Old West Investment Management LLC increased its position in shares of Elanco Animal Health Incorporated (NYSE:ELAN - Free Report) by 3.6% during the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 407,869 shares of the company's stock after acquiring an additional 14,087 shares during the period. Elanco Animal Health makes up about 1.5% of Old West Investment Management LLC's investment portfolio, making the stock its 23rd largest position. Old West Investment Management LLC owned approximately 0.08% of Elanco Animal Health worth $4,283,000 at the end of the most recent quarter.

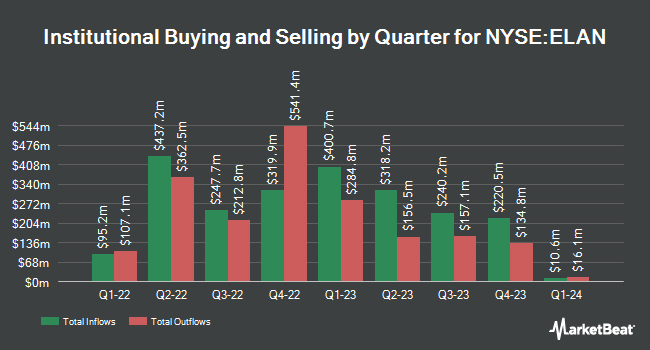

A number of other hedge funds have also recently bought and sold shares of ELAN. Envestnet Asset Management Inc. grew its holdings in Elanco Animal Health by 53.5% during the fourth quarter. Envestnet Asset Management Inc. now owns 211,904 shares of the company's stock worth $2,566,000 after acquiring an additional 73,838 shares during the period. Mariner LLC increased its stake in Elanco Animal Health by 79.6% in the 4th quarter. Mariner LLC now owns 56,193 shares of the company's stock worth $680,000 after purchasing an additional 24,901 shares in the last quarter. First Trust Advisors LP increased its stake in Elanco Animal Health by 508.2% in the 4th quarter. First Trust Advisors LP now owns 133,038 shares of the company's stock worth $1,611,000 after purchasing an additional 111,163 shares in the last quarter. Stifel Financial Corp increased its stake in Elanco Animal Health by 103.6% in the 4th quarter. Stifel Financial Corp now owns 228,277 shares of the company's stock worth $2,764,000 after purchasing an additional 116,175 shares in the last quarter. Finally, Adage Capital Partners GP L.L.C. increased its stake in Elanco Animal Health by 148.8% in the 4th quarter. Adage Capital Partners GP L.L.C. now owns 1,741,308 shares of the company's stock worth $21,087,000 after purchasing an additional 1,041,308 shares in the last quarter. 97.48% of the stock is owned by institutional investors and hedge funds.

Elanco Animal Health Stock Down 0.4%

NYSE ELAN traded down $0.08 during trading on Friday, reaching $18.38. 71,268,743 shares of the company's stock were exchanged, compared to its average volume of 7,713,274. The firm has a market capitalization of $9.13 billion, a PE ratio of 21.37, a P/E/G ratio of 3.41 and a beta of 1.66. The company has a current ratio of 2.60, a quick ratio of 1.40 and a debt-to-equity ratio of 0.61. Elanco Animal Health Incorporated has a fifty-two week low of $8.02 and a fifty-two week high of $18.87. The company's fifty day simple moving average is $15.55 and its 200-day simple moving average is $12.70.

Elanco Animal Health (NYSE:ELAN - Get Free Report) last announced its quarterly earnings results on Thursday, August 7th. The company reported $0.26 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.20 by $0.06. The business had revenue of $1.24 billion during the quarter, compared to analyst estimates of $1.19 billion. Elanco Animal Health had a return on equity of 7.04% and a net margin of 9.68%.The firm's revenue was up 4.8% on a year-over-year basis. During the same period in the previous year, the company earned $0.30 EPS. Elanco Animal Health has set its Q3 2025 guidance at 0.120-0.160 EPS. FY 2025 guidance at 0.850-0.91 EPS. Sell-side analysts predict that Elanco Animal Health Incorporated will post 0.91 EPS for the current year.

Analyst Ratings Changes

ELAN has been the topic of a number of analyst reports. Leerink Partnrs raised Elanco Animal Health from a "hold" rating to a "strong-buy" rating in a research note on Thursday, July 17th. Leerink Partners raised Elanco Animal Health from a "market perform" rating to an "outperform" rating and set a $18.00 price target on the stock in a research note on Thursday, July 17th. UBS Group lifted their price target on Elanco Animal Health from $18.00 to $19.00 and gave the stock a "buy" rating in a research note on Friday, August 8th. Wall Street Zen raised Elanco Animal Health from a "hold" rating to a "buy" rating in a research note on Saturday, July 5th. Finally, Zacks Research lowered Elanco Animal Health from a "strong-buy" rating to a "hold" rating in a research report on Wednesday, August 20th. One analyst has rated the stock with a Strong Buy rating, five have given a Buy rating and three have assigned a Hold rating to the stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus target price of $17.33.

View Our Latest Stock Report on Elanco Animal Health

Elanco Animal Health Profile

(

Free Report)

Elanco Animal Health Incorporated, an animal health company, innovates, develops, manufactures, and markets products for pets and farm animals. It offers pet health disease prevention products, such as parasiticide and vaccine products that protect pets from worms, fleas, and ticks under the Seresto, Advantage, Advantix, and Advocate brands; pet health therapeutics for pain, osteoarthritis, ear infections, cardiovascular, and dermatology indications in canines and felines under the Galliprant and Claro brands; vaccines, antibiotics, parasiticides, and other products for use in poultry and aquaculture production, as well as nutritional health products, including enzymes, probiotics, and prebiotics; and a range of vaccines, antibiotics, implants, parasiticides, and other products used in ruminant and swine production under the Rumensin and Baytril brands.

Featured Articles

Before you consider Elanco Animal Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Elanco Animal Health wasn't on the list.

While Elanco Animal Health currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.