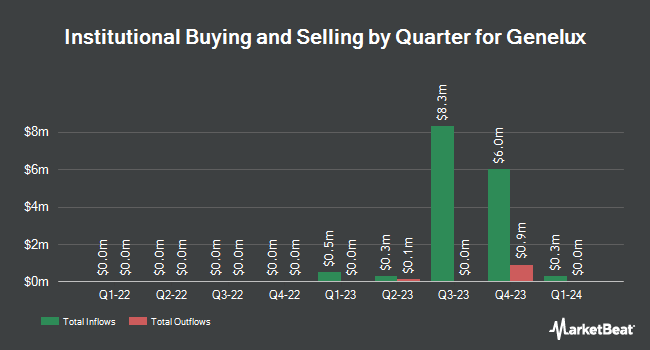

OMERS ADMINISTRATION Corp acquired a new stake in shares of Genelux Corporation (NASDAQ:GNLX - Free Report) in the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund acquired 79,700 shares of the company's stock, valued at approximately $215,000. OMERS ADMINISTRATION Corp owned 0.21% of Genelux as of its most recent filing with the Securities & Exchange Commission.

Several other large investors have also recently bought and sold shares of GNLX. American Century Companies Inc. acquired a new stake in Genelux in the first quarter worth $51,000. Charles Schwab Investment Management Inc. acquired a new stake in Genelux during the 1st quarter worth $68,000. Liberty Wealth Management LLC acquired a new stake in Genelux during the 1st quarter worth $45,000. Woodward Diversified Capital LLC lifted its holdings in Genelux by 15.2% during the first quarter. Woodward Diversified Capital LLC now owns 1,461,113 shares of the company's stock worth $3,945,000 after acquiring an additional 192,808 shares in the last quarter. Finally, 5T Wealth LLC acquired a new position in Genelux in the first quarter valued at about $49,000. Institutional investors own 37.33% of the company's stock.

Genelux Price Performance

Shares of Genelux stock opened at $3.48 on Friday. The firm has a market cap of $131.44 million, a price-to-earnings ratio of -4.05 and a beta of -0.33. The stock's 50-day moving average is $3.36 and its 200-day moving average is $3.14. Genelux Corporation has a one year low of $1.95 and a one year high of $5.89.

Genelux (NASDAQ:GNLX - Get Free Report) last posted its quarterly earnings data on Thursday, August 7th. The company reported ($0.20) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.22) by $0.02. On average, equities analysts expect that Genelux Corporation will post -0.88 EPS for the current year.

Analyst Upgrades and Downgrades

Several equities research analysts have issued reports on GNLX shares. Benchmark lowered their price target on Genelux from $25.00 to $23.00 and set a "speculative buy" rating for the company in a report on Thursday, May 8th. Wall Street Zen upgraded Genelux from a "sell" rating to a "hold" rating in a research report on Saturday, July 12th. Finally, HC Wainwright reissued a "buy" rating on shares of Genelux in a research note on Wednesday, July 23rd. Three investment analysts have rated the stock with a Buy rating, According to MarketBeat.com, the company presently has an average rating of "Buy" and a consensus target price of $20.33.

Read Our Latest Stock Report on GNLX

Genelux Profile

(

Free Report)

Genelux Corporation, a clinical-stage biopharmaceutical company, focuses on developing next-generation oncolytic viral immunotherapies for patients suffering from aggressive and/or difficult-to-treat solid tumor types. Its lead product candidate is Olvi-Vec, a proprietary modified strain of the vaccinia virus for the treatment of ovarian cancer and non-small cell lung cancer.

Recommended Stories

Want to see what other hedge funds are holding GNLX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Genelux Corporation (NASDAQ:GNLX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Genelux, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genelux wasn't on the list.

While Genelux currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.