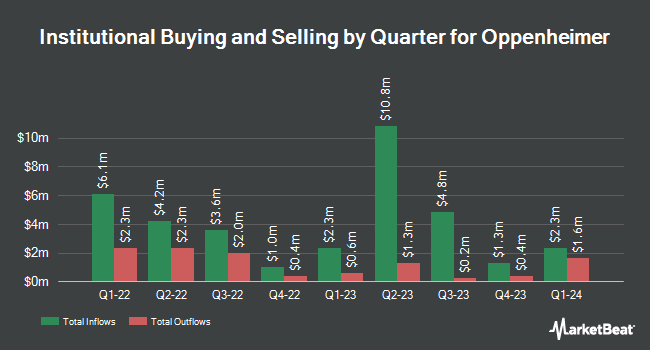

Vanguard Group Inc. grew its holdings in Oppenheimer Holdings, Inc. (NYSE:OPY - Free Report) by 1.5% during the first quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 391,435 shares of the financial services provider's stock after purchasing an additional 5,666 shares during the quarter. Vanguard Group Inc. owned about 3.72% of Oppenheimer worth $23,341,000 as of its most recent filing with the SEC.

Several other large investors have also made changes to their positions in the company. State of Wyoming lifted its stake in shares of Oppenheimer by 10.9% during the fourth quarter. State of Wyoming now owns 4,403 shares of the financial services provider's stock valued at $282,000 after acquiring an additional 431 shares during the period. Jane Street Group LLC lifted its stake in shares of Oppenheimer by 10.7% during the fourth quarter. Jane Street Group LLC now owns 6,900 shares of the financial services provider's stock valued at $442,000 after acquiring an additional 666 shares during the period. Tudor Investment Corp ET AL lifted its stake in shares of Oppenheimer by 3.7% during the fourth quarter. Tudor Investment Corp ET AL now owns 22,825 shares of the financial services provider's stock valued at $1,463,000 after acquiring an additional 822 shares during the period. Beverly Hills Private Wealth LLC lifted its stake in shares of Oppenheimer by 3.3% during the fourth quarter. Beverly Hills Private Wealth LLC now owns 27,271 shares of the financial services provider's stock valued at $1,748,000 after acquiring an additional 866 shares during the period. Finally, Gordian Capital Singapore Pte Ltd acquired a new position in shares of Oppenheimer during the fourth quarter valued at $77,000. Institutional investors and hedge funds own 32.26% of the company's stock.

Insider Activity at Oppenheimer

In related news, insider Dennis P. Mcnamara sold 2,000 shares of the stock in a transaction that occurred on Tuesday, August 5th. The stock was sold at an average price of $73.81, for a total transaction of $147,620.00. Following the completion of the transaction, the insider directly owned 21,766 shares of the company's stock, valued at approximately $1,606,548.46. This represents a 8.42% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director Paul M. Friedman sold 3,500 shares of the stock in a transaction that occurred on Monday, June 9th. The shares were sold at an average price of $63.32, for a total value of $221,620.00. Following the transaction, the director directly owned 20,500 shares of the company's stock, valued at $1,298,060. This trade represents a 14.58% decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 34.25% of the company's stock.

Oppenheimer Price Performance

Shares of Oppenheimer stock traded up $1.17 during trading hours on Monday, hitting $72.72. The company's stock had a trading volume of 56,148 shares, compared to its average volume of 37,130. Oppenheimer Holdings, Inc. has a 12 month low of $47.39 and a 12 month high of $77.83. The stock has a 50 day moving average of $70.21 and a 200 day moving average of $64.19. The company has a market capitalization of $765.11 million, a PE ratio of 9.43 and a beta of 1.21.

Oppenheimer (NYSE:OPY - Get Free Report) last announced its quarterly earnings results on Friday, August 1st. The financial services provider reported $1.91 earnings per share (EPS) for the quarter. The company had revenue of $373.18 million during the quarter. Oppenheimer had a return on equity of 10.13% and a net margin of 5.88%.

Oppenheimer Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, August 29th. Investors of record on Friday, August 15th were given a dividend of $0.18 per share. The ex-dividend date of this dividend was Friday, August 15th. This represents a $0.72 annualized dividend and a yield of 1.0%. Oppenheimer's dividend payout ratio is 9.34%.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen raised Oppenheimer from a "hold" rating to a "strong-buy" rating in a research note on Sunday, August 10th.

View Our Latest Analysis on OPY

About Oppenheimer

(

Free Report)

Oppenheimer Holdings Inc operates as a middle-market investment bank and full-service broker-dealer in the Americas, Europe, the Middle East, and Asia. The company provides brokerage services covering corporate equity and debt securities, money market instruments, exchange-traded options and futures contracts, municipal bonds, mutual funds, exchange-traded funds, and unit investment trusts; financial and wealth planning services; and margin lending services.

Read More

Before you consider Oppenheimer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oppenheimer wasn't on the list.

While Oppenheimer currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.