Credit Agricole S A lifted its position in shares of Pacific Gas & Electric Co. (NYSE:PCG - Free Report) by 29.6% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 768,031 shares of the utilities provider's stock after acquiring an additional 175,280 shares during the period. Credit Agricole S A's holdings in Pacific Gas & Electric were worth $13,195,000 as of its most recent filing with the Securities & Exchange Commission.

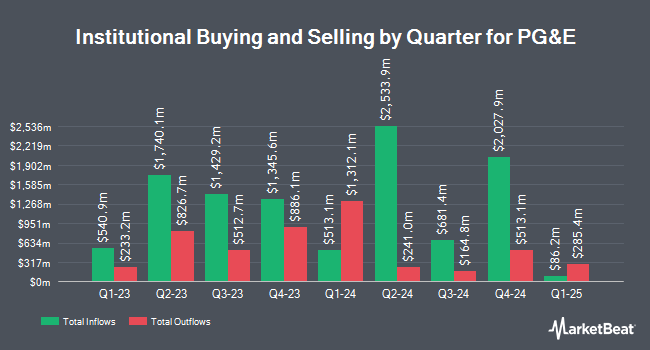

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Deseret Mutual Benefit Administrators increased its position in Pacific Gas & Electric by 45.0% during the first quarter. Deseret Mutual Benefit Administrators now owns 2,173 shares of the utilities provider's stock valued at $37,000 after acquiring an additional 674 shares during the last quarter. Farther Finance Advisors LLC grew its position in shares of Pacific Gas & Electric by 1.9% during the 1st quarter. Farther Finance Advisors LLC now owns 42,747 shares of the utilities provider's stock valued at $738,000 after acquiring an additional 785 shares during the period. Optiver Holding B.V. grew its position in shares of Pacific Gas & Electric by 23.9% during the 4th quarter. Optiver Holding B.V. now owns 4,271 shares of the utilities provider's stock valued at $86,000 after acquiring an additional 825 shares during the period. Parallel Advisors LLC grew its position in shares of Pacific Gas & Electric by 2.4% during the 1st quarter. Parallel Advisors LLC now owns 38,625 shares of the utilities provider's stock valued at $664,000 after acquiring an additional 887 shares during the period. Finally, Oregon Public Employees Retirement Fund grew its position in shares of Pacific Gas & Electric by 0.5% during the 1st quarter. Oregon Public Employees Retirement Fund now owns 188,411 shares of the utilities provider's stock valued at $3,237,000 after acquiring an additional 1,010 shares during the period. Institutional investors own 78.56% of the company's stock.

Pacific Gas & Electric Price Performance

PCG stock traded up $0.10 during mid-day trading on Tuesday, hitting $15.01. The company had a trading volume of 3,901,327 shares, compared to its average volume of 23,619,736. The company has a market capitalization of $40.15 billion, a price-to-earnings ratio of 13.78, a P/E/G ratio of 1.13 and a beta of 0.54. Pacific Gas & Electric Co. has a 12-month low of $12.97 and a 12-month high of $21.72. The company has a quick ratio of 0.89, a current ratio of 0.94 and a debt-to-equity ratio of 1.81. The company has a 50-day moving average price of $14.21 and a 200 day moving average price of $15.72.

Pacific Gas & Electric (NYSE:PCG - Get Free Report) last announced its quarterly earnings results on Thursday, July 31st. The utilities provider reported $0.31 EPS for the quarter, missing the consensus estimate of $0.33 by ($0.02). The company had revenue of $5.90 billion during the quarter, compared to analysts' expectations of $6.37 billion. Pacific Gas & Electric had a return on equity of 10.13% and a net margin of 9.95%.The firm's revenue for the quarter was down 1.5% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $0.31 EPS. Pacific Gas & Electric has set its FY 2025 guidance at 1.480-1.520 EPS. On average, research analysts anticipate that Pacific Gas & Electric Co. will post 1.49 earnings per share for the current year.

Analysts Set New Price Targets

A number of brokerages have recently issued reports on PCG. Argus raised shares of Pacific Gas & Electric to a "hold" rating in a research report on Monday, June 16th. Evercore ISI boosted their price objective on shares of Pacific Gas & Electric from $15.00 to $17.00 and gave the company an "in-line" rating in a research report on Monday, April 28th. Morgan Stanley reissued an "underweight" rating on shares of Pacific Gas & Electric in a research report on Thursday. Barclays cut their price objective on shares of Pacific Gas & Electric from $22.00 to $20.00 and set an "overweight" rating for the company in a research report on Tuesday, July 22nd. Finally, Mizuho upped their target price on shares of Pacific Gas & Electric from $20.00 to $21.00 and gave the stock an "outperform" rating in a report on Monday, May 19th. Seven analysts have rated the stock with a Buy rating, five have assigned a Hold rating and one has issued a Sell rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus target price of $20.55.

Read Our Latest Stock Analysis on Pacific Gas & Electric

Pacific Gas & Electric Company Profile

(

Free Report)

PG&E Corp. operates as a holding company, which engages in generation, transmission, and distribution of electricity and natural gas to customers. It specializes in energy, utility, power, gas, electricity, solar and sustainability. The company was founded in 1995 and is headquartered in Oakland, CA.

Recommended Stories

Before you consider Pacific Gas & Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pacific Gas & Electric wasn't on the list.

While Pacific Gas & Electric currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.