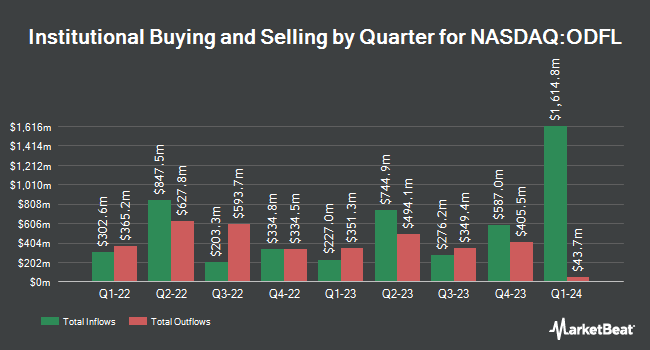

BNP Paribas Financial Markets grew its stake in shares of Old Dominion Freight Line, Inc. (NASDAQ:ODFL - Free Report) by 19.6% in the first quarter, according to the company in its most recent filing with the SEC. The firm owned 534,278 shares of the transportation company's stock after acquiring an additional 87,668 shares during the quarter. BNP Paribas Financial Markets owned about 0.25% of Old Dominion Freight Line worth $88,396,000 as of its most recent SEC filing.

Other large investors have also made changes to their positions in the company. Vanguard Group Inc. lifted its position in shares of Old Dominion Freight Line by 1.9% during the 1st quarter. Vanguard Group Inc. now owns 22,666,405 shares of the transportation company's stock worth $3,750,157,000 after buying an additional 416,097 shares during the last quarter. Invesco Ltd. lifted its position in shares of Old Dominion Freight Line by 1.3% during the 1st quarter. Invesco Ltd. now owns 4,272,231 shares of the transportation company's stock worth $706,841,000 after buying an additional 53,079 shares during the last quarter. T. Rowe Price Investment Management Inc. lifted its position in shares of Old Dominion Freight Line by 79.5% during the 1st quarter. T. Rowe Price Investment Management Inc. now owns 2,599,005 shares of the transportation company's stock worth $430,006,000 after buying an additional 1,151,221 shares during the last quarter. JPMorgan Chase & Co. lifted its position in shares of Old Dominion Freight Line by 45.1% during the 1st quarter. JPMorgan Chase & Co. now owns 2,429,750 shares of the transportation company's stock worth $402,002,000 after buying an additional 754,796 shares during the last quarter. Finally, Ameriprise Financial Inc. lifted its position in shares of Old Dominion Freight Line by 11.4% during the 1st quarter. Ameriprise Financial Inc. now owns 1,412,698 shares of the transportation company's stock worth $232,955,000 after buying an additional 145,058 shares during the last quarter. Institutional investors and hedge funds own 77.82% of the company's stock.

Old Dominion Freight Line Stock Down 1.1%

Shares of NASDAQ ODFL traded down $1.60 during midday trading on Wednesday, hitting $148.02. 805,314 shares of the stock traded hands, compared to its average volume of 1,843,196. The company has a debt-to-equity ratio of 0.04, a quick ratio of 1.38 and a current ratio of 1.38. Old Dominion Freight Line, Inc. has a one year low of $140.91 and a one year high of $233.26. The business has a 50 day moving average price of $157.65 and a two-hundred day moving average price of $162.08. The company has a market cap of $31.11 billion, a PE ratio of 28.88, a P/E/G ratio of 3.50 and a beta of 1.23.

Old Dominion Freight Line (NASDAQ:ODFL - Get Free Report) last announced its earnings results on Wednesday, July 30th. The transportation company reported $1.27 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.29 by ($0.02). Old Dominion Freight Line had a net margin of 19.42% and a return on equity of 25.94%. The company had revenue of $1.41 billion for the quarter, compared to analysts' expectations of $1.43 billion. During the same period in the previous year, the firm earned $1.48 EPS. The firm's quarterly revenue was down 6.1% on a year-over-year basis. On average, equities analysts predict that Old Dominion Freight Line, Inc. will post 5.68 EPS for the current year.

Old Dominion Freight Line Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, September 17th. Stockholders of record on Wednesday, September 3rd will be paid a dividend of $0.28 per share. The ex-dividend date is Wednesday, September 3rd. This represents a $1.12 annualized dividend and a dividend yield of 0.8%. Old Dominion Freight Line's dividend payout ratio (DPR) is presently 21.88%.

Analyst Upgrades and Downgrades

A number of brokerages have issued reports on ODFL. Susquehanna lowered their target price on Old Dominion Freight Line from $168.00 to $160.00 and set a "neutral" rating for the company in a report on Wednesday, June 18th. Stifel Nicolaus lowered their target price on Old Dominion Freight Line from $183.00 to $168.00 and set a "buy" rating for the company in a report on Thursday, July 31st. Baird R W raised Old Dominion Freight Line to a "hold" rating in a report on Tuesday, July 1st. Stephens dropped their price target on shares of Old Dominion Freight Line from $186.00 to $174.00 and set an "overweight" rating for the company in a research note on Thursday, July 31st. Finally, The Goldman Sachs Group raised shares of Old Dominion Freight Line from a "neutral" rating to a "buy" rating and raised their price target for the company from $190.00 to $200.00 in a research note on Monday, June 2nd. Eight analysts have rated the stock with a Buy rating, fourteen have issued a Hold rating and one has assigned a Sell rating to the company's stock. According to MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $167.62.

View Our Latest Research Report on ODFL

Old Dominion Freight Line Profile

(

Free Report)

Old Dominion Freight Line, Inc operates as a less-than-truckload motor carrier in the United States and North America. The company offers regional, inter-regional, and national less-than-truckload services, as well as expedited transportation. It also provides various value-added services, including container drayage, truckload brokerage, and supply chain consulting.

Read More

Before you consider Old Dominion Freight Line, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Old Dominion Freight Line wasn't on the list.

While Old Dominion Freight Line currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.