Osterweis Capital Management Inc. bought a new position in shares of Amicus Therapeutics, Inc. (NASDAQ:FOLD - Free Report) during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm bought 824,740 shares of the biopharmaceutical company's stock, valued at approximately $6,730,000. Osterweis Capital Management Inc. owned 0.27% of Amicus Therapeutics as of its most recent SEC filing.

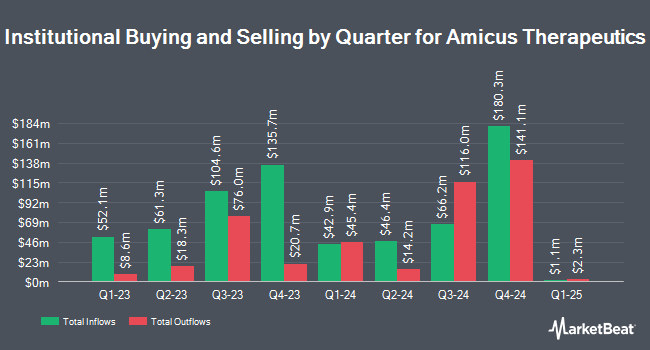

Several other institutional investors also recently bought and sold shares of the stock. Nuveen LLC acquired a new stake in shares of Amicus Therapeutics during the 1st quarter worth approximately $28,741,000. Vestal Point Capital LP purchased a new stake in Amicus Therapeutics during the fourth quarter worth $31,557,000. Millennium Management LLC grew its position in Amicus Therapeutics by 635.1% during the first quarter. Millennium Management LLC now owns 3,359,389 shares of the biopharmaceutical company's stock valued at $27,413,000 after buying an additional 2,902,375 shares during the period. Redmile Group LLC grew its position in Amicus Therapeutics by 35.1% during the first quarter. Redmile Group LLC now owns 9,533,669 shares of the biopharmaceutical company's stock valued at $77,795,000 after buying an additional 2,478,779 shares during the period. Finally, Prosight Management LP purchased a new position in Amicus Therapeutics in the fourth quarter valued at $8,666,000.

Amicus Therapeutics Price Performance

NASDAQ FOLD traded up $0.04 during mid-day trading on Wednesday, hitting $8.05. The stock had a trading volume of 1,750,649 shares, compared to its average volume of 3,868,041. The firm's 50 day moving average is $7.01 and its 200 day moving average is $6.98. The company has a debt-to-equity ratio of 1.92, a current ratio of 3.21 and a quick ratio of 2.29. The stock has a market capitalization of $2.48 billion, a price-to-earnings ratio of -66.95 and a beta of 0.55. Amicus Therapeutics, Inc. has a twelve month low of $5.51 and a twelve month high of $12.65.

Wall Street Analysts Forecast Growth

Several equities analysts recently weighed in on the company. Wall Street Zen lowered Amicus Therapeutics from a "buy" rating to a "hold" rating in a research note on Saturday, August 30th. Morgan Stanley raised Amicus Therapeutics from an "equal weight" rating to an "overweight" rating in a report on Thursday, July 17th. Seven equities research analysts have rated the stock with a Buy rating and two have given a Hold rating to the company's stock. Based on data from MarketBeat.com, Amicus Therapeutics has an average rating of "Moderate Buy" and an average price target of $16.00.

Get Our Latest Stock Analysis on Amicus Therapeutics

Amicus Therapeutics Company Profile

(

Free Report)

Amicus Therapeutics, Inc, a biotechnology company, focuses on discovering, developing, and delivering medicines for rare diseases. Its commercial product and product candidates include Galafold, an oral precision medicine for the treatment of adults with a confirmed diagnosis of Fabry disease and an amenable galactosidase alpha gene variant; and Pombiliti + Opfolda, for the treatment of late onset.

Featured Articles

Before you consider Amicus Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amicus Therapeutics wasn't on the list.

While Amicus Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.