Osterweis Capital Management Inc. acquired a new stake in The Ensign Group, Inc. (NASDAQ:ENSG - Free Report) during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm acquired 51,185 shares of the company's stock, valued at approximately $6,623,000. Osterweis Capital Management Inc. owned approximately 0.09% of The Ensign Group at the end of the most recent quarter.

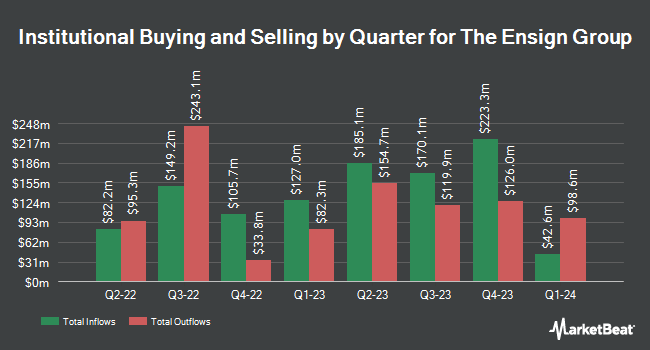

Several other institutional investors and hedge funds have also recently bought and sold shares of ENSG. Rise Advisors LLC grew its position in shares of The Ensign Group by 114.0% during the first quarter. Rise Advisors LLC now owns 199 shares of the company's stock worth $26,000 after buying an additional 106 shares in the last quarter. TCTC Holdings LLC lifted its stake in The Ensign Group by 116.7% in the first quarter. TCTC Holdings LLC now owns 208 shares of the company's stock worth $27,000 after acquiring an additional 112 shares during the last quarter. WPG Advisers LLC acquired a new position in The Ensign Group during the 1st quarter worth approximately $27,000. Opal Wealth Advisors LLC purchased a new stake in shares of The Ensign Group in the 1st quarter valued at approximately $36,000. Finally, AdvisorNet Financial Inc purchased a new stake in shares of The Ensign Group in the 1st quarter valued at approximately $38,000. 96.12% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of brokerages recently commented on ENSG. Truist Financial boosted their target price on shares of The Ensign Group from $155.00 to $165.00 and gave the stock a "hold" rating in a research note on Monday, July 28th. UBS Group upped their price objective on The Ensign Group from $195.00 to $205.00 and gave the stock a "buy" rating in a research report on Tuesday, September 2nd. Finally, Stephens raised their target price on The Ensign Group from $165.00 to $170.00 and gave the stock an "overweight" rating in a research report on Monday, July 28th. Five analysts have rated the stock with a Buy rating and one has issued a Hold rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $172.67.

Read Our Latest Stock Analysis on ENSG

The Ensign Group Stock Performance

Shares of ENSG stock traded up $0.48 during mid-day trading on Wednesday, hitting $164.82. The stock had a trading volume of 222,389 shares, compared to its average volume of 420,061. The firm has a market cap of $9.51 billion, a PE ratio of 29.84, a PEG ratio of 1.91 and a beta of 0.93. The company's 50-day simple moving average is $158.89 and its 200-day simple moving average is $145.34. The company has a debt-to-equity ratio of 0.07, a current ratio of 1.41 and a quick ratio of 1.41. The Ensign Group, Inc. has a fifty-two week low of $118.73 and a fifty-two week high of $174.98.

The Ensign Group (NASDAQ:ENSG - Get Free Report) last posted its quarterly earnings results on Thursday, July 24th. The company reported $1.59 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.54 by $0.05. The firm had revenue of $1.23 billion during the quarter, compared to analysts' expectations of $1.22 billion. The Ensign Group had a net margin of 6.99% and a return on equity of 16.92%. The firm's revenue for the quarter was up 18.5% on a year-over-year basis. During the same period in the prior year, the company posted $1.32 earnings per share. The Ensign Group has set its FY 2025 guidance at 6.340-6.460 EPS. Sell-side analysts anticipate that The Ensign Group, Inc. will post 5.59 earnings per share for the current year.

The Ensign Group Cuts Dividend

The business also recently announced a quarterly dividend, which was paid on Thursday, July 31st. Shareholders of record on Monday, June 30th were given a dividend of $0.0625 per share. This represents a $0.25 annualized dividend and a dividend yield of 0.2%. The ex-dividend date was Monday, June 30th. The Ensign Group's payout ratio is presently 4.54%.

Insiders Place Their Bets

In other The Ensign Group news, CFO Suzanne D. Snapper sold 8,379 shares of the company's stock in a transaction dated Monday, July 7th. The shares were sold at an average price of $148.21, for a total transaction of $1,241,851.59. Following the transaction, the chief financial officer directly owned 269,692 shares in the company, valued at approximately $39,971,051.32. This represents a 3.01% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, Director Barry M. Smith sold 700 shares of the stock in a transaction dated Tuesday, September 2nd. The shares were sold at an average price of $172.06, for a total transaction of $120,442.00. Following the completion of the transaction, the director directly owned 27,052 shares of the company's stock, valued at approximately $4,654,567.12. This trade represents a 2.52% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 9,779 shares of company stock worth $1,469,730. Corporate insiders own 3.90% of the company's stock.

The Ensign Group Profile

(

Free Report)

The Ensign Group, Inc provides skilled nursing, senior living, and rehabilitative services. It operates through two segments: Skilled Services and Standard Bearer. The company's Skilled Services segment engages in the operation of skilled nursing facilities and rehabilitation therapy services for patients with chronic conditions, prolonged illness, and the elderly; and offers nursing facilities including specialty care, such as on-site dialysis, ventilator care, cardiac, and pulmonary management, as well as standard services comprising room and board, special nutritional programs, social services, recreational activities, entertainment, and other services.

Featured Articles

Before you consider The Ensign Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Ensign Group wasn't on the list.

While The Ensign Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.