Pallas Capital Advisors LLC purchased a new stake in shares of Carlyle Group Inc. (NASDAQ:CG - Free Report) in the 2nd quarter, according to the company in its most recent disclosure with the SEC. The firm purchased 6,000 shares of the financial services provider's stock, valued at approximately $308,000.

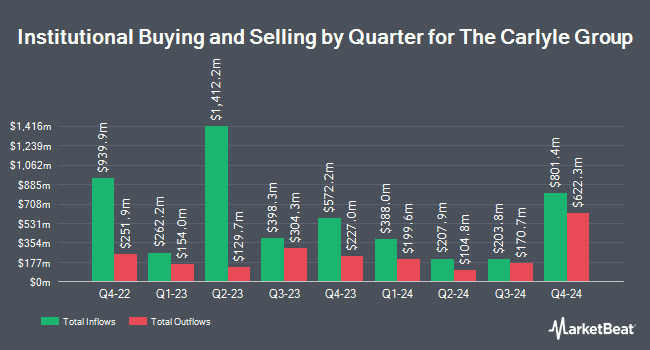

Other hedge funds have also added to or reduced their stakes in the company. Vanguard Group Inc. lifted its holdings in shares of Carlyle Group by 4.9% during the first quarter. Vanguard Group Inc. now owns 24,292,937 shares of the financial services provider's stock worth $1,058,929,000 after buying an additional 1,131,514 shares in the last quarter. Citigroup Inc. lifted its holdings in shares of Carlyle Group by 484.4% during the first quarter. Citigroup Inc. now owns 623,440 shares of the financial services provider's stock worth $27,176,000 after buying an additional 516,761 shares in the last quarter. Ameriprise Financial Inc. lifted its holdings in shares of Carlyle Group by 21.7% during the first quarter. Ameriprise Financial Inc. now owns 2,722,737 shares of the financial services provider's stock worth $118,684,000 after buying an additional 485,488 shares in the last quarter. Nuveen LLC acquired a new stake in shares of Carlyle Group during the first quarter worth $20,793,000. Finally, Massachusetts Financial Services Co. MA raised its stake in Carlyle Group by 7.5% in the first quarter. Massachusetts Financial Services Co. MA now owns 6,827,559 shares of the financial services provider's stock valued at $297,613,000 after purchasing an additional 476,127 shares in the last quarter. Institutional investors and hedge funds own 55.88% of the company's stock.

Carlyle Group Price Performance

NASDAQ:CG opened at $68.17 on Monday. The firm has a market capitalization of $24.66 billion, a price-to-earnings ratio of 19.93, a PEG ratio of 1.24 and a beta of 2.01. Carlyle Group Inc. has a 1 year low of $33.02 and a 1 year high of $69.85. The business has a 50 day simple moving average of $63.22 and a 200-day simple moving average of $50.86. The company has a debt-to-equity ratio of 1.52, a current ratio of 2.24 and a quick ratio of 2.24.

Carlyle Group Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Thursday, August 28th. Shareholders of record on Monday, August 18th were issued a dividend of $0.35 per share. This represents a $1.40 annualized dividend and a yield of 2.1%. The ex-dividend date was Monday, August 18th. Carlyle Group's dividend payout ratio (DPR) is presently 40.94%.

Analyst Ratings Changes

CG has been the topic of a number of recent analyst reports. Jefferies Financial Group lifted their target price on Carlyle Group from $54.00 to $66.00 and gave the company a "hold" rating in a research report on Wednesday, August 13th. Citigroup reaffirmed an "outperform" rating on shares of Carlyle Group in a research report on Thursday, August 14th. JMP Securities upped their target price on Carlyle Group from $70.00 to $75.00 and gave the stock a "market outperform" rating in a research report on Thursday, August 14th. Barclays reiterated an "overweight" rating and set a $74.00 price target (up previously from $66.00) on shares of Carlyle Group in a report on Thursday, August 7th. Finally, Evercore ISI upped their price target on Carlyle Group from $45.00 to $58.00 and gave the stock an "in-line" rating in a report on Thursday, July 10th. Six investment analysts have rated the stock with a Buy rating, eight have issued a Hold rating and one has assigned a Sell rating to the company's stock. According to data from MarketBeat.com, Carlyle Group currently has an average rating of "Hold" and a consensus price target of $59.93.

View Our Latest Stock Report on CG

Insider Buying and Selling

In other Carlyle Group news, General Counsel Jeffrey W. Ferguson sold 202,606 shares of the firm's stock in a transaction on Tuesday, August 12th. The stock was sold at an average price of $64.23, for a total transaction of $13,013,383.38. Following the transaction, the general counsel directly owned 753,255 shares in the company, valued at $48,381,568.65. This trade represents a 21.20% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. 26.30% of the stock is owned by insiders.

Carlyle Group Company Profile

(

Free Report)

The Carlyle Group Inc is an investment firm specializing in direct and fund of fund investments. Within direct investments, it specializes in management-led/ Leveraged buyouts, privatizations, divestitures, strategic minority equity investments, structured credit, global distressed and corporate opportunities, small and middle market, equity private placements, consolidations and buildups, senior debt, mezzanine and leveraged finance, and venture and growth capital financings, seed/startup, early venture, emerging growth, turnaround, mid venture, late venture, PIPES.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Carlyle Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carlyle Group wasn't on the list.

While Carlyle Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.