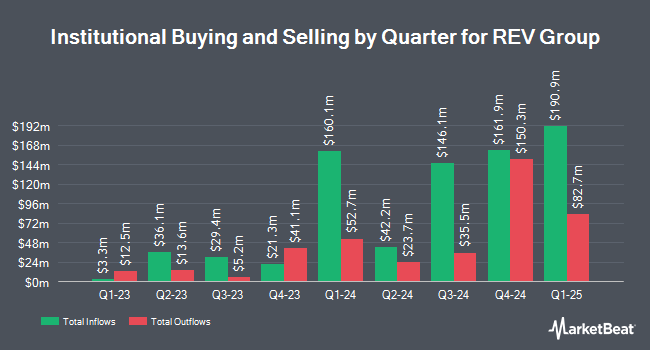

Pallas Capital Advisors LLC purchased a new stake in REV Group, Inc. (NYSE:REVG - Free Report) in the 2nd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor purchased 5,736 shares of the company's stock, valued at approximately $273,000.

Other hedge funds have also made changes to their positions in the company. KBC Group NV purchased a new stake in shares of REV Group in the 1st quarter valued at approximately $33,000. BI Asset Management Fondsmaeglerselskab A S purchased a new stake in shares of REV Group in the 1st quarter valued at approximately $54,000. New Age Alpha Advisors LLC lifted its position in shares of REV Group by 71.0% in the 1st quarter. New Age Alpha Advisors LLC now owns 2,165 shares of the company's stock valued at $68,000 after acquiring an additional 899 shares in the last quarter. Financiere des Professionnels Fonds d investissement inc. purchased a new stake in shares of REV Group in the 2nd quarter valued at approximately $193,000. Finally, Persium Advisors LLC purchased a new stake in REV Group in the 2nd quarter worth approximately $223,000.

REV Group Stock Performance

NYSE REVG traded up $1.51 during midday trading on Monday, hitting $60.43. The company had a trading volume of 676,056 shares, compared to its average volume of 1,067,714. The company has a quick ratio of 0.53, a current ratio of 1.63 and a debt-to-equity ratio of 0.23. The stock has a market cap of $2.95 billion, a price-to-earnings ratio of 27.15 and a beta of 1.15. The firm has a fifty day simple moving average of $53.28 and a two-hundred day simple moving average of $42.95. REV Group, Inc. has a fifty-two week low of $25.76 and a fifty-two week high of $64.47.

REV Group (NYSE:REVG - Get Free Report) last posted its quarterly earnings results on Wednesday, September 3rd. The company reported $0.79 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.63 by $0.16. The company had revenue of $644.90 million for the quarter, compared to analyst estimates of $613.24 million. REV Group had a net margin of 4.51% and a return on equity of 27.25%. The business's quarterly revenue was up 11.3% on a year-over-year basis. During the same period last year, the business posted $0.48 EPS. REV Group has set its FY 2025 guidance at EPS. Equities analysts forecast that REV Group, Inc. will post 2.12 earnings per share for the current fiscal year.

REV Group Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, October 10th. Stockholders of record on Friday, September 26th will be given a dividend of $0.06 per share. This represents a $0.24 annualized dividend and a dividend yield of 0.4%. The ex-dividend date is Friday, September 26th. REV Group's payout ratio is 11.32%.

Wall Street Analyst Weigh In

A number of equities research analysts have issued reports on REVG shares. Zacks Research downgraded shares of REV Group from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, September 2nd. DA Davidson raised their price target on shares of REV Group from $55.00 to $68.00 and gave the company a "buy" rating in a report on Thursday, September 4th. Robert W. Baird raised their price target on shares of REV Group from $50.00 to $64.00 and gave the company an "outperform" rating in a report on Thursday, September 4th. The Goldman Sachs Group raised their price target on shares of REV Group from $26.00 to $30.00 and gave the company a "sell" rating in a report on Tuesday, May 27th. Finally, Morgan Stanley set a $64.00 price target on shares of REV Group in a report on Tuesday, September 9th. Two investment analysts have rated the stock with a Buy rating, two have assigned a Hold rating and one has issued a Sell rating to the company. According to MarketBeat, REV Group has a consensus rating of "Hold" and a consensus price target of $56.50.

Read Our Latest Research Report on REV Group

REV Group Company Profile

(

Free Report)

REV Group, Inc, together with its subsidiaries, designs, manufactures, and distributes specialty vehicles, and related aftermarket parts and services in the United States, Canada, and internationally. It operates through three segments: Fire & Emergency, Commercial, and Recreation. The Fire & Emergency segment provides fire apparatus equipment under the Emergency One, Kovatch Mobile Equipment, Ferrara, Spartan Emergency Response, Smeal, Spartan Fire Chassis, and Ladder Tower brand names; and ambulances under the American Emergency Vehicles, Horton Emergency Vehicles, Leader Emergency Vehicles, Road Rescue, and Wheeled Coach brand names.

Further Reading

Before you consider REV Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and REV Group wasn't on the list.

While REV Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.