Ontario Teachers Pension Plan Board bought a new stake in shares of Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR - Free Report) during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund bought 45,769 shares of the biotechnology company's stock, valued at approximately $583,000.

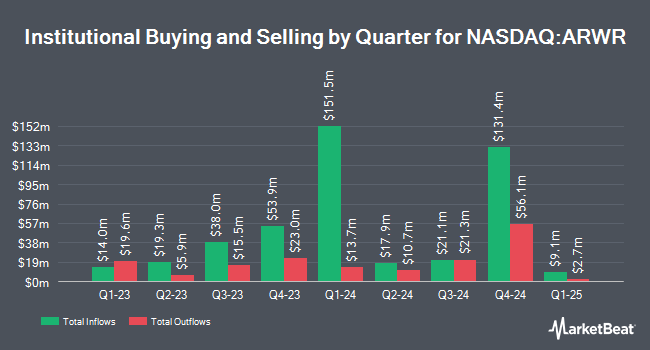

Other hedge funds and other institutional investors also recently modified their holdings of the company. Summit Investment Advisors Inc. grew its position in Arrowhead Pharmaceuticals by 2.2% in the 4th quarter. Summit Investment Advisors Inc. now owns 37,994 shares of the biotechnology company's stock worth $714,000 after purchasing an additional 803 shares during the period. GAMMA Investing LLC grew its holdings in shares of Arrowhead Pharmaceuticals by 297.6% in the first quarter. GAMMA Investing LLC now owns 2,175 shares of the biotechnology company's stock worth $28,000 after acquiring an additional 1,628 shares during the period. Bank of Montreal Can increased its position in Arrowhead Pharmaceuticals by 13.3% during the fourth quarter. Bank of Montreal Can now owns 15,018 shares of the biotechnology company's stock valued at $282,000 after acquiring an additional 1,759 shares during the last quarter. Captrust Financial Advisors increased its position in Arrowhead Pharmaceuticals by 13.5% during the fourth quarter. Captrust Financial Advisors now owns 17,074 shares of the biotechnology company's stock valued at $321,000 after acquiring an additional 2,035 shares during the last quarter. Finally, KBC Group NV lifted its holdings in Arrowhead Pharmaceuticals by 40.8% in the first quarter. KBC Group NV now owns 7,356 shares of the biotechnology company's stock valued at $94,000 after acquiring an additional 2,132 shares during the period. Hedge funds and other institutional investors own 62.61% of the company's stock.

Wall Street Analyst Weigh In

Several brokerages have recently weighed in on ARWR. B. Riley upgraded shares of Arrowhead Pharmaceuticals to a "strong-buy" rating in a research note on Monday. Royal Bank Of Canada decreased their price target on shares of Arrowhead Pharmaceuticals from $40.00 to $38.00 and set an "outperform" rating on the stock in a research report on Friday, August 8th. HC Wainwright reiterated a "buy" rating and set a $80.00 price target on shares of Arrowhead Pharmaceuticals in a research note on Tuesday, May 20th. Wall Street Zen lowered Arrowhead Pharmaceuticals from a "buy" rating to a "hold" rating in a research note on Friday, July 18th. Finally, TD Cowen upgraded Arrowhead Pharmaceuticals to a "strong-buy" rating in a research report on Monday, July 28th. Three research analysts have rated the stock with a hold rating, five have issued a buy rating and two have given a strong buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $43.14.

Check Out Our Latest Stock Analysis on ARWR

Arrowhead Pharmaceuticals Price Performance

Shares of NASDAQ ARWR traded down $1.40 during mid-day trading on Thursday, reaching $18.59. The company's stock had a trading volume of 2,649,249 shares, compared to its average volume of 1,907,557. The company has a debt-to-equity ratio of 0.39, a current ratio of 4.87 and a quick ratio of 4.87. Arrowhead Pharmaceuticals, Inc. has a 52 week low of $9.57 and a 52 week high of $27.34. The stock has a fifty day moving average of $16.59 and a two-hundred day moving average of $15.95. The firm has a market capitalization of $2.57 billion, a PE ratio of -14.53 and a beta of 0.94.

Arrowhead Pharmaceuticals (NASDAQ:ARWR - Get Free Report) last posted its quarterly earnings results on Thursday, August 7th. The biotechnology company reported ($1.26) EPS for the quarter, missing analysts' consensus estimates of ($0.94) by ($0.32). The company had revenue of $27.77 million during the quarter, compared to the consensus estimate of $29.01 million. During the same quarter in the previous year, the company posted ($1.38) earnings per share. As a group, sell-side analysts anticipate that Arrowhead Pharmaceuticals, Inc. will post -2.42 EPS for the current fiscal year.

Arrowhead Pharmaceuticals Profile

(

Free Report)

Arrowhead Pharmaceuticals, Inc develops medicines for the treatment of intractable diseases in the United States. The company's products in pipeline includes Plozasiran, which is in Phase 2b and one Phase 3 clinical trial to treat hypertriglyceridemia, mixed dyslipidemia, and chylomicronemia syndrome; Zodasiran that is in Phase 2b clinical trial for the treatment of dyslipidemia and hypertriglyceridemia; ARO-PNPLA3, which is in Phase 1 clinical trial to treat patients with non-alcoholic steatohepatitis; ARO-RAGE that is in Phase 1/2a clinical trial to treat inflammatory pulmonary conditions; and ARO-MUC5AC, which is in Phase 1/2a clinical trial to treat muco-obstructive pulmonary diseases.

Further Reading

Before you consider Arrowhead Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arrowhead Pharmaceuticals wasn't on the list.

While Arrowhead Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.