Ontario Teachers Pension Plan Board boosted its holdings in shares of Dropbox, Inc. (NASDAQ:DBX - Free Report) by 29.8% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 64,390 shares of the company's stock after buying an additional 14,773 shares during the period. Ontario Teachers Pension Plan Board's holdings in Dropbox were worth $1,720,000 as of its most recent SEC filing.

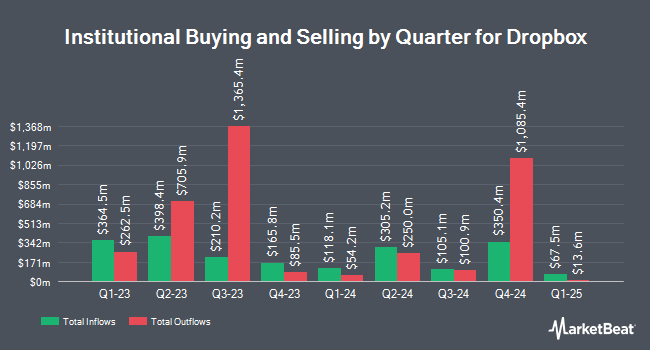

Several other institutional investors have also bought and sold shares of the stock. LSV Asset Management grew its stake in shares of Dropbox by 18.4% in the 1st quarter. LSV Asset Management now owns 7,633,516 shares of the company's stock worth $203,891,000 after acquiring an additional 1,187,395 shares in the last quarter. AQR Capital Management LLC grew its stake in shares of Dropbox by 3.0% in the 4th quarter. AQR Capital Management LLC now owns 3,332,516 shares of the company's stock worth $99,842,000 after acquiring an additional 97,551 shares in the last quarter. Charles Schwab Investment Management Inc. grew its stake in shares of Dropbox by 1.2% in the 1st quarter. Charles Schwab Investment Management Inc. now owns 2,950,273 shares of the company's stock worth $78,802,000 after acquiring an additional 36,268 shares in the last quarter. Dimensional Fund Advisors LP increased its position in shares of Dropbox by 3.2% during the 4th quarter. Dimensional Fund Advisors LP now owns 2,646,502 shares of the company's stock valued at $79,505,000 after purchasing an additional 82,284 shares during the last quarter. Finally, First Trust Advisors LP increased its position in shares of Dropbox by 12.2% during the 4th quarter. First Trust Advisors LP now owns 2,415,093 shares of the company's stock valued at $72,549,000 after purchasing an additional 262,871 shares during the last quarter. Institutional investors own 94.84% of the company's stock.

Insider Transactions at Dropbox

In other Dropbox news, insider Ashraf Alkarmi sold 10,098 shares of Dropbox stock in a transaction that occurred on Friday, June 13th. The stock was sold at an average price of $28.10, for a total transaction of $283,753.80. Following the sale, the insider directly owned 492,856 shares of the company's stock, valued at approximately $13,849,253.60. The trade was a 2.01% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CEO Andrew Houston sold 92,000 shares of Dropbox stock in a transaction that occurred on Tuesday, July 1st. The shares were sold at an average price of $27.96, for a total value of $2,572,320.00. Following the sale, the chief executive officer directly owned 8,266,666 shares in the company, valued at approximately $231,135,981.36. The trade was a 1.10% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders sold 466,125 shares of company stock valued at $13,221,355. Insiders own 28.59% of the company's stock.

Dropbox Price Performance

Dropbox stock traded up $0.35 during trading hours on Tuesday, reaching $27.22. The company had a trading volume of 742,619 shares, compared to its average volume of 3,772,266. The company has a 50-day moving average price of $27.84 and a 200 day moving average price of $28.20. Dropbox, Inc. has a 12-month low of $21.84 and a 12-month high of $33.33. The firm has a market cap of $7.66 billion, a price-to-earnings ratio of 16.60, a P/E/G ratio of 10.58 and a beta of 0.64.

Dropbox (NASDAQ:DBX - Get Free Report) last released its quarterly earnings results on Thursday, August 7th. The company reported $0.71 EPS for the quarter, beating analysts' consensus estimates of $0.63 by $0.08. Dropbox had a negative return on equity of 61.31% and a net margin of 19.17%. The business had revenue of $625.70 million during the quarter, compared to analyst estimates of $618.60 million. During the same quarter in the prior year, the company posted $0.60 EPS. Dropbox's quarterly revenue was down 1.4% compared to the same quarter last year. As a group, research analysts expect that Dropbox, Inc. will post 1.64 earnings per share for the current year.

Wall Street Analyst Weigh In

Several brokerages have recently issued reports on DBX. Citigroup raised their target price on Dropbox from $30.00 to $32.00 and gave the company a "neutral" rating in a research report on Friday, May 9th. UBS Group reduced their price objective on Dropbox from $31.00 to $29.00 and set a "neutral" rating for the company in a report on Friday.

Check Out Our Latest Analysis on Dropbox

Dropbox Profile

(

Free Report)

Dropbox, Inc provides a content collaboration platform worldwide. The company's platform allows individuals, families, teams, and organizations to collaborate and sign up for free through its website or app, as well as upgrade to a paid subscription plan for premium features. It serves customers in professional services, technology, media, education, industrial, consumer and retail, and financial services industries.

Featured Articles

Before you consider Dropbox, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dropbox wasn't on the list.

While Dropbox currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report