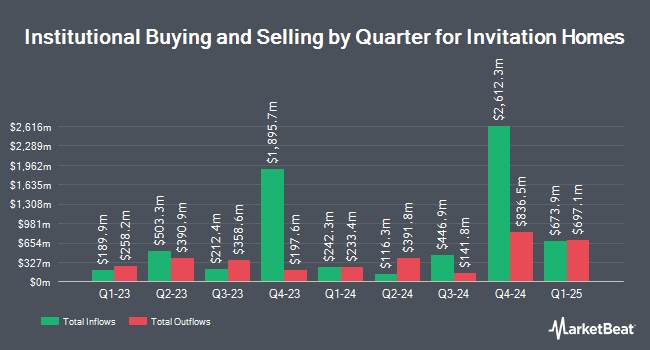

Panagora Asset Management Inc. lessened its holdings in Invitation Home (NYSE:INVH - Free Report) by 80.3% in the first quarter, according to its most recent filing with the SEC. The institutional investor owned 281,006 shares of the company's stock after selling 1,145,716 shares during the period. Panagora Asset Management Inc.'s holdings in Invitation Home were worth $9,793,000 as of its most recent SEC filing.

Other institutional investors have also bought and sold shares of the company. Stifel Financial Corp lifted its holdings in shares of Invitation Home by 33.3% in the 4th quarter. Stifel Financial Corp now owns 91,288 shares of the company's stock valued at $2,918,000 after acquiring an additional 22,816 shares during the last quarter. Mercer Global Advisors Inc. ADV lifted its holdings in shares of Invitation Home by 107.3% in the 4th quarter. Mercer Global Advisors Inc. ADV now owns 28,942 shares of the company's stock valued at $925,000 after acquiring an additional 14,979 shares during the last quarter. Ameriprise Financial Inc. lifted its holdings in shares of Invitation Home by 36.5% in the 4th quarter. Ameriprise Financial Inc. now owns 3,969,533 shares of the company's stock valued at $123,634,000 after acquiring an additional 1,060,805 shares during the last quarter. Alethea Capital Management LLC bought a new position in shares of Invitation Home in the 4th quarter valued at about $392,000. Finally, BNP Paribas Financial Markets lifted its stake in Invitation Home by 110.1% in the fourth quarter. BNP Paribas Financial Markets now owns 2,158,395 shares of the company's stock worth $69,004,000 after purchasing an additional 1,131,029 shares during the last quarter. Hedge funds and other institutional investors own 96.79% of the company's stock.

Analyst Upgrades and Downgrades

Several analysts have issued reports on the stock. Scotiabank decreased their price objective on shares of Invitation Home from $38.00 to $36.00 and set a "sector performer" rating for the company in a research note on Thursday. Citigroup raised shares of Invitation Home from a "neutral" rating to a "buy" rating and lifted their price objective for the company from $35.00 to $38.50 in a report on Friday, June 6th. Oppenheimer lifted their price objective on shares of Invitation Home from $39.00 to $41.00 and gave the company an "outperform" rating in a report on Tuesday, May 6th. Royal Bank Of Canada cut their price objective on shares of Invitation Home from $35.00 to $34.00 and set a "sector perform" rating on the stock in a report on Friday, August 1st. Finally, Raymond James Financial lifted their price objective on shares of Invitation Home from $36.00 to $39.00 and gave the company an "outperform" rating in a report on Friday, May 9th. Eight equities research analysts have rated the stock with a Buy rating and nine have given a Hold rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Hold" and a consensus price target of $36.85.

Get Our Latest Report on Invitation Home

Invitation Home Trading Up 1.2%

NYSE INVH opened at $31.32 on Monday. The company has a market capitalization of $19.20 billion, a PE ratio of 35.59, a P/E/G ratio of 3.13 and a beta of 0.82. The company has a fifty day moving average of $31.58 and a 200 day moving average of $32.81. Invitation Home has a 1 year low of $29.37 and a 1 year high of $37.80. The company has a debt-to-equity ratio of 0.47, a current ratio of 0.02 and a quick ratio of 0.02.

Invitation Home (NYSE:INVH - Get Free Report) last posted its earnings results on Wednesday, July 30th. The company reported $0.48 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.48. Invitation Home had a net margin of 20.36% and a return on equity of 5.56%. The company had revenue of $681.40 million during the quarter, compared to the consensus estimate of $675.01 million. During the same period in the previous year, the firm posted $0.47 earnings per share. The firm's quarterly revenue was up 4.3% on a year-over-year basis. Invitation Home has set its FY 2025 guidance at 1.880-1.940 EPS. Research analysts forecast that Invitation Home will post 1.83 earnings per share for the current year.

Invitation Home Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Friday, July 18th. Shareholders of record on Thursday, June 26th were issued a $0.29 dividend. The ex-dividend date of this dividend was Thursday, June 26th. This represents a $1.16 dividend on an annualized basis and a yield of 3.7%. Invitation Home's payout ratio is presently 131.82%.

Insiders Place Their Bets

In other Invitation Home news, CEO Dallas B. Tanner sold 148,749 shares of Invitation Home stock in a transaction on Friday, June 13th. The shares were sold at an average price of $33.41, for a total value of $4,969,704.09. Following the completion of the transaction, the chief executive officer owned 642,973 shares of the company's stock, valued at approximately $21,481,727.93. The trade was a 18.79% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Insiders own 0.29% of the company's stock.

About Invitation Home

(

Free Report)

Invitation Homes, an S&P 500 company, is the nation's premier single-family home leasing and management company, meeting changing lifestyle demands by providing access to high-quality, updated homes with valued features such as close proximity to jobs and access to good schools. The company's mission, Together with you, we make a house a home, reflects its commitment to providing homes where individuals and families can thrive and high-touch service that continuously enhances residents' living experiences.

Featured Stories

Want to see what other hedge funds are holding INVH? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Invitation Home (NYSE:INVH - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Invitation Home, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Invitation Home wasn't on the list.

While Invitation Home currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.