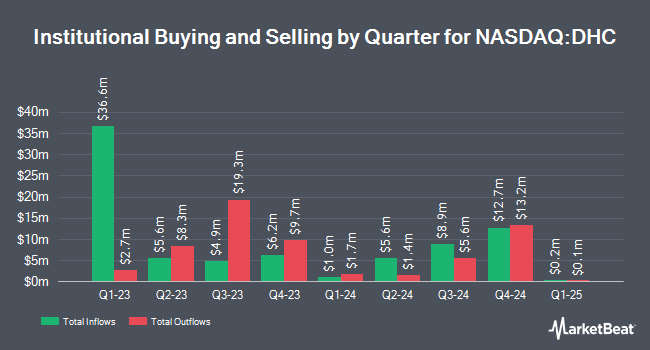

Park West Asset Management LLC purchased a new position in shares of Diversified Healthcare Trust (NASDAQ:DHC - Free Report) in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund purchased 3,576,386 shares of the real estate investment trust's stock, valued at approximately $8,583,000. Park West Asset Management LLC owned about 1.48% of Diversified Healthcare Trust at the end of the most recent reporting period.

A number of other hedge funds have also made changes to their positions in DHC. Chicago Partners Investment Group LLC purchased a new stake in Diversified Healthcare Trust during the first quarter worth approximately $34,000. Brooklyn Investment Group boosted its position in shares of Diversified Healthcare Trust by 296.3% in the 1st quarter. Brooklyn Investment Group now owns 18,174 shares of the real estate investment trust's stock valued at $44,000 after purchasing an additional 13,588 shares during the period. Ground Swell Capital LLC acquired a new stake in Diversified Healthcare Trust during the 1st quarter worth $45,000. Teacher Retirement System of Texas purchased a new stake in shares of Diversified Healthcare Trust in the 1st quarter worth about $59,000. Finally, BNP Paribas Financial Markets purchased a new position in Diversified Healthcare Trust during the fourth quarter worth $65,000. Hedge funds and other institutional investors own 75.98% of the company's stock.

Diversified Healthcare Trust Trading Up 1.9%

Shares of NASDAQ:DHC traded up $0.08 during trading on Wednesday, reaching $4.36. The stock had a trading volume of 837,500 shares, compared to its average volume of 669,591. Diversified Healthcare Trust has a fifty-two week low of $2.00 and a fifty-two week high of $4.37. The business has a fifty day moving average price of $3.63 and a 200-day moving average price of $3.09. The stock has a market cap of $1.05 billion, a P/E ratio of 23.78 and a beta of 2.62. The company has a quick ratio of 6.35, a current ratio of 6.35 and a debt-to-equity ratio of 1.42.

Diversified Healthcare Trust (NASDAQ:DHC - Get Free Report) last released its earnings results on Monday, August 4th. The real estate investment trust reported $0.08 EPS for the quarter, hitting the consensus estimate of $0.08. Diversified Healthcare Trust had a negative net margin of 18.83% and a negative return on equity of 14.69%. The firm had revenue of $382.71 million during the quarter, compared to analysts' expectations of $382.74 million.

Diversified Healthcare Trust Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Thursday, August 14th. Shareholders of record on Monday, July 21st were paid a $0.01 dividend. This represents a $0.04 dividend on an annualized basis and a yield of 0.9%. The ex-dividend date of this dividend was Monday, July 21st. Diversified Healthcare Trust's dividend payout ratio (DPR) is presently -3.36%.

Diversified Healthcare Trust Profile

(

Free Report)

Diversified Healthcare Trust is a real estate investment trust, which engages in the ownership of senior living communities, medical office buildings, and wellness centers. It operates through the following segments: Office Portfolio, Senior Housing Operating Portfolio (SHOP), and Non-Segment. The Office Portfolio segment consists of medical office properties leased to medical providers and other medical related businesses, as well as life science properties leased to biotech laboratories and other similar tenants.

Read More

Before you consider Diversified Healthcare Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Diversified Healthcare Trust wasn't on the list.

While Diversified Healthcare Trust currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.