CW Advisors LLC decreased its stake in Ollie's Bargain Outlet Holdings, Inc. (NASDAQ:OLLI - Free Report) by 3.4% in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 253,133 shares of the company's stock after selling 9,024 shares during the period. CW Advisors LLC owned 0.41% of Ollie's Bargain Outlet worth $29,455,000 at the end of the most recent quarter.

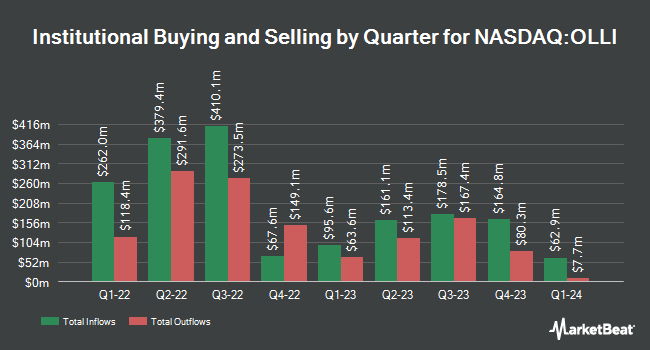

Several other institutional investors and hedge funds have also bought and sold shares of OLLI. Barclays PLC grew its stake in Ollie's Bargain Outlet by 75.9% in the fourth quarter. Barclays PLC now owns 72,671 shares of the company's stock valued at $7,976,000 after purchasing an additional 31,364 shares in the last quarter. Mariner LLC raised its holdings in shares of Ollie's Bargain Outlet by 15.6% in the 4th quarter. Mariner LLC now owns 14,950 shares of the company's stock valued at $1,640,000 after purchasing an additional 2,022 shares during the period. CANADA LIFE ASSURANCE Co grew its holdings in Ollie's Bargain Outlet by 0.7% during the fourth quarter. CANADA LIFE ASSURANCE Co now owns 50,069 shares of the company's stock worth $5,492,000 after purchasing an additional 325 shares during the period. GeoWealth Management LLC acquired a new position in Ollie's Bargain Outlet during the fourth quarter worth approximately $38,000. Finally, Dimensional Fund Advisors LP raised its stake in Ollie's Bargain Outlet by 2.0% in the fourth quarter. Dimensional Fund Advisors LP now owns 1,242,332 shares of the company's stock valued at $136,325,000 after buying an additional 24,890 shares during the period.

Analysts Set New Price Targets

OLLI has been the subject of several research analyst reports. Loop Capital downgraded Ollie's Bargain Outlet from a "buy" rating to a "hold" rating and set a $130.00 target price for the company. in a research note on Tuesday, June 24th. JPMorgan Chase & Co. lifted their price objective on shares of Ollie's Bargain Outlet from $137.00 to $159.00 and gave the stock an "overweight" rating in a research report on Monday, July 21st. Royal Bank Of Canada increased their price objective on shares of Ollie's Bargain Outlet from $133.00 to $144.00 and gave the company an "outperform" rating in a research report on Monday, August 18th. Piper Sandler upped their price target on shares of Ollie's Bargain Outlet from $123.00 to $150.00 and gave the company an "overweight" rating in a research note on Tuesday, August 19th. Finally, Truist Financial upped their target price on Ollie's Bargain Outlet from $128.00 to $146.00 and gave the company a "buy" rating in a research report on Wednesday, August 13th. Nine equities research analysts have rated the stock with a Buy rating and five have issued a Hold rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $130.79.

View Our Latest Research Report on OLLI

Ollie's Bargain Outlet Stock Performance

Shares of NASDAQ OLLI traded down $1.94 during midday trading on Friday, reaching $132.19. The company's stock had a trading volume of 1,689,683 shares, compared to its average volume of 852,849. The company has a market cap of $8.11 billion, a P/E ratio of 40.67, a P/E/G ratio of 2.96 and a beta of 0.40. The business's 50 day moving average price is $131.77 and its two-hundred day moving average price is $116.87. Ollie's Bargain Outlet Holdings, Inc. has a fifty-two week low of $86.29 and a fifty-two week high of $141.74.

Ollie's Bargain Outlet (NASDAQ:OLLI - Get Free Report) last announced its quarterly earnings data on Tuesday, June 3rd. The company reported $0.75 earnings per share for the quarter, beating the consensus estimate of $0.70 by $0.05. The firm had revenue of $576.77 million during the quarter, compared to analysts' expectations of $565.04 million. Ollie's Bargain Outlet had a return on equity of 12.27% and a net margin of 8.59%.The company's quarterly revenue was up 13.4% compared to the same quarter last year. During the same period in the previous year, the firm earned $0.73 EPS. Ollie's Bargain Outlet has set its FY 2025 guidance at 3.650-3.750 EPS. Sell-side analysts forecast that Ollie's Bargain Outlet Holdings, Inc. will post 3.29 earnings per share for the current fiscal year.

Insiders Place Their Bets

In related news, CEO Der Valk Eric Van sold 728 shares of the company's stock in a transaction dated Friday, June 13th. The shares were sold at an average price of $112.85, for a total transaction of $82,154.80. Following the completion of the sale, the chief executive officer owned 7,761 shares of the company's stock, valued at $875,828.85. This represents a 8.58% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. 0.75% of the stock is owned by corporate insiders.

Ollie's Bargain Outlet Company Profile

(

Free Report)

Ollie's Bargain Outlet Holdings, Inc is a holding company, which engages in the retail of closeouts, excess inventory, and salvage merchandise. It offers overstocks, package changes, manufacturer refurbished goods, and irregulars. The company's products include housewares, food, books and stationery, bed and bath, floor coverings, electronics and toys.

See Also

Before you consider Ollie's Bargain Outlet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ollie's Bargain Outlet wasn't on the list.

While Ollie's Bargain Outlet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.