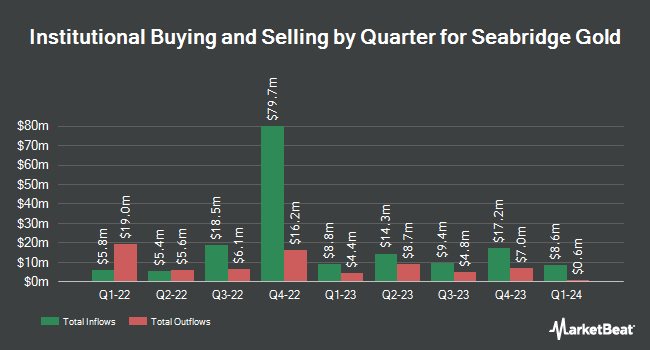

OMERS ADMINISTRATION Corp purchased a new stake in shares of Seabridge Gold, Inc. (NYSE:SA - Free Report) TSE: SEA during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor purchased 39,000 shares of the basic materials company's stock, valued at approximately $455,000.

Other institutional investors have also recently made changes to their positions in the company. Banque Cantonale Vaudoise purchased a new position in shares of Seabridge Gold during the 1st quarter valued at $26,000. Northwest & Ethical Investments L.P. purchased a new position in shares of Seabridge Gold during the 1st quarter valued at $39,000. Wealth Preservation Advisors LLC purchased a new position in shares of Seabridge Gold during the 1st quarter valued at $121,000. Ewing Morris & Co. Investment Partners Ltd. purchased a new position in shares of Seabridge Gold during the 4th quarter valued at $138,000. Finally, Tudor Investment Corp ET AL purchased a new position in shares of Seabridge Gold during the 4th quarter valued at $140,000. Hedge funds and other institutional investors own 34.85% of the company's stock.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen lowered Seabridge Gold from a "hold" rating to a "sell" rating in a research note on Saturday, August 16th.

Read Our Latest Stock Report on Seabridge Gold

Seabridge Gold Stock Performance

Shares of SA opened at $17.60 on Wednesday. The stock's 50-day simple moving average is $15.99 and its 200 day simple moving average is $13.51. The stock has a market capitalization of $1.80 billion, a price-to-earnings ratio of -46.33 and a beta of 0.68. The company has a debt-to-equity ratio of 0.57, a quick ratio of 4.24 and a current ratio of 4.24. Seabridge Gold, Inc. has a 52-week low of $9.40 and a 52-week high of $20.55.

Seabridge Gold (NYSE:SA - Get Free Report) TSE: SEA last issued its quarterly earnings data on Wednesday, August 13th. The basic materials company reported $0.09 earnings per share (EPS) for the quarter.

Seabridge Gold Company Profile

(

Free Report)

Seabridge Gold Inc, together with its subsidiaries, engages in the acquisition and exploration of gold properties in North America. The company also explores for gold, copper, silver, and molybdenum deposits. The company was formerly known as Seabridge Resources Inc and changed its name to Seabridge Gold Inc in June 2002.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Seabridge Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Seabridge Gold wasn't on the list.

While Seabridge Gold currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.