% of the stock is owned by institutional investors and hedge funds.

Insider Transactions at Match Group

In other Match Group news, Director Stephen Bailey sold 12,500 shares of the firm's stock in a transaction that occurred on Thursday, August 7th. The stock was sold at an average price of $36.72, for a total value of $459,000.00. Following the sale, the director owned 8,058 shares of the company's stock, valued at $295,889.76. This trade represents a 60.80% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. 0.64% of the stock is owned by company insiders.

Wall Street Analyst Weigh In

MTCH has been the subject of a number of recent research reports. JPMorgan Chase & Co. upped their price objective on Match Group from $28.00 to $33.00 and gave the stock a "neutral" rating in a research note on Wednesday, August 6th. Wall Street Zen lowered Match Group from a "buy" rating to a "hold" rating in a report on Saturday, May 17th. Evercore ISI upped their price objective on Match Group from $32.00 to $38.00 and gave the company an "in-line" rating in a report on Wednesday, August 6th. Barclays cut their price objective on Match Group from $52.00 to $46.00 and set an "overweight" rating for the company in a report on Friday, May 9th. Finally, Morgan Stanley decreased their price target on Match Group from $33.00 to $32.00 and set an "equal weight" rating for the company in a research report on Thursday, April 17th. Sixteen analysts have rated the stock with a hold rating and five have given a buy rating to the company. According to MarketBeat, the company presently has a consensus rating of "Hold" and a consensus price target of $35.44.

Get Our Latest Stock Report on MTCH

Match Group Price Performance

Shares of MTCH stock traded down $0.08 during trading on Thursday, reaching $38.66. The company had a trading volume of 3,507,240 shares, compared to its average volume of 4,815,464. The firm's 50 day simple moving average is $32.78 and its two-hundred day simple moving average is $31.65. Match Group Inc. has a one year low of $26.39 and a one year high of $38.94. The company has a market capitalization of $9.68 billion, a PE ratio of 19.04, a PEG ratio of 0.72 and a beta of 1.36.

Match Group Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, October 17th. Shareholders of record on Friday, October 3rd will be issued a $0.19 dividend. The ex-dividend date of this dividend is Friday, October 3rd. This represents a $0.76 dividend on an annualized basis and a yield of 2.0%. Match Group's dividend payout ratio (DPR) is 37.44%.

Match Group Profile

(

Free Report)

Match Group, Inc engages in the provision of dating products. Its portfolio of brands includes Tinder, Hinge, Match, Meetic, OkCupid, Pairs, Plenty Of Fish, Azar, BLK, and Hakuna, as well as a various other brands, each built to increase users' likelihood of connecting with others. Its services are available in over 40 languages to users worldwide.

Featured Articles

Before you consider Match Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Match Group wasn't on the list.

While Match Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.