Parnassus Investments LLC trimmed its position in shares of MSCI Inc (NYSE:MSCI - Free Report) by 21.0% during the 1st quarter, according to its most recent 13F filing with the SEC. The fund owned 28,058 shares of the technology company's stock after selling 7,446 shares during the quarter. Parnassus Investments LLC's holdings in MSCI were worth $15,867,000 at the end of the most recent reporting period.

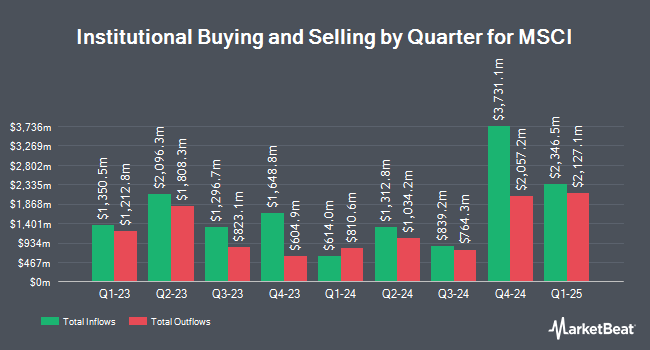

Several other institutional investors also recently bought and sold shares of MSCI. Vanguard Group Inc. lifted its stake in MSCI by 5.9% during the 1st quarter. Vanguard Group Inc. now owns 9,376,852 shares of the technology company's stock valued at $5,302,610,000 after acquiring an additional 518,833 shares during the period. Principal Financial Group Inc. lifted its stake in shares of MSCI by 0.9% in the 1st quarter. Principal Financial Group Inc. now owns 1,626,923 shares of the technology company's stock worth $920,026,000 after purchasing an additional 13,918 shares during the period. American Century Companies Inc. lifted its stake in shares of MSCI by 2.0% in the 1st quarter. American Century Companies Inc. now owns 1,008,778 shares of the technology company's stock worth $570,464,000 after purchasing an additional 19,846 shares during the period. Northern Trust Corp lifted its stake in shares of MSCI by 2.6% in the 1st quarter. Northern Trust Corp now owns 804,640 shares of the technology company's stock worth $455,024,000 after purchasing an additional 20,150 shares during the period. Finally, JPMorgan Chase & Co. lifted its stake in shares of MSCI by 8.4% in the 1st quarter. JPMorgan Chase & Co. now owns 615,770 shares of the technology company's stock worth $348,218,000 after purchasing an additional 47,936 shares during the period. 89.97% of the stock is owned by hedge funds and other institutional investors.

MSCI Price Performance

MSCI opened at $567.57 on Friday. The firm has a market cap of $43.91 billion, a P/E ratio of 37.59, a PEG ratio of 2.78 and a beta of 1.29. MSCI Inc has a 1-year low of $486.73 and a 1-year high of $642.45. The company has a 50 day simple moving average of $565.89 and a two-hundred day simple moving average of $560.07.

MSCI (NYSE:MSCI - Get Free Report) last announced its quarterly earnings data on Tuesday, July 22nd. The technology company reported $4.17 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $4.12 by $0.05. MSCI had a net margin of 39.46% and a negative return on equity of 143.13%. The business had revenue of $772.68 million during the quarter, compared to analyst estimates of $763.06 million. During the same period last year, the firm posted $3.64 EPS. The company's revenue was up 9.1% on a year-over-year basis. Equities analysts anticipate that MSCI Inc will post 16.86 earnings per share for the current year.

MSCI Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, August 29th. Investors of record on Friday, August 15th were issued a $1.80 dividend. The ex-dividend date of this dividend was Friday, August 15th. This represents a $7.20 dividend on an annualized basis and a dividend yield of 1.3%. MSCI's dividend payout ratio (DPR) is 47.68%.

Analyst Ratings Changes

MSCI has been the topic of several recent research reports. Raymond James Financial upgraded shares of MSCI from a "market perform" rating to an "outperform" rating and set a $650.00 price objective on the stock in a research note on Friday, July 25th. JPMorgan Chase & Co. increased their price objective on shares of MSCI from $650.00 to $680.00 and gave the stock an "overweight" rating in a research note on Monday, July 21st. UBS Group increased their price objective on shares of MSCI from $655.00 to $700.00 and gave the stock a "buy" rating in a research note on Tuesday, July 8th. Finally, Wells Fargo & Company lowered their price objective on shares of MSCI from $578.00 to $533.00 and set an "equal weight" rating on the stock in a research note on Wednesday, July 23rd. Ten equities research analysts have rated the stock with a Buy rating and three have assigned a Hold rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $654.73.

Check Out Our Latest Stock Analysis on MSCI

Insider Buying and Selling at MSCI

In other MSCI news, CEO Henry A. Fernandez bought 9,916 shares of the business's stock in a transaction that occurred on Thursday, July 24th. The stock was purchased at an average cost of $544.70 per share, with a total value of $5,401,245.20. Following the completion of the acquisition, the chief executive officer owned 1,279,867 shares in the company, valued at $697,143,554.90. This trade represents a 0.78% increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Insiders have acquired 12,400 shares of company stock valued at $6,731,599 over the last ninety days. Company insiders own 3.31% of the company's stock.

MSCI Profile

(

Free Report)

MSCI Inc, together with its subsidiaries, provides critical decision support tools and solutions for the investment community to manage investment processes worldwide. The Index segment provides indexes for use in various areas of the investment process, including indexed financial product, such as ETFs, mutual funds, annuities, futures, options, structured products, and over-the-counter derivatives; performance benchmarking; portfolio construction and rebalancing; and asset allocation, as well as licenses GICS and GICS Direct.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MSCI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MSCI wasn't on the list.

While MSCI currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.