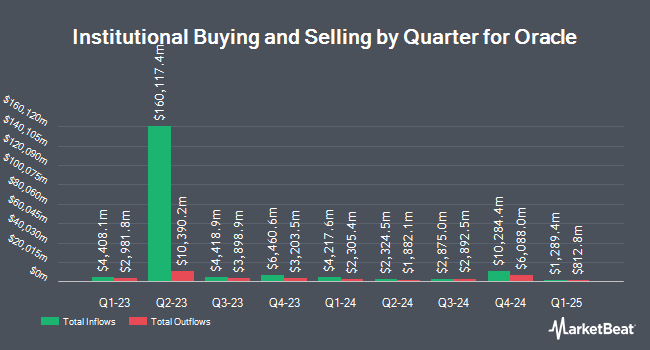

Phoenix Financial Ltd. decreased its position in Oracle Corporation (NYSE:ORCL - Free Report) by 45.5% in the 2nd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 524,070 shares of the enterprise software provider's stock after selling 437,420 shares during the quarter. Oracle accounts for about 1.5% of Phoenix Financial Ltd.'s investment portfolio, making the stock its 19th largest holding. Phoenix Financial Ltd.'s holdings in Oracle were worth $114,530,000 at the end of the most recent reporting period.

A number of other hedge funds have also made changes to their positions in ORCL. Harel Insurance Investments & Financial Services Ltd. increased its stake in shares of Oracle by 71.6% in the first quarter. Harel Insurance Investments & Financial Services Ltd. now owns 257,378 shares of the enterprise software provider's stock worth $35,984,000 after buying an additional 107,404 shares during the last quarter. Lockheed Martin Investment Management Co. increased its stake in shares of Oracle by 4.3% in the first quarter. Lockheed Martin Investment Management Co. now owns 51,350 shares of the enterprise software provider's stock worth $7,179,000 after buying an additional 2,110 shares during the last quarter. Private Wealth Asset Management LLC increased its stake in shares of Oracle by 9.2% in the second quarter. Private Wealth Asset Management LLC now owns 3,817 shares of the enterprise software provider's stock worth $835,000 after buying an additional 321 shares during the last quarter. Cascade Investment Group Inc. bought a new stake in shares of Oracle in the second quarter worth $239,000. Finally, Lockerman Financial Group Inc. bought a new stake in shares of Oracle in the second quarter worth $328,000. Institutional investors and hedge funds own 42.44% of the company's stock.

Oracle Stock Performance

Shares of ORCL opened at $276.93 on Tuesday. Oracle Corporation has a 1 year low of $118.86 and a 1 year high of $345.72. The company has a market cap of $789.47 billion, a price-to-earnings ratio of 64.10, a price-to-earnings-growth ratio of 3.14 and a beta of 1.53. The company has a debt-to-equity ratio of 3.33, a quick ratio of 0.62 and a current ratio of 0.62. The firm has a fifty day moving average of $272.19 and a 200-day moving average of $217.44.

Oracle (NYSE:ORCL - Get Free Report) last announced its quarterly earnings results on Tuesday, September 9th. The enterprise software provider reported $1.47 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.48 by ($0.01). Oracle had a net margin of 21.08% and a return on equity of 72.93%. The firm had revenue of $14.93 billion for the quarter, compared to analyst estimates of $15.04 billion. During the same period last year, the firm posted $1.39 EPS. The business's revenue was up 12.2% compared to the same quarter last year. Oracle has set its Q2 2026 guidance at 1.270-1.310 EPS. As a group, equities analysts anticipate that Oracle Corporation will post 5 earnings per share for the current year.

Oracle Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Thursday, October 23rd. Stockholders of record on Thursday, October 9th will be issued a dividend of $0.50 per share. The ex-dividend date of this dividend is Thursday, October 9th. This represents a $2.00 annualized dividend and a dividend yield of 0.7%. Oracle's payout ratio is 46.30%.

Insiders Place Their Bets

In related news, EVP Stuart Levey sold 19,758 shares of the company's stock in a transaction dated Friday, October 10th. The shares were sold at an average price of $300.00, for a total value of $5,927,400.00. Following the completion of the sale, the executive vice president owned 18,429 shares of the company's stock, valued at $5,528,700. This represents a 51.74% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, insider Michael D. Sicilia sold 33,845 shares of the company's stock in a transaction dated Tuesday, September 23rd. The stock was sold at an average price of $321.16, for a total transaction of $10,869,660.20. Following the completion of the sale, the insider directly owned 132,656 shares of the company's stock, valued at $42,603,800.96. The trade was a 20.33% decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 120,769 shares of company stock valued at $36,428,967. Corporate insiders own 40.90% of the company's stock.

Analyst Ratings Changes

A number of analysts recently issued reports on the stock. DA Davidson lifted their price target on shares of Oracle from $220.00 to $300.00 and gave the stock a "neutral" rating in a research note on Wednesday, September 10th. Cowen reaffirmed a "buy" rating on shares of Oracle in a report on Friday. Redburn Partners set a $175.00 price objective on shares of Oracle in a report on Thursday, September 25th. UBS Group lifted their price objective on shares of Oracle from $360.00 to $380.00 and gave the stock a "buy" rating in a report on Friday. Finally, Melius Research lifted their price objective on shares of Oracle from $270.00 to $370.00 and gave the stock a "buy" rating in a report on Wednesday, September 10th. Three research analysts have rated the stock with a Strong Buy rating, twenty-seven have given a Buy rating, nine have given a Hold rating and two have given a Sell rating to the stock. According to MarketBeat.com, Oracle has a consensus rating of "Moderate Buy" and an average target price of $323.69.

Check Out Our Latest Research Report on ORCL

About Oracle

(

Free Report)

Oracle Corporation offers products and services that address enterprise information technology environments worldwide. Its Oracle cloud software as a service offering include various cloud software applications, including Oracle Fusion cloud enterprise resource planning (ERP), Oracle Fusion cloud enterprise performance management, Oracle Fusion cloud supply chain and manufacturing management, Oracle Fusion cloud human capital management, Oracle Cerner healthcare, Oracle Advertising, and NetSuite applications suite, as well as Oracle Fusion Sales, Service, and Marketing.

Further Reading

Want to see what other hedge funds are holding ORCL? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Oracle Corporation (NYSE:ORCL - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Oracle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oracle wasn't on the list.

While Oracle currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report