Nuveen LLC acquired a new position in shares of OneWater Marine Inc. (NASDAQ:ONEW - Free Report) in the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The fund acquired 32,676 shares of the company's stock, valued at approximately $529,000. Nuveen LLC owned 0.20% of OneWater Marine at the end of the most recent quarter.

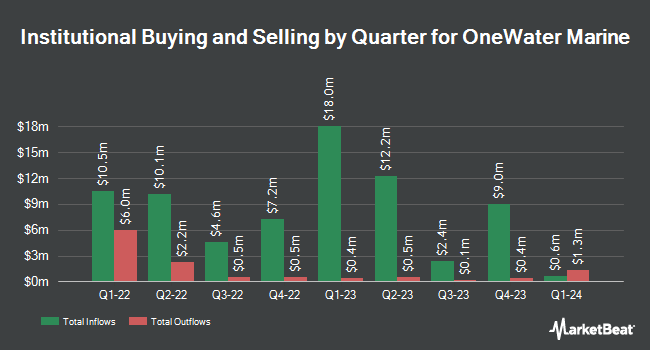

Several other hedge funds have also recently made changes to their positions in ONEW. BNP Paribas Financial Markets acquired a new stake in OneWater Marine during the 4th quarter worth about $29,000. GAMMA Investing LLC raised its stake in shares of OneWater Marine by 404.5% in the first quarter. GAMMA Investing LLC now owns 2,109 shares of the company's stock worth $34,000 after purchasing an additional 1,691 shares during the last quarter. Wells Fargo & Company MN lifted its holdings in shares of OneWater Marine by 27.0% during the fourth quarter. Wells Fargo & Company MN now owns 7,194 shares of the company's stock worth $125,000 after purchasing an additional 1,529 shares during the period. Raymond James Financial Inc. purchased a new stake in OneWater Marine in the fourth quarter valued at approximately $199,000. Finally, Bank of America Corp DE boosted its position in OneWater Marine by 23.3% in the fourth quarter. Bank of America Corp DE now owns 16,296 shares of the company's stock valued at $283,000 after buying an additional 3,077 shares during the last quarter. 94.32% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several brokerages have commented on ONEW. KeyCorp lifted their price objective on shares of OneWater Marine from $16.00 to $17.00 and gave the company an "overweight" rating in a research note on Friday, August 1st. Zacks Research cut shares of OneWater Marine from a "hold" rating to a "strong sell" rating in a report on Monday, August 25th. Three investment analysts have rated the stock with a Buy rating, four have given a Hold rating and one has given a Sell rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Hold" and a consensus price target of $19.60.

Check Out Our Latest Analysis on ONEW

OneWater Marine Stock Performance

Shares of ONEW traded down $0.50 during trading hours on Wednesday, hitting $15.73. The stock had a trading volume of 47,683 shares, compared to its average volume of 118,606. The firm has a 50-day moving average price of $15.79 and a 200 day moving average price of $15.19. OneWater Marine Inc. has a fifty-two week low of $11.58 and a fifty-two week high of $26.77. The firm has a market capitalization of $257.50 million, a price-to-earnings ratio of -19.42 and a beta of 1.99. The company has a debt-to-equity ratio of 0.97, a quick ratio of 0.37 and a current ratio of 1.23.

OneWater Marine (NASDAQ:ONEW - Get Free Report) last released its quarterly earnings data on Thursday, July 31st. The company reported $0.79 earnings per share for the quarter, missing analysts' consensus estimates of $1.12 by ($0.33). OneWater Marine had a negative net margin of 0.61% and a positive return on equity of 0.45%. The firm had revenue of $552.86 million during the quarter, compared to analysts' expectations of $532.01 million. OneWater Marine has set its FY 2025 guidance at 0.500-0.750 EPS. As a group, research analysts anticipate that OneWater Marine Inc. will post 1.57 EPS for the current year.

Insider Transactions at OneWater Marine

In other OneWater Marine news, Director John Troiano sold 15,041 shares of the stock in a transaction that occurred on Wednesday, August 27th. The stock was sold at an average price of $17.35, for a total transaction of $260,961.35. Following the transaction, the director owned 52,226 shares in the company, valued at approximately $906,121.10. This represents a 22.36% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Corporate insiders own 20.30% of the company's stock.

About OneWater Marine

(

Free Report)

OneWater Marine Inc operates as a recreational boat retailer in the United States. The company offers new and pre-owned recreational boats and yachts, as well as related marine products, such as parts and accessories. It provides boat repair and maintenance services. In addition, the company arranges boat financing and insurance; and other ancillary services, including indoor and outdoor storage, and marina services.

Recommended Stories

Before you consider OneWater Marine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OneWater Marine wasn't on the list.

While OneWater Marine currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.