Pallas Capital Advisors LLC purchased a new position in shares of nVent Electric PLC (NYSE:NVT - Free Report) during the 2nd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor purchased 4,396 shares of the company's stock, valued at approximately $322,000.

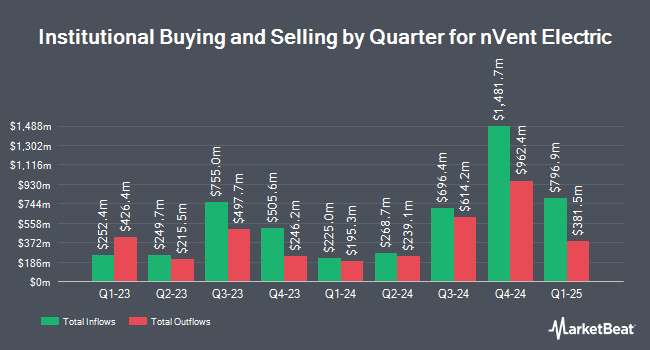

Several other large investors also recently bought and sold shares of NVT. Nuveen LLC purchased a new stake in nVent Electric during the 1st quarter worth about $229,615,000. American Century Companies Inc. increased its holdings in nVent Electric by 1,869.8% during the 1st quarter. American Century Companies Inc. now owns 1,462,840 shares of the company's stock worth $76,682,000 after purchasing an additional 1,388,578 shares during the period. Fiduciary Management Inc. WI increased its holdings in nVent Electric by 38.1% during the 1st quarter. Fiduciary Management Inc. WI now owns 2,120,222 shares of the company's stock worth $111,142,000 after purchasing an additional 585,449 shares during the period. Champlain Investment Partners LLC increased its holdings in nVent Electric by 40.1% during the 1st quarter. Champlain Investment Partners LLC now owns 1,783,105 shares of the company's stock worth $93,470,000 after purchasing an additional 510,535 shares during the period. Finally, Ameriprise Financial Inc. increased its holdings in nVent Electric by 45.6% during the 1st quarter. Ameriprise Financial Inc. now owns 1,440,890 shares of the company's stock worth $75,531,000 after purchasing an additional 451,561 shares during the period. Hedge funds and other institutional investors own 90.05% of the company's stock.

Insider Transactions at nVent Electric

In related news, EVP Aravind Padmanabhan sold 24,534 shares of the company's stock in a transaction dated Tuesday, August 12th. The stock was sold at an average price of $90.00, for a total value of $2,208,060.00. Following the completion of the sale, the executive vice president directly owned 12,063 shares of the company's stock, valued at $1,085,670. This represents a 67.04% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, EVP Lynnette R. Heath sold 17,853 shares of the stock in a transaction that occurred on Tuesday, August 5th. The stock was sold at an average price of $89.33, for a total value of $1,594,808.49. Following the sale, the executive vice president directly owned 30,512 shares of the company's stock, valued at $2,725,636.96. The trade was a 36.91% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 261,111 shares of company stock worth $23,367,520. Insiders own 1.80% of the company's stock.

nVent Electric Stock Up 0.4%

Shares of NYSE NVT opened at $99.01 on Monday. The stock has a market cap of $15.94 billion, a PE ratio of 28.21, a price-to-earnings-growth ratio of 1.54 and a beta of 1.39. The company has a quick ratio of 1.20, a current ratio of 1.67 and a debt-to-equity ratio of 0.50. nVent Electric PLC has a 52-week low of $41.71 and a 52-week high of $99.44. The business has a 50-day moving average price of $87.40 and a 200 day moving average price of $70.46.

nVent Electric (NYSE:NVT - Get Free Report) last announced its earnings results on Friday, August 1st. The company reported $0.86 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.79 by $0.07. The firm had revenue of $963.10 million during the quarter, compared to analysts' expectations of $906.96 million. nVent Electric had a return on equity of 13.36% and a net margin of 17.72%.The business's revenue was up 30.1% on a year-over-year basis. During the same period in the prior year, the firm earned $0.82 EPS. nVent Electric has set its Q3 2025 guidance at 0.860-0.880 EPS. FY 2025 guidance at 3.220-3.300 EPS. Equities research analysts forecast that nVent Electric PLC will post 3.04 earnings per share for the current year.

Analyst Upgrades and Downgrades

A number of research analysts have recently commented on NVT shares. KeyCorp increased their price objective on nVent Electric from $78.00 to $84.00 and gave the company an "overweight" rating in a report on Tuesday, July 15th. Barclays reiterated an "overweight" rating on shares of nVent Electric in a report on Monday, August 4th. Royal Bank Of Canada reiterated an "outperform" rating and issued a $102.00 price objective (up previously from $85.00) on shares of nVent Electric in a report on Monday, August 4th. The Goldman Sachs Group increased their price objective on nVent Electric from $99.00 to $111.00 and gave the company a "buy" rating in a report on Tuesday, September 16th. Finally, Wall Street Zen upgraded nVent Electric from a "hold" rating to a "buy" rating in a report on Saturday, July 12th. One equities research analyst has rated the stock with a Strong Buy rating and seven have given a Buy rating to the stock. Based on data from MarketBeat.com, the company has an average rating of "Buy" and an average price target of $90.43.

Read Our Latest Analysis on NVT

About nVent Electric

(

Free Report)

nVent Electric plc, together with its subsidiaries, designs, manufactures, markets, installs, and services electrical connection and protection solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally. The company operates through three segments: Enclosures, Electrical & Fastening Solutions, and Thermal Management.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider nVent Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and nVent Electric wasn't on the list.

While nVent Electric currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report