Pallas Capital Advisors LLC acquired a new stake in shares of Roku, Inc. (NASDAQ:ROKU - Free Report) in the first quarter, according to its most recent disclosure with the SEC. The firm acquired 3,418 shares of the company's stock, valued at approximately $241,000.

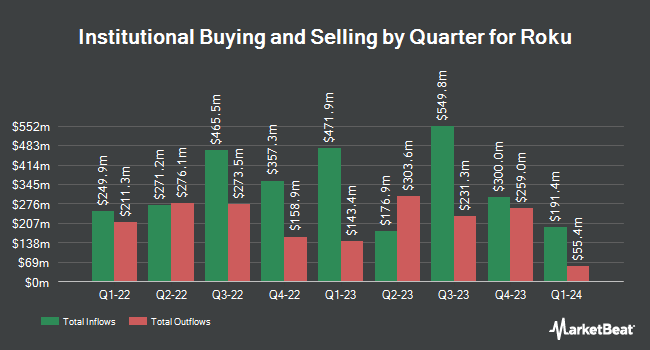

A number of other hedge funds and other institutional investors have also recently modified their holdings of the company. Jacobs Levy Equity Management Inc. grew its stake in Roku by 505.3% in the fourth quarter. Jacobs Levy Equity Management Inc. now owns 1,296,774 shares of the company's stock valued at $96,402,000 after purchasing an additional 1,082,548 shares during the last quarter. Geode Capital Management LLC grew its stake in Roku by 2.7% in the fourth quarter. Geode Capital Management LLC now owns 2,147,259 shares of the company's stock valued at $159,353,000 after purchasing an additional 56,820 shares during the last quarter. Charles Schwab Investment Management Inc. grew its stake in Roku by 3.7% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 990,867 shares of the company's stock valued at $73,661,000 after purchasing an additional 34,898 shares during the last quarter. Achmea Investment Management B.V. grew its stake in Roku by 146.4% in the fourth quarter. Achmea Investment Management B.V. now owns 10,168 shares of the company's stock valued at $756,000 after purchasing an additional 6,042 shares during the last quarter. Finally, J. Goldman & Co LP grew its stake in Roku by 973.1% in the fourth quarter. J. Goldman & Co LP now owns 354,326 shares of the company's stock valued at $26,341,000 after purchasing an additional 321,307 shares during the last quarter. 86.30% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In other news, Director Mai Fyfield sold 914 shares of Roku stock in a transaction that occurred on Friday, June 6th. The shares were sold at an average price of $78.50, for a total value of $71,749.00. Following the completion of the sale, the director now directly owns 4,374 shares in the company, valued at approximately $343,359. The trade was a 17.28% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, CEO Anthony J. Wood sold 25,000 shares of Roku stock in a transaction that occurred on Tuesday, June 10th. The shares were sold at an average price of $80.27, for a total transaction of $2,006,750.00. Following the completion of the sale, the chief executive officer now owns 11,953 shares of the company's stock, valued at approximately $959,467.31. The trade was a 67.65% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 64,737 shares of company stock worth $4,987,114. Company insiders own 13.98% of the company's stock.

Analysts Set New Price Targets

A number of equities research analysts have recently weighed in on the company. Needham & Company LLC restated a "buy" rating and set a $88.50 price target on shares of Roku in a research note on Monday, May 12th. FBN Securities assumed coverage on Roku in a report on Friday, March 28th. They set an "outperform" rating and a $93.00 target price for the company. JMP Securities reaffirmed a "market outperform" rating and set a $95.00 target price on shares of Roku in a report on Monday, June 2nd. Moffett Nathanson raised Roku from a "sell" rating to a "neutral" rating and set a $70.00 target price for the company in a report on Tuesday, March 4th. Finally, Loop Capital decreased their target price on Roku from $90.00 to $80.00 and set a "hold" rating for the company in a report on Friday, May 2nd. One research analyst has rated the stock with a sell rating, eight have issued a hold rating, fifteen have issued a buy rating and two have issued a strong buy rating to the company. Based on data from MarketBeat, Roku currently has a consensus rating of "Moderate Buy" and a consensus price target of $88.37.

Check Out Our Latest Analysis on Roku

Roku Price Performance

ROKU stock traded up $7.76 during trading hours on Monday, reaching $82.17. 9,908,889 shares of the stock were exchanged, compared to its average volume of 3,850,866. The firm's 50-day moving average is $67.99 and its 200-day moving average is $74.97. The company has a market cap of $11.99 billion, a price-to-earnings ratio of -92.33 and a beta of 2.09. Roku, Inc. has a 12 month low of $48.33 and a 12 month high of $104.96.

Roku (NASDAQ:ROKU - Get Free Report) last announced its quarterly earnings data on Thursday, May 1st. The company reported ($0.19) earnings per share for the quarter, beating the consensus estimate of ($0.27) by $0.08. The company had revenue of $1.02 billion during the quarter, compared to analysts' expectations of $1.01 billion. Roku had a negative return on equity of 5.34% and a negative net margin of 3.15%. Roku's revenue for the quarter was up 15.8% compared to the same quarter last year. During the same quarter last year, the company earned ($0.35) EPS. As a group, equities research analysts forecast that Roku, Inc. will post -0.3 earnings per share for the current year.

Roku Company Profile

(

Free Report)

Roku, Inc, together with its subsidiaries, operates a TV streaming platform in the United states and internationally. The company operates in two segments, Platform and Devices. Its streaming platform allows users to find and access TV shows, movies, news, sports, and others. The Platform segment offers digital advertising, including direct and programmatic video advertising, media and entertainment promotional spending, and related services; and streaming services distribution, such as subscription and transaction revenue shares, and sale of premium subscriptions and branded app buttons on remote controls.

Further Reading

Before you consider Roku, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Roku wasn't on the list.

While Roku currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report