Pacer Advisors Inc. lessened its stake in News Corporation (NASDAQ:NWS - Free Report) by 97.8% in the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 5,716 shares of the company's stock after selling 254,498 shares during the quarter. Pacer Advisors Inc.'s holdings in News were worth $174,000 at the end of the most recent reporting period.

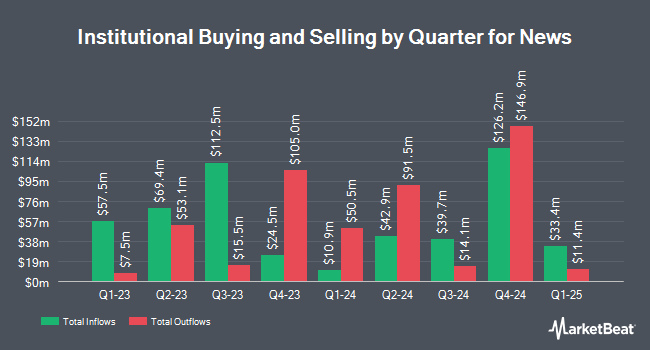

A number of other hedge funds and other institutional investors have also bought and sold shares of the stock. Independent Franchise Partners LLP increased its stake in shares of News by 7.0% in the fourth quarter. Independent Franchise Partners LLP now owns 9,649,717 shares of the company's stock valued at $293,641,000 after buying an additional 627,774 shares during the period. Vanguard Group Inc. increased its stake in shares of News by 2.2% in the fourth quarter. Vanguard Group Inc. now owns 6,535,237 shares of the company's stock valued at $198,867,000 after buying an additional 138,680 shares during the period. 59 North Capital Management LP increased its stake in shares of News by 29.4% in the fourth quarter. 59 North Capital Management LP now owns 4,345,606 shares of the company's stock valued at $132,237,000 after buying an additional 986,781 shares during the period. Geode Capital Management LLC increased its stake in shares of News by 0.5% in the fourth quarter. Geode Capital Management LLC now owns 2,855,707 shares of the company's stock valued at $86,799,000 after buying an additional 13,329 shares during the period. Finally, Dimensional Fund Advisors LP increased its stake in shares of News by 8.9% in the fourth quarter. Dimensional Fund Advisors LP now owns 1,965,125 shares of the company's stock valued at $59,799,000 after buying an additional 160,922 shares during the period. Institutional investors and hedge funds own 14.63% of the company's stock.

News Trading Up 0.3%

Shares of News stock traded up $0.10 on Wednesday, hitting $33.65. The stock had a trading volume of 496,795 shares, compared to its average volume of 747,144. The stock has a 50 day moving average of $33.31 and a 200 day moving average of $32.16. News Corporation has a twelve month low of $26.25 and a twelve month high of $35.58. The company has a debt-to-equity ratio of 0.21, a quick ratio of 1.60 and a current ratio of 1.68. The firm has a market capitalization of $19.05 billion, a P/E ratio of 39.13 and a beta of 1.23.

News (NASDAQ:NWS - Get Free Report) last announced its earnings results on Tuesday, August 5th. The company reported $0.19 EPS for the quarter, beating the consensus estimate of $0.18 by $0.01. News had a return on equity of 5.64% and a net margin of 5.18%. The business had revenue of $2.11 billion for the quarter, compared to analysts' expectations of $2.09 billion. Sell-side analysts expect that News Corporation will post 1.03 earnings per share for the current fiscal year.

About News

(

Free Report)

News Corporation, a media and information services company, creates and distributes authoritative and engaging content, and other products and services for consumers and businesses worldwide. It operates through six segments: Digital Real Estate Services, Subscription Video Services, Dow Jones, Book Publishing, News Media, and Other.

Further Reading

Before you consider News, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and News wasn't on the list.

While News currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.