Pacer Advisors Inc. increased its position in shares of Ulta Beauty Inc. (NASDAQ:ULTA - Free Report) by 5,117.0% in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 220,312 shares of the specialty retailer's stock after purchasing an additional 216,089 shares during the quarter. Pacer Advisors Inc. owned 0.49% of Ulta Beauty worth $80,753,000 as of its most recent SEC filing.

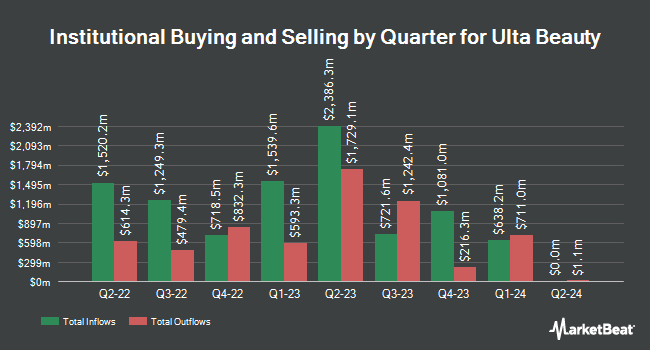

A number of other institutional investors and hedge funds have also recently modified their holdings of ULTA. Capital World Investors purchased a new position in shares of Ulta Beauty during the 4th quarter valued at about $430,674,000. Norges Bank purchased a new stake in shares of Ulta Beauty in the fourth quarter worth about $239,432,000. Marshall Wace LLP boosted its stake in shares of Ulta Beauty by 10,336.7% in the fourth quarter. Marshall Wace LLP now owns 459,110 shares of the specialty retailer's stock worth $199,681,000 after buying an additional 454,711 shares during the last quarter. GAMMA Investing LLC boosted its stake in shares of Ulta Beauty by 38,770.6% in the first quarter. GAMMA Investing LLC now owns 443,513 shares of the specialty retailer's stock worth $162,565,000 after buying an additional 442,372 shares during the last quarter. Finally, Universal Beteiligungs und Servicegesellschaft mbH purchased a new stake in shares of Ulta Beauty in the fourth quarter worth about $73,780,000. Institutional investors and hedge funds own 90.39% of the company's stock.

Ulta Beauty Stock Performance

Shares of NASDAQ ULTA traded up $1.40 during mid-day trading on Friday, reaching $514.95. The company's stock had a trading volume of 466,057 shares, compared to its average volume of 606,426. The stock has a 50-day moving average of $464.66 and a two-hundred day moving average of $407.87. The stock has a market capitalization of $23.15 billion, a P/E ratio of 20.12, a P/E/G ratio of 3.12 and a beta of 1.08. Ulta Beauty Inc. has a 1-year low of $309.01 and a 1-year high of $515.99.

Ulta Beauty (NASDAQ:ULTA - Get Free Report) last issued its earnings results on Thursday, May 29th. The specialty retailer reported $6.70 EPS for the quarter, beating analysts' consensus estimates of $5.73 by $0.97. The business had revenue of $2.85 billion during the quarter, compared to analysts' expectations of $2.79 billion. Ulta Beauty had a net margin of 10.45% and a return on equity of 49.73%. The company's quarterly revenue was up 4.5% compared to the same quarter last year. During the same period in the prior year, the business earned $6.47 earnings per share. Analysts predict that Ulta Beauty Inc. will post 23.96 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

ULTA has been the topic of a number of recent research reports. Raymond James Financial restated an "outperform" rating and issued a $500.00 target price (up previously from $450.00) on shares of Ulta Beauty in a research note on Friday, May 30th. UBS Group upped their target price on Ulta Beauty from $490.00 to $525.00 and gave the stock a "buy" rating in a research note on Friday, May 30th. DA Davidson upped their target price on Ulta Beauty from $485.00 to $550.00 and gave the stock a "buy" rating in a research note on Monday, July 7th. Loop Capital restated a "hold" rating and issued a $510.00 target price on shares of Ulta Beauty in a research note on Friday. Finally, Wall Street Zen upgraded Ulta Beauty from a "hold" rating to a "buy" rating in a research report on Saturday, June 28th. One analyst has rated the stock with a sell rating, twelve have issued a hold rating and thirteen have given a buy rating to the company's stock. According to data from MarketBeat, the company has an average rating of "Hold" and a consensus target price of $465.04.

View Our Latest Stock Analysis on ULTA

Ulta Beauty Company Profile

(

Free Report)

Ulta Beauty, Inc operates as a specialty beauty retailer in the United States. The company offers branded and private label beauty products, including cosmetics, fragrance, haircare, skincare, bath and body products, professional hair products, and salon styling tools through its Ulta Beauty stores, shop-in-shops, Ulta.com website, and its mobile applications.

Featured Articles

Before you consider Ulta Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ulta Beauty wasn't on the list.

While Ulta Beauty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.