Nuveen LLC acquired a new stake in shares of SEI Investments Company (NASDAQ:SEIC - Free Report) during the 1st quarter, according to the company in its most recent 13F filing with the SEC. The firm acquired 275,763 shares of the asset manager's stock, valued at approximately $21,407,000. Nuveen LLC owned approximately 0.22% of SEI Investments as of its most recent filing with the SEC.

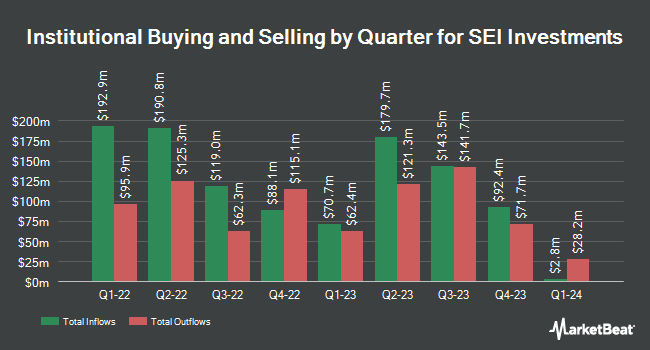

Other institutional investors and hedge funds also recently made changes to their positions in the company. Sumitomo Mitsui DS Asset Management Company Ltd grew its holdings in shares of SEI Investments by 59.9% during the 1st quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 12,553 shares of the asset manager's stock valued at $974,000 after purchasing an additional 4,701 shares during the last quarter. Janney Montgomery Scott LLC bought a new position in shares of SEI Investments during the 1st quarter valued at $206,000. LPL Financial LLC grew its holdings in shares of SEI Investments by 6.0% during the 1st quarter. LPL Financial LLC now owns 93,455 shares of the asset manager's stock valued at $7,255,000 after purchasing an additional 5,291 shares during the last quarter. Deutsche Bank AG grew its holdings in shares of SEI Investments by 41.9% during the 1st quarter. Deutsche Bank AG now owns 216,212 shares of the asset manager's stock valued at $16,785,000 after purchasing an additional 63,810 shares during the last quarter. Finally, Wealth Enhancement Advisory Services LLC grew its holdings in shares of SEI Investments by 41.6% during the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 21,301 shares of the asset manager's stock valued at $1,654,000 after purchasing an additional 6,261 shares during the last quarter. Institutional investors own 70.59% of the company's stock.

Insider Transactions at SEI Investments

In other news, CEO Ryan Hicke sold 35,000 shares of the firm's stock in a transaction dated Tuesday, August 19th. The shares were sold at an average price of $88.30, for a total value of $3,090,500.00. Following the completion of the sale, the chief executive officer directly owned 171,260 shares of the company's stock, valued at approximately $15,122,258. This trade represents a 16.97% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, Chairman Alfred P. West, Jr. sold 66,126 shares of the firm's stock in a transaction dated Thursday, May 29th. The stock was sold at an average price of $84.28, for a total transaction of $5,573,099.28. Following the completion of the sale, the chairman directly owned 6,937,582 shares of the company's stock, valued at approximately $584,699,410.96. This represents a 0.94% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 181,126 shares of company stock valued at $15,540,849. Company insiders own 14.30% of the company's stock.

Analyst Ratings Changes

Several equities analysts recently commented on the stock. Wall Street Zen raised shares of SEI Investments from a "hold" rating to a "buy" rating in a report on Tuesday, May 20th. Morgan Stanley reaffirmed an "overweight" rating and set a $100.00 target price (up previously from $84.00) on shares of SEI Investments in a report on Thursday, June 26th. Piper Sandler reduced their target price on shares of SEI Investments from $96.00 to $93.00 and set a "neutral" rating on the stock in a report on Thursday, July 24th. Raymond James Financial raised their price target on shares of SEI Investments from $115.00 to $118.00 and gave the stock an "outperform" rating in a report on Thursday, July 24th. Finally, Keefe, Bruyette & Woods reissued a "market perform" rating and issued a $98.00 price target (down previously from $100.00) on shares of SEI Investments in a report on Thursday, July 24th. Three analysts have rated the stock with a Buy rating and three have given a Hold rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $102.00.

View Our Latest Analysis on SEI Investments

SEI Investments Price Performance

SEI Investments stock traded up $2.01 during trading hours on Friday, reaching $90.15. The stock had a trading volume of 451,945 shares, compared to its average volume of 665,873. The stock has a market cap of $11.14 billion, a PE ratio of 16.91, a PEG ratio of 1.40 and a beta of 0.95. SEI Investments Company has a 52 week low of $64.66 and a 52 week high of $93.96. The company has a fifty day simple moving average of $89.09 and a 200-day simple moving average of $82.45.

SEI Investments (NASDAQ:SEIC - Get Free Report) last posted its earnings results on Wednesday, July 23rd. The asset manager reported $1.78 EPS for the quarter, topping the consensus estimate of $1.18 by $0.60. SEI Investments had a net margin of 31.25% and a return on equity of 29.96%. The firm had revenue of $559.60 million during the quarter, compared to analysts' expectations of $550.72 million. During the same period last year, the company posted $1.05 EPS. The company's quarterly revenue was up 7.8% compared to the same quarter last year. Research analysts predict that SEI Investments Company will post 4.86 earnings per share for the current fiscal year.

SEI Investments Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Tuesday, June 17th. Stockholders of record on Monday, June 9th were given a $0.49 dividend. The ex-dividend date of this dividend was Monday, June 9th. This represents a $1.96 annualized dividend and a dividend yield of 2.2%. This is a positive change from SEI Investments's previous quarterly dividend of $0.46. SEI Investments's dividend payout ratio is 18.39%.

About SEI Investments

(

Free Report)

SEI Investments Company is a publicly owned asset management holding company. Through its subsidiaries, the firm provides wealth management, retirement and investment solutions, asset management, asset administration, investment processing outsourcing solutions, financial services, and investment advisory services to its clients.

Further Reading

Before you consider SEI Investments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SEI Investments wasn't on the list.

While SEI Investments currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report