Pallas Capital Advisors LLC lessened its stake in ManpowerGroup Inc. (NYSE:MAN - Free Report) by 50.3% in the 2nd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 8,489 shares of the business services provider's stock after selling 8,601 shares during the quarter. Pallas Capital Advisors LLC's holdings in ManpowerGroup were worth $343,000 at the end of the most recent reporting period.

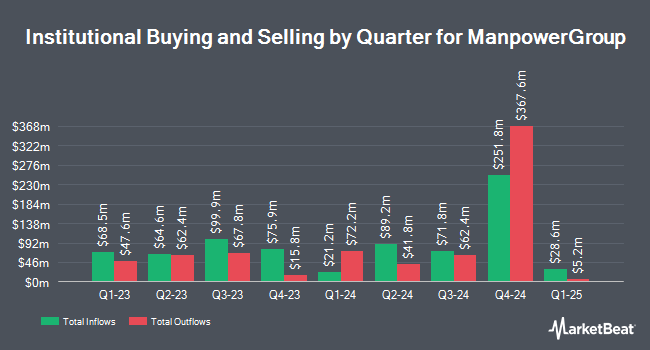

Several other large investors have also added to or reduced their stakes in the business. Invesco Ltd. boosted its holdings in ManpowerGroup by 36.1% during the first quarter. Invesco Ltd. now owns 2,608,221 shares of the business services provider's stock worth $150,964,000 after purchasing an additional 691,678 shares during the last quarter. Dimensional Fund Advisors LP raised its position in ManpowerGroup by 1.5% during the first quarter. Dimensional Fund Advisors LP now owns 2,532,196 shares of the business services provider's stock worth $146,564,000 after acquiring an additional 38,358 shares in the last quarter. AQR Capital Management LLC raised its position in ManpowerGroup by 10.7% during the first quarter. AQR Capital Management LLC now owns 2,503,668 shares of the business services provider's stock worth $144,912,000 after acquiring an additional 241,403 shares in the last quarter. Vaughan Nelson Investment Management L.P. raised its position in ManpowerGroup by 73.3% during the first quarter. Vaughan Nelson Investment Management L.P. now owns 1,027,000 shares of the business services provider's stock worth $59,443,000 after acquiring an additional 434,480 shares in the last quarter. Finally, Hotchkis & Wiley Capital Management LLC raised its position in ManpowerGroup by 4.2% during the first quarter. Hotchkis & Wiley Capital Management LLC now owns 865,394 shares of the business services provider's stock worth $50,089,000 after acquiring an additional 34,514 shares in the last quarter. Institutional investors and hedge funds own 98.03% of the company's stock.

ManpowerGroup Stock Performance

NYSE:MAN traded up $0.49 during mid-day trading on Monday, reaching $37.83. 1,087,943 shares of the company's stock were exchanged, compared to its average volume of 1,235,087. ManpowerGroup Inc. has a one year low of $36.96 and a one year high of $75.17. The firm has a market capitalization of $1.75 billion, a PE ratio of -99.55 and a beta of 1.08. The business's fifty day simple moving average is $41.14 and its two-hundred day simple moving average is $44.58. The company has a debt-to-equity ratio of 0.24, a quick ratio of 0.98 and a current ratio of 0.98.

ManpowerGroup (NYSE:MAN - Get Free Report) last released its quarterly earnings results on Thursday, July 17th. The business services provider reported $0.78 EPS for the quarter, topping analysts' consensus estimates of $0.69 by $0.09. ManpowerGroup had a negative net margin of 0.09% and a positive return on equity of 7.98%. The business had revenue of $4.52 billion for the quarter, compared to analyst estimates of $4.34 billion. During the same period last year, the firm earned $1.30 earnings per share. ManpowerGroup's revenue for the quarter was down .5% compared to the same quarter last year. ManpowerGroup has set its Q3 2025 guidance at 0.770-0.870 EPS. Analysts anticipate that ManpowerGroup Inc. will post 4.23 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several research firms have issued reports on MAN. UBS Group upped their price target on shares of ManpowerGroup from $42.00 to $45.00 and gave the stock a "neutral" rating in a research report on Monday, July 14th. Wall Street Zen raised shares of ManpowerGroup from a "sell" rating to a "hold" rating in a research report on Friday, June 27th. Five investment analysts have rated the stock with a Hold rating, According to data from MarketBeat, the company presently has an average rating of "Hold" and an average price target of $48.20.

Check Out Our Latest Stock Analysis on ManpowerGroup

About ManpowerGroup

(

Free Report)

ManpowerGroup Inc provides workforce solutions and services worldwide. The company offers recruitment services, including permanent, temporary, and contract recruitment of professionals, as well as administrative and industrial positions under the Manpower and Experis brands. It also offers various assessment services; training and development services; career and talent management; and outsourcing services related to human resources functions primarily in the areas of large-scale recruiting and workforce-intensive initiatives.

Featured Articles

Before you consider ManpowerGroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ManpowerGroup wasn't on the list.

While ManpowerGroup currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.