Resona Asset Management Co. Ltd. grew its stake in Packaging Corporation of America (NYSE:PKG - Free Report) by 7.5% in the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 27,981 shares of the industrial products company's stock after buying an additional 1,962 shares during the quarter. Resona Asset Management Co. Ltd.'s holdings in Packaging Corporation of America were worth $5,530,000 as of its most recent SEC filing.

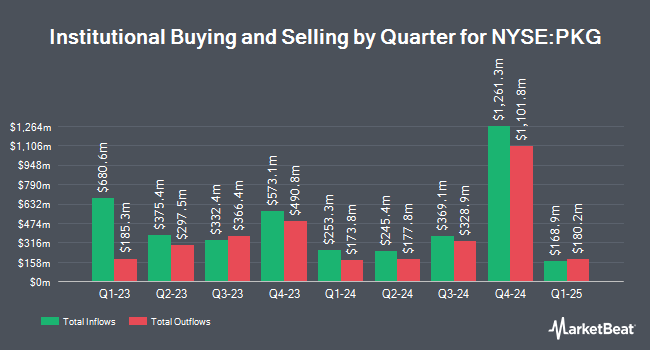

Other institutional investors have also recently modified their holdings of the company. Clearstead Trust LLC grew its position in shares of Packaging Corporation of America by 118.6% during the 1st quarter. Clearstead Trust LLC now owns 129 shares of the industrial products company's stock valued at $26,000 after acquiring an additional 70 shares during the period. TCTC Holdings LLC grew its position in shares of Packaging Corporation of America by 86.4% during the 1st quarter. TCTC Holdings LLC now owns 151 shares of the industrial products company's stock valued at $30,000 after acquiring an additional 70 shares during the period. Alpine Bank Wealth Management acquired a new stake in shares of Packaging Corporation of America during the 1st quarter valued at about $39,000. Banque Cantonale Vaudoise acquired a new stake in shares of Packaging Corporation of America during the 1st quarter valued at about $40,000. Finally, Manchester Capital Management LLC boosted its holdings in Packaging Corporation of America by 39.0% in the 1st quarter. Manchester Capital Management LLC now owns 203 shares of the industrial products company's stock worth $40,000 after buying an additional 57 shares during the last quarter. 89.78% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several equities research analysts recently issued reports on the company. Citigroup lifted their price objective on Packaging Corporation of America from $197.00 to $214.00 and gave the stock a "neutral" rating in a report on Friday, July 25th. UBS Group lifted their price objective on Packaging Corporation of America from $210.00 to $220.00 and gave the stock a "neutral" rating in a report on Tuesday, July 29th. Wells Fargo & Company lifted their price objective on Packaging Corporation of America from $180.00 to $200.00 and gave the stock an "equal weight" rating in a report on Thursday, July 10th. Jefferies Financial Group cut Packaging Corporation of America from a "buy" rating to a "hold" rating and lowered their price objective for the stock from $245.00 to $205.00 in a report on Monday, June 16th. Finally, Truist Financial lowered their price objective on Packaging Corporation of America from $239.00 to $238.00 and set a "buy" rating on the stock in a report on Friday, July 25th. Five research analysts have rated the stock with a hold rating, one has given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, Packaging Corporation of America currently has a consensus rating of "Hold" and an average target price of $215.40.

Get Our Latest Stock Report on Packaging Corporation of America

Packaging Corporation of America Trading Down 1.6%

PKG opened at $193.46 on Friday. The firm has a market capitalization of $17.41 billion, a price-to-earnings ratio of 19.31, a price-to-earnings-growth ratio of 2.31 and a beta of 0.85. The company has a debt-to-equity ratio of 0.54, a current ratio of 3.54 and a quick ratio of 2.32. The company's 50 day simple moving average is $196.95 and its two-hundred day simple moving average is $196.58. Packaging Corporation of America has a 1-year low of $172.71 and a 1-year high of $250.82.

Packaging Corporation of America (NYSE:PKG - Get Free Report) last released its quarterly earnings results on Wednesday, July 23rd. The industrial products company reported $2.48 EPS for the quarter, beating the consensus estimate of $2.44 by $0.04. The firm had revenue of $2.17 billion for the quarter, compared to analyst estimates of $2.18 billion. Packaging Corporation of America had a net margin of 10.47% and a return on equity of 20.08%. The business's revenue for the quarter was up 4.7% compared to the same quarter last year. During the same quarter in the previous year, the company earned $2.20 EPS. Analysts expect that Packaging Corporation of America will post 10.44 EPS for the current fiscal year.

About Packaging Corporation of America

(

Free Report)

Packaging Corporation of America engages in the production of container products. It operates through the following segments: Packaging, Paper, and Corporate and Other. The Packaging segment offers a variety of corrugated packaging products, such as conventional shipping containers. The Paper segment manufactures and sells a range of papers, including communication-based papers, and pressure sensitive papers.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Packaging Corporation of America, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Packaging Corporation of America wasn't on the list.

While Packaging Corporation of America currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.