Nuveen LLC purchased a new position in shares of Resideo Technologies, Inc. (NYSE:REZI - Free Report) in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor purchased 1,934,397 shares of the company's stock, valued at approximately $34,239,000. Nuveen LLC owned 1.30% of Resideo Technologies at the end of the most recent reporting period.

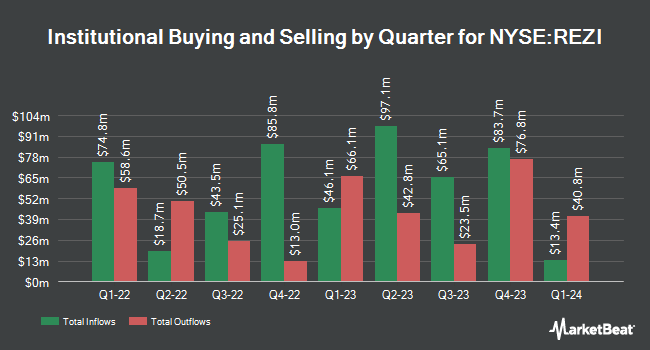

A number of other large investors have also recently bought and sold shares of REZI. Nuveen Asset Management LLC lifted its stake in shares of Resideo Technologies by 32.4% in the 4th quarter. Nuveen Asset Management LLC now owns 2,320,863 shares of the company's stock worth $53,496,000 after acquiring an additional 567,800 shares during the period. Raymond James Financial Inc. acquired a new stake in shares of Resideo Technologies in the 4th quarter worth $5,914,000. Northern Trust Corp lifted its stake in shares of Resideo Technologies by 14.3% in the 4th quarter. Northern Trust Corp now owns 1,917,077 shares of the company's stock worth $44,189,000 after acquiring an additional 239,967 shares during the period. Invesco Ltd. lifted its stake in shares of Resideo Technologies by 22.6% in the 4th quarter. Invesco Ltd. now owns 988,890 shares of the company's stock worth $22,794,000 after acquiring an additional 182,197 shares during the period. Finally, Algert Global LLC lifted its stake in shares of Resideo Technologies by 86.5% in the 4th quarter. Algert Global LLC now owns 305,400 shares of the company's stock worth $7,039,000 after acquiring an additional 141,650 shares during the period. Institutional investors and hedge funds own 91.71% of the company's stock.

Resideo Technologies Price Performance

Shares of REZI traded up $0.0620 during trading hours on Thursday, reaching $32.1120. The company had a trading volume of 2,481,803 shares, compared to its average volume of 2,065,690. The firm has a 50 day simple moving average of $25.22 and a 200-day simple moving average of $21.03. The company has a current ratio of 1.00, a quick ratio of 0.63 and a debt-to-equity ratio of 0.93. The company has a market capitalization of $4.78 billion, a price-to-earnings ratio of -5.88 and a beta of 2.16. Resideo Technologies, Inc. has a 12-month low of $14.18 and a 12-month high of $33.03.

Resideo Technologies (NYSE:REZI - Get Free Report) last posted its earnings results on Tuesday, August 5th. The company reported $0.66 earnings per share for the quarter, beating the consensus estimate of $0.54 by $0.12. Resideo Technologies had a negative net margin of 10.52% and a positive return on equity of 12.55%. The firm had revenue of $1.94 billion during the quarter, compared to the consensus estimate of $1.83 billion. During the same period last year, the firm posted $0.62 EPS. The firm's revenue for the quarter was up 22.3% on a year-over-year basis. Resideo Technologies has set its FY 2025 guidance at 2.750-2.870 EPS. Q3 2025 guidance at 0.700-0.760 EPS. Research analysts expect that Resideo Technologies, Inc. will post 2.13 earnings per share for the current year.

Insiders Place Their Bets

In other Resideo Technologies news, major shareholder Channel Holdings Ii L.P. Cd&R bought 4,477,919 shares of the company's stock in a transaction on Friday, July 25th. The stock was purchased at an average cost of $22.33 per share, for a total transaction of $99,991,931.27. Following the acquisition, the insider owned 10,232,420 shares of the company's stock, valued at $228,489,938.60. The trade was a 77.82% increase in their position. The acquisition was disclosed in a document filed with the SEC, which is available through the SEC website. In the last ninety days, insiders have bought 7,060,707 shares of company stock worth $177,795,316 and have sold 132,688 shares worth $3,976,654. Company insiders own 1.50% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have recently commented on REZI shares. JPMorgan Chase & Co. raised their target price on shares of Resideo Technologies from $20.00 to $21.00 and gave the stock a "neutral" rating in a research note on Tuesday, June 3rd. Oppenheimer upgraded shares of Resideo Technologies from a "market perform" rating to an "outperform" rating in a report on Wednesday, July 30th. Finally, Morgan Stanley upgraded shares of Resideo Technologies from an "equal weight" rating to an "overweight" rating and increased their price target for the company from $24.00 to $35.00 in a report on Tuesday, August 12th. Two research analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $28.00.

Check Out Our Latest Analysis on REZI

Resideo Technologies Profile

(

Free Report)

Resideo Technologies, Inc develops, manufactures, and sells comfort, energy management, and safety and security solutions to the commercial and residential end markets in the United States, Europe, and internationally. The company operates in two segments, Products and Solutions, and ADI Global Distribution.

Further Reading

Before you consider Resideo Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Resideo Technologies wasn't on the list.

While Resideo Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.