Pacific Capital Partners Ltd reduced its holdings in shares of CBIZ, Inc. (NYSE:CBZ - Free Report) by 24.0% during the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 95,000 shares of the business services provider's stock after selling 30,000 shares during the quarter. CBIZ accounts for 6.4% of Pacific Capital Partners Ltd's portfolio, making the stock its 4th biggest holding. Pacific Capital Partners Ltd owned about 0.17% of CBIZ worth $6,812,000 as of its most recent SEC filing.

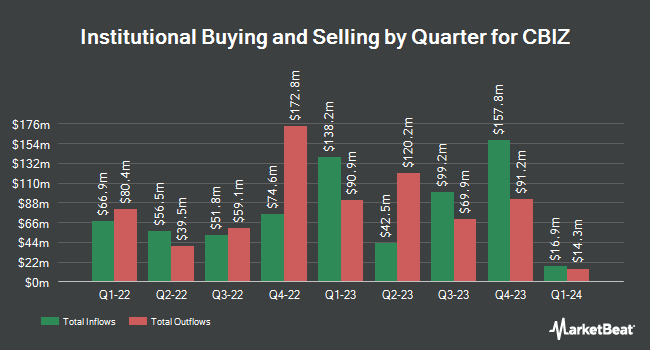

A number of other hedge funds and other institutional investors have also recently modified their holdings of the business. Rhumbline Advisers lifted its holdings in shares of CBIZ by 3.7% during the first quarter. Rhumbline Advisers now owns 72,236 shares of the business services provider's stock valued at $5,480,000 after purchasing an additional 2,574 shares in the last quarter. Strs Ohio bought a new position in shares of CBIZ during the first quarter valued at $6,918,000. Intech Investment Management LLC lifted its holdings in shares of CBIZ by 37.0% during the first quarter. Intech Investment Management LLC now owns 31,596 shares of the business services provider's stock valued at $2,397,000 after purchasing an additional 8,532 shares in the last quarter. Jane Street Group LLC lifted its holdings in shares of CBIZ by 96.1% during the first quarter. Jane Street Group LLC now owns 41,240 shares of the business services provider's stock valued at $3,128,000 after purchasing an additional 20,214 shares in the last quarter. Finally, UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC lifted its holdings in shares of CBIZ by 5.7% during the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 143,270 shares of the business services provider's stock valued at $10,868,000 after purchasing an additional 7,676 shares in the last quarter. 87.44% of the stock is owned by institutional investors.

CBIZ Stock Performance

CBZ traded down $0.92 during midday trading on Friday, reaching $53.98. The company had a trading volume of 265,995 shares, compared to its average volume of 475,221. The company has a quick ratio of 1.60, a current ratio of 1.60 and a debt-to-equity ratio of 0.79. The business has a 50-day moving average of $65.17 and a two-hundred day moving average of $69.97. The company has a market cap of $2.91 billion, a P/E ratio of 30.99 and a beta of 0.95. CBIZ, Inc. has a 1 year low of $53.71 and a 1 year high of $90.13.

CBIZ (NYSE:CBZ - Get Free Report) last issued its quarterly earnings results on Wednesday, July 30th. The business services provider reported $0.95 EPS for the quarter, topping analysts' consensus estimates of $0.84 by $0.11. The business had revenue of $683.50 million during the quarter, compared to analysts' expectations of $701.43 million. CBIZ had a return on equity of 14.73% and a net margin of 4.51%.The business's quarterly revenue was up 62.7% on a year-over-year basis. During the same quarter in the prior year, the business posted $0.39 earnings per share. CBIZ has set its FY 2025 guidance at 3.600-3.650 EPS. As a group, equities research analysts predict that CBIZ, Inc. will post 2.65 earnings per share for the current fiscal year.

Insider Activity

In related news, Director Rodney A. Young acquired 2,000 shares of the business's stock in a transaction on Friday, August 8th. The stock was acquired at an average cost of $62.43 per share, with a total value of $124,860.00. Following the acquisition, the director directly owned 8,310 shares in the company, valued at $518,793.30. This represents a 31.70% increase in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. Corporate insiders own 4.95% of the company's stock.

Analyst Ratings Changes

Separately, William Blair reaffirmed an "outperform" rating on shares of CBIZ in a report on Friday, September 5th. One equities research analyst has rated the stock with a Buy rating, According to MarketBeat.com, CBIZ presently has an average rating of "Buy".

Read Our Latest Research Report on CBIZ

About CBIZ

(

Free Report)

CBIZ, Inc provides financial, insurance, and advisory services in the United States and Canada. It operates through Financial Services, Benefits and Insurance Services, and National Practices segments. The Financial Services segment offers accounting and tax, financial advisory, valuation, risk and advisory, and government healthcare consulting services.

Featured Articles

Before you consider CBIZ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CBIZ wasn't on the list.

While CBIZ currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.