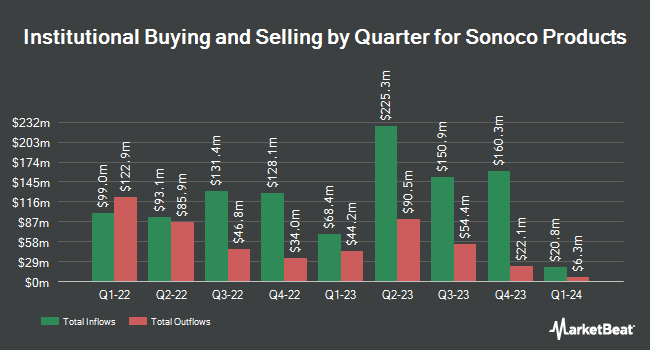

Park Avenue Securities LLC purchased a new stake in Sonoco Products Company (NYSE:SON - Free Report) during the second quarter, according to its most recent Form 13F filing with the SEC. The fund purchased 13,913 shares of the industrial products company's stock, valued at approximately $606,000.

Other institutional investors and hedge funds have also made changes to their positions in the company. Dimensional Fund Advisors LP lifted its holdings in Sonoco Products by 14.4% during the 1st quarter. Dimensional Fund Advisors LP now owns 3,591,263 shares of the industrial products company's stock worth $169,646,000 after buying an additional 450,792 shares in the last quarter. Earnest Partners LLC lifted its holdings in Sonoco Products by 2.3% during the 1st quarter. Earnest Partners LLC now owns 2,655,347 shares of the industrial products company's stock worth $125,439,000 after buying an additional 60,746 shares in the last quarter. Fuller & Thaler Asset Management Inc. lifted its holdings in Sonoco Products by 9.8% during the 1st quarter. Fuller & Thaler Asset Management Inc. now owns 2,308,939 shares of the industrial products company's stock worth $109,074,000 after buying an additional 206,749 shares in the last quarter. Invesco Ltd. lifted its holdings in Sonoco Products by 3.2% during the 1st quarter. Invesco Ltd. now owns 1,401,051 shares of the industrial products company's stock worth $66,186,000 after buying an additional 43,049 shares in the last quarter. Finally, Millennium Management LLC lifted its holdings in Sonoco Products by 739.7% during the 1st quarter. Millennium Management LLC now owns 1,152,506 shares of the industrial products company's stock worth $54,444,000 after buying an additional 1,015,250 shares in the last quarter. 77.69% of the stock is owned by hedge funds and other institutional investors.

Sonoco Products Stock Down 0.5%

Shares of Sonoco Products stock opened at $43.90 on Monday. The company has a market cap of $4.33 billion, a P/E ratio of 7.87, a PEG ratio of 0.59 and a beta of 0.70. The company has a debt-to-equity ratio of 1.53, a quick ratio of 0.72 and a current ratio of 1.25. Sonoco Products Company has a one year low of $39.46 and a one year high of $55.33. The firm has a fifty day moving average of $46.32 and a two-hundred day moving average of $45.59.

Sonoco Products (NYSE:SON - Get Free Report) last announced its quarterly earnings data on Wednesday, July 23rd. The industrial products company reported $1.37 EPS for the quarter, missing analysts' consensus estimates of $1.44 by ($0.07). The firm had revenue of $1.91 billion for the quarter, compared to analysts' expectations of $1.92 billion. Sonoco Products had a return on equity of 20.46% and a net margin of 8.35%.The firm's quarterly revenue was up 17.7% compared to the same quarter last year. During the same quarter in the previous year, the company posted $1.28 EPS. Sonoco Products has set its FY 2025 guidance at 6.000-6.2 EPS. On average, analysts forecast that Sonoco Products Company will post 6.1 earnings per share for the current year.

Sonoco Products Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Wednesday, September 10th. Stockholders of record on Friday, August 8th were paid a dividend of $0.53 per share. The ex-dividend date of this dividend was Friday, August 8th. This represents a $2.12 dividend on an annualized basis and a dividend yield of 4.8%. Sonoco Products's dividend payout ratio is 37.99%.

Wall Street Analysts Forecast Growth

SON has been the topic of a number of research reports. Truist Financial lifted their price objective on shares of Sonoco Products from $53.00 to $58.00 and gave the stock a "buy" rating in a research report on Friday, July 25th. Raymond James Financial boosted their target price on shares of Sonoco Products from $50.00 to $55.00 and gave the stock an "outperform" rating in a research note on Tuesday, July 15th. Finally, UBS Group boosted their target price on shares of Sonoco Products from $48.00 to $50.00 and gave the stock a "neutral" rating in a research note on Thursday, July 24th. Six investment analysts have rated the stock with a Buy rating and two have issued a Hold rating to the stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $57.63.

Check Out Our Latest Analysis on Sonoco Products

About Sonoco Products

(

Free Report)

Sonoco Products Company, together with its subsidiaries, designs, develops, manufactures, and sells various engineered and sustainable packaging products in North and South America, Europe, Australia, and Asia. The company operates Consumer Packaging and Industrial Paper Packaging segments. The Consumer Packaging segment offers round and shaped rigid paper, steel, and plastic containers; metal and peelable membrane ends, closures, and components; thermoformed plastic trays and enclosures; and high-barrier flexible packaging products.

Read More

Want to see what other hedge funds are holding SON? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Sonoco Products Company (NYSE:SON - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sonoco Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sonoco Products wasn't on the list.

While Sonoco Products currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.