Nuveen LLC acquired a new position in Red River Bancshares, Inc. (NASDAQ:RRBI - Free Report) during the 1st quarter, according to its most recent filing with the SEC. The fund acquired 12,899 shares of the company's stock, valued at approximately $666,000. Nuveen LLC owned approximately 0.19% of Red River Bancshares as of its most recent SEC filing.

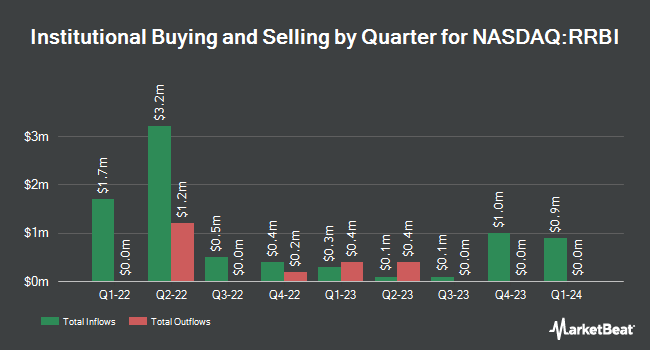

Several other institutional investors and hedge funds have also made changes to their positions in the business. Dimensional Fund Advisors LP boosted its position in shares of Red River Bancshares by 6.7% in the 4th quarter. Dimensional Fund Advisors LP now owns 84,557 shares of the company's stock worth $4,564,000 after buying an additional 5,346 shares in the last quarter. Northern Trust Corp boosted its position in shares of Red River Bancshares by 2.9% in the 4th quarter. Northern Trust Corp now owns 38,831 shares of the company's stock worth $2,096,000 after buying an additional 1,087 shares in the last quarter. Millennium Management LLC boosted its position in shares of Red River Bancshares by 50.4% in the 4th quarter. Millennium Management LLC now owns 21,883 shares of the company's stock worth $1,181,000 after buying an additional 7,334 shares in the last quarter. Bank of New York Mellon Corp boosted its position in shares of Red River Bancshares by 2.4% in the 1st quarter. Bank of New York Mellon Corp now owns 21,839 shares of the company's stock worth $1,128,000 after buying an additional 518 shares in the last quarter. Finally, Citadel Advisors LLC boosted its position in shares of Red River Bancshares by 40.6% in the 4th quarter. Citadel Advisors LLC now owns 18,630 shares of the company's stock worth $1,006,000 after buying an additional 5,381 shares in the last quarter. 27.55% of the stock is currently owned by hedge funds and other institutional investors.

Red River Bancshares Price Performance

NASDAQ:RRBI traded down $0.47 on Tuesday, reaching $64.99. The stock had a trading volume of 3,079 shares, compared to its average volume of 11,540. The company has a market cap of $434.10 million, a price-to-earnings ratio of 11.45 and a beta of 0.53. The firm's fifty day moving average is $63.16 and its two-hundred day moving average is $57.16. Red River Bancshares, Inc. has a 12-month low of $46.33 and a 12-month high of $66.50.

Red River Bancshares (NASDAQ:RRBI - Get Free Report) last posted its quarterly earnings data on Wednesday, July 30th. The company reported $1.51 EPS for the quarter, beating analysts' consensus estimates of $1.43 by $0.08. Red River Bancshares had a net margin of 23.62% and a return on equity of 11.76%. The company had revenue of $30.09 million during the quarter, compared to the consensus estimate of $30.04 million. As a group, research analysts forecast that Red River Bancshares, Inc. will post 5.28 earnings per share for the current fiscal year.

Red River Bancshares Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, September 18th. Stockholders of record on Monday, September 8th will be paid a dividend of $0.15 per share. The ex-dividend date of this dividend is Monday, September 8th. This represents a $0.60 dividend on an annualized basis and a dividend yield of 0.9%. This is an increase from Red River Bancshares's previous quarterly dividend of $0.12. Red River Bancshares's dividend payout ratio is currently 8.47%.

Wall Street Analysts Forecast Growth

Separately, Raymond James Financial reiterated an "outperform" rating and issued a $67.00 price objective (up from $62.00) on shares of Red River Bancshares in a research report on Friday, August 1st. One equities research analyst has rated the stock with a Buy rating, According to data from MarketBeat.com, Red River Bancshares currently has an average rating of "Buy" and an average target price of $67.00.

Get Our Latest Report on Red River Bancshares

Red River Bancshares Company Profile

(

Free Report)

Red River Bancshares, Inc operates as a bank holding company for Red River Bank that provides banking products and services to commercial and retail customers in Louisiana. The company provides various deposit products, including checking, saving, money market accounts, and time deposits. It offers commercial real estate loans; one-to-four family mortgage loans and home equity lines of credit; construction and development loans; commercial and industrial loans; small business administration paycheck protection program loans; tax-exempt loans; consumer loans to individuals for personal, family, and household purposes, including secured and unsecured installment and term loans; home mortgage loans; and lines of credit and standby letters of credit.

See Also

Before you consider Red River Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Red River Bancshares wasn't on the list.

While Red River Bancshares currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.