Jump Financial LLC trimmed its stake in shares of Oscar Health, Inc. (NYSE:OSCR - Free Report) by 71.5% during the first quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 160,474 shares of the company's stock after selling 401,902 shares during the quarter. Jump Financial LLC owned about 0.06% of Oscar Health worth $2,104,000 as of its most recent filing with the Securities and Exchange Commission.

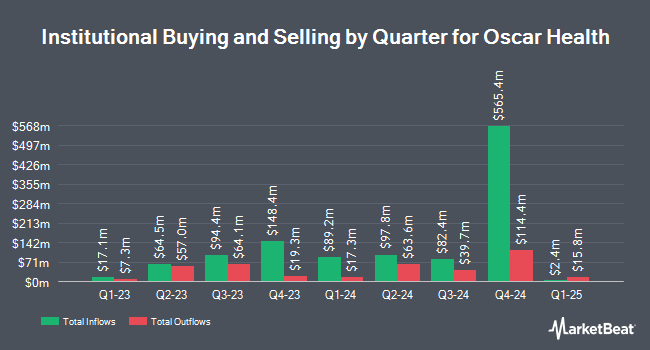

Several other institutional investors and hedge funds have also made changes to their positions in the stock. Southeastern Asset Management Inc. TN raised its holdings in Oscar Health by 52.2% during the fourth quarter. Southeastern Asset Management Inc. TN now owns 3,131,084 shares of the company's stock worth $42,082,000 after purchasing an additional 1,073,359 shares in the last quarter. Jacobs Levy Equity Management Inc. raised its holdings in shares of Oscar Health by 37.8% in the 4th quarter. Jacobs Levy Equity Management Inc. now owns 1,741,306 shares of the company's stock worth $23,403,000 after purchasing an additional 477,634 shares in the last quarter. Man Group plc boosted its holdings in Oscar Health by 344.8% during the fourth quarter. Man Group plc now owns 1,813,216 shares of the company's stock worth $24,370,000 after buying an additional 1,405,554 shares in the last quarter. Victory Capital Management Inc. boosted its holdings in Oscar Health by 23.8% during the first quarter. Victory Capital Management Inc. now owns 285,997 shares of the company's stock worth $3,749,000 after buying an additional 54,938 shares in the last quarter. Finally, Toronto Dominion Bank bought a new stake in Oscar Health during the fourth quarter worth approximately $1,008,000. 75.70% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

OSCR has been the topic of several research reports. Robert W. Baird reaffirmed a "neutral" rating and issued a $14.00 price target (down previously from $28.00) on shares of Oscar Health in a report on Friday, July 25th. Baird R W lowered Oscar Health from a "strong-buy" rating to a "hold" rating in a research report on Friday, July 25th. UBS Group restated a "sell" rating and set a $11.00 price objective (down previously from $15.00) on shares of Oscar Health in a report on Tuesday, July 15th. Raymond James Financial cut shares of Oscar Health from an "outperform" rating to a "market perform" rating in a report on Tuesday, June 24th. Finally, Piper Sandler cut their price target on shares of Oscar Health from $14.00 to $13.00 and set a "neutral" rating on the stock in a report on Thursday, August 14th. Four research analysts have rated the stock with a Hold rating and five have assigned a Sell rating to the company's stock. According to MarketBeat, Oscar Health has an average rating of "Strong Sell" and an average price target of $12.07.

Read Our Latest Report on OSCR

Oscar Health Stock Performance

Shares of OSCR traded down $0.59 on Monday, reaching $16.66. 9,548,309 shares of the stock traded hands, compared to its average volume of 18,137,728. The firm has a market cap of $4.31 billion, a price-to-earnings ratio of -20.56 and a beta of 1.87. The company has a debt-to-equity ratio of 0.26, a current ratio of 0.86 and a quick ratio of 0.86. Oscar Health, Inc. has a 12 month low of $11.20 and a 12 month high of $23.79. The stock's 50-day moving average price is $16.02 and its 200-day moving average price is $14.90.

Oscar Health (NYSE:OSCR - Get Free Report) last released its quarterly earnings results on Wednesday, August 6th. The company reported ($0.89) EPS for the quarter, topping analysts' consensus estimates of ($0.90) by $0.01. Oscar Health had a negative return on equity of 13.78% and a negative net margin of 1.50%.The business had revenue of $2.86 billion for the quarter, compared to analyst estimates of $2.88 billion. During the same period in the prior year, the company earned $0.20 EPS. Oscar Health's revenue for the quarter was up 29.0% on a year-over-year basis. Equities analysts forecast that Oscar Health, Inc. will post 0.69 EPS for the current fiscal year.

About Oscar Health

(

Free Report)

Oscar Health, Inc operates as a health insurance in the United States. The company offers health plans in individual and small group markets, as well as +Oscar, a technology driven platform that help providers and payors directly enable their shift to value-based care. It also provides reinsurance products.

Read More

Before you consider Oscar Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oscar Health wasn't on the list.

While Oscar Health currently has a Strong Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.