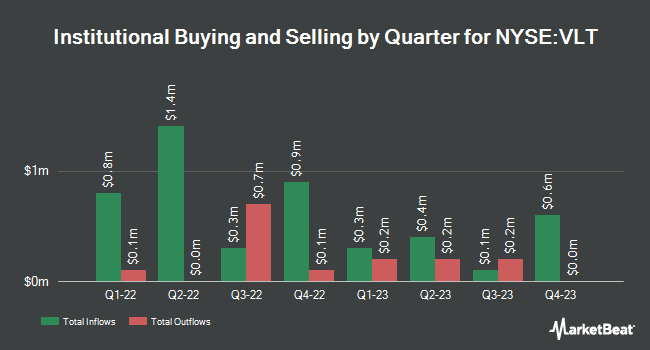

Park Avenue Securities LLC bought a new stake in shares of INV VK HI INC2 (NYSE:VLT - Free Report) in the 2nd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund bought 64,926 shares of the financial services provider's stock, valued at approximately $710,000. Park Avenue Securities LLC owned about 1.00% of INV VK HI INC2 at the end of the most recent reporting period.

Several other hedge funds have also bought and sold shares of VLT. Envestnet Asset Management Inc. lifted its position in INV VK HI INC2 by 1.8% during the first quarter. Envestnet Asset Management Inc. now owns 73,616 shares of the financial services provider's stock valued at $780,000 after purchasing an additional 1,275 shares during the last quarter. Shaker Financial Services LLC lifted its holdings in shares of INV VK HI INC2 by 126.9% in the 1st quarter. Shaker Financial Services LLC now owns 149,862 shares of the financial services provider's stock worth $1,587,000 after acquiring an additional 83,823 shares during the last quarter. Wolverine Asset Management LLC bought a new stake in shares of INV VK HI INC2 in the 1st quarter worth approximately $195,000. Finally, Wealth Enhancement Advisory Services LLC bought a new stake in shares of INV VK HI INC2 in the 2nd quarter worth approximately $121,000. 21.63% of the stock is currently owned by institutional investors.

INV VK HI INC2 Stock Performance

Shares of VLT opened at $11.21 on Friday. INV VK HI INC2 has a fifty-two week low of $9.12 and a fifty-two week high of $11.63. The firm has a 50 day moving average price of $11.14 and a 200-day moving average price of $10.76.

INV VK HI INC2 Cuts Dividend

The firm also recently disclosed a monthly dividend, which will be paid on Tuesday, September 30th. Stockholders of record on Tuesday, September 16th will be issued a $0.094 dividend. This represents a c) dividend on an annualized basis and a dividend yield of 10.1%. The ex-dividend date is Tuesday, September 16th.

INV VK HI INC2 Company Profile

(

Free Report)

Invesco High Income Trust II is a closed ended fixed income mutual fund launched by Invesco Ltd. The fund is co-managed by Invesco Advisers, Inc, INVESCO Asset Management (Japan) Limited, INVESCO Asset Management Deutschland GmbH, INVESCO Asset Management Limited, Invesco Hong Kong Limited, INVESCO Senior Secured Management, Inc, and Invesco Canada Ltd.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider INV VK HI INC2, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and INV VK HI INC2 wasn't on the list.

While INV VK HI INC2 currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.