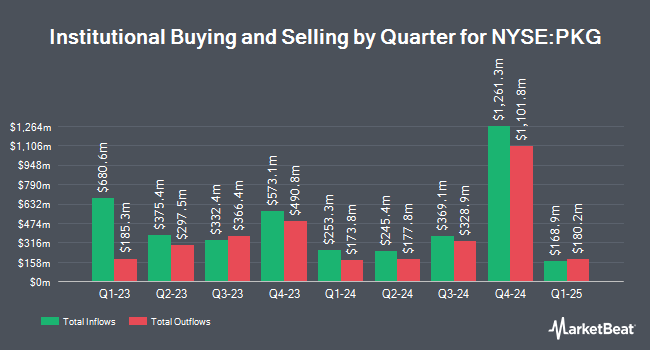

Summit Financial Strategies Inc. raised its holdings in Packaging Corporation of America (NYSE:PKG - Free Report) by 7.4% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 230,617 shares of the industrial products company's stock after acquiring an additional 15,860 shares during the period. Packaging Corporation of America makes up approximately 4.6% of Summit Financial Strategies Inc.'s investment portfolio, making the stock its 9th largest position. Summit Financial Strategies Inc. owned about 0.26% of Packaging Corporation of America worth $45,667,000 as of its most recent SEC filing.

A number of other hedge funds also recently bought and sold shares of the business. Wellington Management Group LLP increased its holdings in shares of Packaging Corporation of America by 134.1% during the 4th quarter. Wellington Management Group LLP now owns 28,260 shares of the industrial products company's stock worth $6,362,000 after buying an additional 16,190 shares during the last quarter. Cerity Partners LLC increased its holdings in shares of Packaging Corporation of America by 2.4% during the 4th quarter. Cerity Partners LLC now owns 16,211 shares of the industrial products company's stock worth $3,613,000 after buying an additional 378 shares during the last quarter. Bank of Nova Scotia increased its holdings in Packaging Corporation of America by 534.3% in the 4th quarter. Bank of Nova Scotia now owns 84,411 shares of the industrial products company's stock valued at $19,003,000 after purchasing an additional 71,103 shares during the last quarter. Advisory Services Network LLC increased its holdings in Packaging Corporation of America by 2.2% in the 4th quarter. Advisory Services Network LLC now owns 5,140 shares of the industrial products company's stock valued at $1,157,000 after purchasing an additional 112 shares during the last quarter. Finally, APG Asset Management N.V. increased its holdings in Packaging Corporation of America by 1.7% in the 4th quarter. APG Asset Management N.V. now owns 60,600 shares of the industrial products company's stock valued at $13,175,000 after purchasing an additional 1,000 shares during the last quarter. Institutional investors and hedge funds own 89.78% of the company's stock.

Analyst Upgrades and Downgrades

Several analysts recently weighed in on the stock. Truist Financial dropped their target price on shares of Packaging Corporation of America from $239.00 to $238.00 and set a "buy" rating for the company in a report on Friday, July 25th. UBS Group lifted their target price on shares of Packaging Corporation of America from $210.00 to $220.00 and gave the company a "neutral" rating in a report on Tuesday, July 29th. Wells Fargo & Company lifted their target price on shares of Packaging Corporation of America from $180.00 to $200.00 and gave the company an "equal weight" rating in a report on Thursday, July 10th. Citigroup lifted their target price on shares of Packaging Corporation of America from $197.00 to $214.00 and gave the company a "neutral" rating in a report on Friday, July 25th. Finally, Jefferies Financial Group downgraded shares of Packaging Corporation of America from a "buy" rating to a "hold" rating and dropped their target price for the company from $245.00 to $205.00 in a report on Monday, June 16th. Five research analysts have rated the stock with a hold rating, one has issued a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus price target of $215.40.

Check Out Our Latest Research Report on Packaging Corporation of America

Packaging Corporation of America Stock Up 0.8%

PKG stock traded up $1.59 during midday trading on Friday, hitting $196.45. The company's stock had a trading volume of 440,660 shares, compared to its average volume of 676,521. The company has a quick ratio of 2.15, a current ratio of 3.28 and a debt-to-equity ratio of 0.55. Packaging Corporation of America has a 52-week low of $172.71 and a 52-week high of $250.82. The firm has a market capitalization of $17.68 billion, a P/E ratio of 19.61, a PEG ratio of 2.31 and a beta of 0.85. The firm has a 50-day simple moving average of $196.64 and a 200-day simple moving average of $197.74.

Packaging Corporation of America (NYSE:PKG - Get Free Report) last released its quarterly earnings data on Wednesday, July 23rd. The industrial products company reported $2.48 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.44 by $0.04. The business had revenue of $2.17 billion during the quarter, compared to analysts' expectations of $2.18 billion. Packaging Corporation of America had a net margin of 10.47% and a return on equity of 20.36%. The company's revenue for the quarter was up 4.7% on a year-over-year basis. During the same period in the previous year, the company earned $2.20 EPS. As a group, equities analysts forecast that Packaging Corporation of America will post 10.44 EPS for the current year.

About Packaging Corporation of America

(

Free Report)

Packaging Corporation of America engages in the production of container products. It operates through the following segments: Packaging, Paper, and Corporate and Other. The Packaging segment offers a variety of corrugated packaging products, such as conventional shipping containers. The Paper segment manufactures and sells a range of papers, including communication-based papers, and pressure sensitive papers.

Recommended Stories

Before you consider Packaging Corporation of America, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Packaging Corporation of America wasn't on the list.

While Packaging Corporation of America currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.