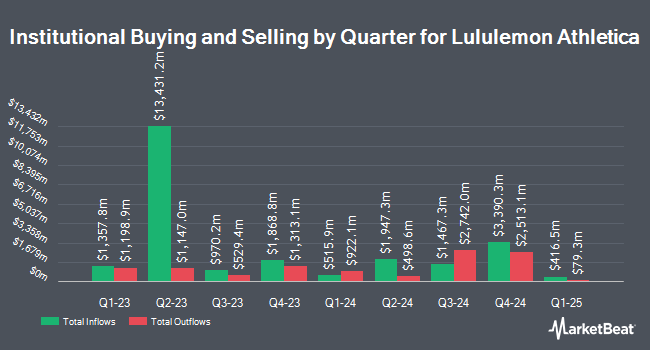

Pacific Heights Asset Management LLC bought a new stake in lululemon athletica inc. (NASDAQ:LULU - Free Report) in the second quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund bought 45,000 shares of the apparel retailer's stock, valued at approximately $10,691,000.

A number of other hedge funds and other institutional investors also recently bought and sold shares of the stock. Vanguard Group Inc. boosted its stake in lululemon athletica by 1.2% in the first quarter. Vanguard Group Inc. now owns 13,266,929 shares of the apparel retailer's stock valued at $3,755,337,000 after acquiring an additional 157,764 shares during the period. Price T Rowe Associates Inc. MD boosted its stake in lululemon athletica by 3.3% in the first quarter. Price T Rowe Associates Inc. MD now owns 5,010,908 shares of the apparel retailer's stock valued at $1,418,389,000 after acquiring an additional 162,295 shares during the period. Alliancebernstein L.P. boosted its stake in lululemon athletica by 9.0% in the first quarter. Alliancebernstein L.P. now owns 4,792,294 shares of the apparel retailer's stock valued at $1,356,507,000 after acquiring an additional 394,706 shares during the period. Flossbach Von Storch SE boosted its stake in lululemon athletica by 10.3% in the first quarter. Flossbach Von Storch SE now owns 1,401,885 shares of the apparel retailer's stock valued at $396,818,000 after acquiring an additional 130,565 shares during the period. Finally, Invesco Ltd. boosted its stake in lululemon athletica by 7.2% in the first quarter. Invesco Ltd. now owns 1,387,609 shares of the apparel retailer's stock valued at $392,777,000 after acquiring an additional 93,530 shares during the period. 85.20% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of equities analysts have commented on the company. Morgan Stanley decreased their target price on lululemon athletica from $223.00 to $185.00 and set an "equal weight" rating for the company in a research note on Tuesday, September 30th. Citigroup cut their price target on lululemon athletica from $220.00 to $190.00 and set a "neutral" rating on the stock in a report on Friday, September 5th. Oppenheimer reaffirmed a "market perform" rating and set a $500.00 price target on shares of lululemon athletica in a report on Friday, September 5th. Baird R W cut lululemon athletica from a "strong-buy" rating to a "hold" rating in a report on Tuesday, September 23rd. Finally, Robert W. Baird reaffirmed a "neutral" rating and set a $195.00 price target (down previously from $225.00) on shares of lululemon athletica in a report on Tuesday, September 23rd. One research analyst has rated the stock with a Strong Buy rating, three have given a Buy rating, twenty-nine have issued a Hold rating and four have assigned a Sell rating to the company's stock. According to data from MarketBeat, lululemon athletica currently has an average rating of "Hold" and an average target price of $228.42.

View Our Latest Research Report on lululemon athletica

Insider Activity

In other lululemon athletica news, insider Nicole Neuburger sold 615 shares of the company's stock in a transaction on Tuesday, September 30th. The stock was sold at an average price of $178.00, for a total value of $109,470.00. Following the transaction, the insider owned 8,993 shares of the company's stock, valued at approximately $1,600,754. This represents a 6.40% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Corporate insiders own 0.54% of the company's stock.

lululemon athletica Price Performance

Shares of NASDAQ:LULU opened at $181.39 on Wednesday. lululemon athletica inc. has a 12 month low of $159.25 and a 12 month high of $423.32. The stock has a market cap of $21.51 billion, a price-to-earnings ratio of 12.33, a PEG ratio of 10.78 and a beta of 1.07. The stock's 50 day moving average price is $181.16 and its 200 day moving average price is $230.32.

lululemon athletica (NASDAQ:LULU - Get Free Report) last announced its earnings results on Thursday, September 4th. The apparel retailer reported $3.10 EPS for the quarter, topping the consensus estimate of $2.86 by $0.24. The firm had revenue of $2.53 billion for the quarter, compared to analysts' expectations of $2.55 billion. lululemon athletica had a return on equity of 42.05% and a net margin of 16.38%.The firm's quarterly revenue was up 6.5% compared to the same quarter last year. During the same quarter in the previous year, the company earned $3.15 earnings per share. lululemon athletica has set its FY 2025 guidance at 12.770-12.970 EPS. Q3 2025 guidance at 2.180-2.230 EPS. On average, sell-side analysts expect that lululemon athletica inc. will post 14.36 EPS for the current year.

lululemon athletica Company Profile

(

Free Report)

Lululemon Athletica Inc, together with its subsidiaries, designs, distributes, and retails athletic apparel, footwear, and accessories under the lululemon brand for women and men. It offers pants, shorts, tops, and jackets for healthy lifestyle, such as yoga, running, training, and other activities. It also provides fitness-inspired accessories.

Recommended Stories

Want to see what other hedge funds are holding LULU? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for lululemon athletica inc. (NASDAQ:LULU - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider lululemon athletica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and lululemon athletica wasn't on the list.

While lululemon athletica currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.