Whitener Capital Management Inc. boosted its position in NVIDIA Corporation (NASDAQ:NVDA - Free Report) by 5.1% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 123,377 shares of the computer hardware maker's stock after purchasing an additional 5,953 shares during the quarter. NVIDIA makes up 3.8% of Whitener Capital Management Inc.'s portfolio, making the stock its 7th biggest position. Whitener Capital Management Inc.'s holdings in NVIDIA were worth $13,372,000 at the end of the most recent quarter.

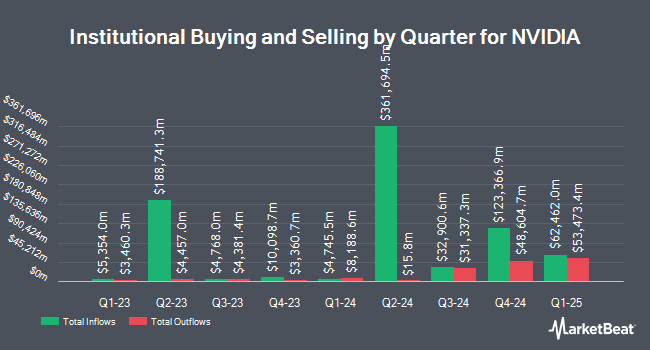

A number of other institutional investors have also added to or reduced their stakes in NVDA. Prudent Man Advisors LLC raised its position in shares of NVIDIA by 4.3% in the 1st quarter. Prudent Man Advisors LLC now owns 38,435 shares of the computer hardware maker's stock worth $4,166,000 after purchasing an additional 1,571 shares during the last quarter. LRI Investments LLC raised its holdings in NVIDIA by 0.9% in the 1st quarter. LRI Investments LLC now owns 66,583 shares of the computer hardware maker's stock worth $7,216,000 after acquiring an additional 563 shares during the last quarter. Secured Retirement Advisors LLC raised its holdings in NVIDIA by 305.4% in the 1st quarter. Secured Retirement Advisors LLC now owns 51,246 shares of the computer hardware maker's stock worth $5,554,000 after acquiring an additional 38,605 shares during the last quarter. Kerntke Otto McGlone Wealth Management Group raised its holdings in NVIDIA by 0.4% in the 1st quarter. Kerntke Otto McGlone Wealth Management Group now owns 25,092 shares of the computer hardware maker's stock worth $2,720,000 after acquiring an additional 110 shares during the last quarter. Finally, Cahaba Wealth Management Inc. raised its holdings in NVIDIA by 3.8% in the 1st quarter. Cahaba Wealth Management Inc. now owns 26,323 shares of the computer hardware maker's stock worth $2,853,000 after acquiring an additional 973 shares during the last quarter. Institutional investors own 65.27% of the company's stock.

Wall Street Analyst Weigh In

NVDA has been the subject of a number of recent analyst reports. Jefferies Financial Group boosted their price objective on shares of NVIDIA from $185.00 to $200.00 in a report on Wednesday, July 16th. Raymond James Financial lifted their price objective on NVIDIA from $150.00 to $165.00 and gave the stock a "strong-buy" rating in a report on Thursday, May 29th. UBS Group reiterated a "buy" rating on shares of NVIDIA in a report on Friday, May 23rd. Needham & Company LLC lifted their price objective on NVIDIA from $160.00 to $200.00 and gave the stock a "buy" rating in a report on Wednesday, July 16th. Finally, Arete Research upgraded NVIDIA to a "strong-buy" rating in a report on Wednesday, May 21st. One investment analyst has rated the stock with a sell rating, five have given a hold rating, thirty-two have given a buy rating and four have assigned a strong buy rating to the company's stock. Based on data from MarketBeat, NVIDIA currently has a consensus rating of "Moderate Buy" and a consensus price target of $183.75.

Check Out Our Latest Stock Report on NVIDIA

NVIDIA Price Performance

NVDA traded down $0.64 during trading on Monday, hitting $182.06. 138,011,711 shares of the company traded hands, compared to its average volume of 244,601,375. The company has a market cap of $4.44 trillion, a PE ratio of 58.73, a P/E/G ratio of 1.61 and a beta of 2.14. The stock's 50-day simple moving average is $159.82 and its two-hundred day simple moving average is $133.62. NVIDIA Corporation has a 1 year low of $86.62 and a 1 year high of $183.88. The company has a current ratio of 3.39, a quick ratio of 2.96 and a debt-to-equity ratio of 0.10.

NVIDIA (NASDAQ:NVDA - Get Free Report) last posted its earnings results on Wednesday, May 28th. The computer hardware maker reported $0.81 earnings per share for the quarter, missing the consensus estimate of $0.87 by ($0.06). The company had revenue of $44.06 billion for the quarter, compared to analysts' expectations of $43.09 billion. NVIDIA had a net margin of 51.69% and a return on equity of 105.09%. The business's revenue was up 69.2% on a year-over-year basis. During the same period in the previous year, the business posted $0.61 earnings per share. As a group, sell-side analysts anticipate that NVIDIA Corporation will post 2.77 earnings per share for the current fiscal year.

NVIDIA Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, July 3rd. Shareholders of record on Wednesday, June 11th were paid a $0.01 dividend. The ex-dividend date of this dividend was Wednesday, June 11th. This represents a $0.04 dividend on an annualized basis and a yield of 0.0%. NVIDIA's payout ratio is presently 1.29%.

Insider Buying and Selling

In related news, CEO Jen Hsun Huang sold 75,000 shares of the company's stock in a transaction on Friday, August 8th. The shares were sold at an average price of $182.38, for a total transaction of $13,678,500.00. Following the sale, the chief executive officer owned 73,223,225 shares of the company's stock, valued at $13,354,451,775.50. This represents a 0.10% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CFO Colette Kress sold 27,640 shares of the company's stock in a transaction on Monday, August 4th. The shares were sold at an average price of $178.06, for a total transaction of $4,921,578.40. Following the sale, the chief financial officer directly owned 2,956,876 shares in the company, valued at approximately $526,501,340.56. The trade was a 0.93% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 5,687,440 shares of company stock worth $862,095,782. Corporate insiders own 4.17% of the company's stock.

About NVIDIA

(

Free Report)

NVIDIA Corporation provides graphics and compute and networking solutions in the United States, Taiwan, China, Hong Kong, and internationally. The Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; virtual GPU or vGPU software for cloud-based visual and virtual computing; automotive platforms for infotainment systems; and Omniverse software for building and operating metaverse and 3D internet applications.

See Also

Before you consider NVIDIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVIDIA wasn't on the list.

While NVIDIA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report