PDT Partners LLC raised its holdings in Penumbra, Inc. (NYSE:PEN - Free Report) by 30.8% during the first quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 15,076 shares of the company's stock after buying an additional 3,546 shares during the quarter. PDT Partners LLC's holdings in Penumbra were worth $4,031,000 at the end of the most recent quarter.

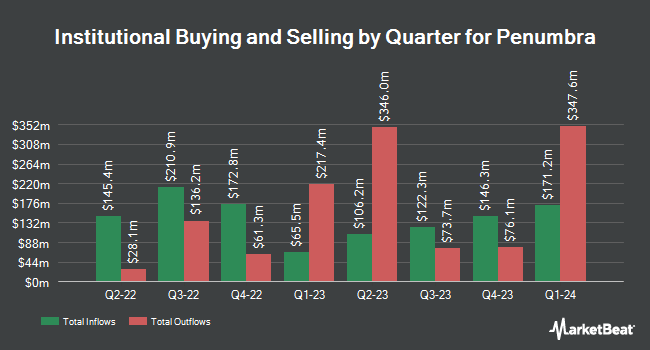

A number of other large investors have also recently made changes to their positions in PEN. Synergy Investment Management LLC bought a new stake in shares of Penumbra in the 1st quarter worth approximately $27,000. First Horizon Advisors Inc. boosted its position in shares of Penumbra by 404.8% during the first quarter. First Horizon Advisors Inc. now owns 106 shares of the company's stock valued at $28,000 after purchasing an additional 85 shares in the last quarter. AlphaQuest LLC purchased a new position in Penumbra during the first quarter valued at $66,000. Caitong International Asset Management Co. Ltd purchased a new position in Penumbra during the first quarter valued at $76,000. Finally, Versant Capital Management Inc raised its stake in Penumbra by 893.5% during the first quarter. Versant Capital Management Inc now owns 308 shares of the company's stock valued at $82,000 after buying an additional 277 shares during the last quarter. 88.88% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other news, EVP Johanna Roberts sold 600 shares of the company's stock in a transaction dated Tuesday, July 1st. The stock was sold at an average price of $252.70, for a total value of $151,620.00. Following the completion of the transaction, the executive vice president owned 66,057 shares of the company's stock, valued at $16,692,603.90. This represents a 0.90% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, Director Arani Bose sold 12,000 shares of the company's stock in a transaction dated Wednesday, August 13th. The stock was sold at an average price of $250.65, for a total value of $3,007,800.00. Following the completion of the transaction, the director directly owned 558 shares of the company's stock, valued at approximately $139,862.70. This trade represents a 95.56% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 111,487 shares of company stock worth $27,494,779. 5.00% of the stock is currently owned by insiders.

Penumbra Stock Performance

NYSE:PEN traded up $9.89 during mid-day trading on Thursday, hitting $279.60. 604,073 shares of the company traded hands, compared to its average volume of 494,769. The stock's fifty day moving average price is $248.82 and its 200-day moving average price is $265.55. Penumbra, Inc. has a one year low of $184.80 and a one year high of $310.00. The company has a quick ratio of 4.04, a current ratio of 6.75 and a debt-to-equity ratio of 0.02. The firm has a market cap of $10.90 billion, a price-to-earnings ratio of 74.36, a price-to-earnings-growth ratio of 2.45 and a beta of 0.45.

Penumbra (NYSE:PEN - Get Free Report) last released its quarterly earnings results on Tuesday, July 29th. The company reported $0.86 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.81 by $0.05. Penumbra had a return on equity of 11.55% and a net margin of 11.54%.The business had revenue of $339.46 million during the quarter, compared to analyst estimates of $327.37 million. During the same quarter in the previous year, the company posted $0.64 earnings per share. Penumbra's revenue for the quarter was up 13.4% on a year-over-year basis. Penumbra has set its FY 2025 guidance at EPS. Research analysts anticipate that Penumbra, Inc. will post 3.67 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

PEN has been the subject of several recent analyst reports. Canaccord Genuity Group set a $350.00 price target on Penumbra and gave the stock a "buy" rating in a research note on Wednesday, July 30th. Truist Financial set a $310.00 price target on Penumbra and gave the stock a "buy" rating in a research note on Wednesday, July 30th. Citigroup cut their price objective on Penumbra from $320.00 to $285.00 and set a "neutral" rating for the company in a report on Wednesday, July 9th. Evercore ISI started coverage on Penumbra in a report on Tuesday. They issued an "outperform" rating and a $300.00 price objective for the company. Finally, Royal Bank Of Canada cut their price objective on Penumbra from $330.00 to $325.00 and set an "outperform" rating for the company in a report on Wednesday, July 30th. One analyst has rated the stock with a Strong Buy rating, thirteen have assigned a Buy rating and three have given a Hold rating to the company. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $302.93.

Read Our Latest Stock Analysis on Penumbra

Penumbra Company Profile

(

Free Report)

Penumbra, Inc, together with its subsidiaries, designs, develops, manufactures, and markets medical devices in the United States and internationally. The company offers peripheral products, including the Indigo System for power aspiration of thrombus in the body; Lightning Flash, a mechanical thrombectomy system; Lightning Bolt 7, an arterial thrombectomy system; and CAT RX.

See Also

Before you consider Penumbra, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Penumbra wasn't on the list.

While Penumbra currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.