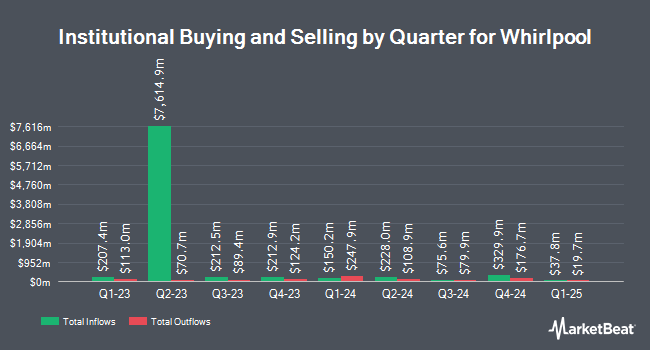

PFG Investments LLC increased its holdings in shares of Whirlpool Corporation (NYSE:WHR - Free Report) by 63.6% in the 2nd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 15,533 shares of the company's stock after purchasing an additional 6,041 shares during the quarter. PFG Investments LLC's holdings in Whirlpool were worth $1,575,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in WHR. Wealth Enhancement Advisory Services LLC raised its position in shares of Whirlpool by 22.5% in the fourth quarter. Wealth Enhancement Advisory Services LLC now owns 12,656 shares of the company's stock valued at $1,449,000 after purchasing an additional 2,326 shares during the period. GAMMA Investing LLC increased its holdings in Whirlpool by 20,810.2% in the 1st quarter. GAMMA Investing LLC now owns 57,503 shares of the company's stock valued at $5,183,000 after buying an additional 57,228 shares during the period. Rhumbline Advisers boosted its stake in shares of Whirlpool by 0.9% in the 1st quarter. Rhumbline Advisers now owns 149,114 shares of the company's stock valued at $13,440,000 after purchasing an additional 1,337 shares in the last quarter. Gilman Hill Asset Management LLC boosted its stake in shares of Whirlpool by 5.5% in the 1st quarter. Gilman Hill Asset Management LLC now owns 81,321 shares of the company's stock valued at $7,329,000 after purchasing an additional 4,264 shares in the last quarter. Finally, UMB Bank n.a. boosted its stake in shares of Whirlpool by 40.4% in the 1st quarter. UMB Bank n.a. now owns 448 shares of the company's stock valued at $40,000 after purchasing an additional 129 shares in the last quarter. 90.78% of the stock is owned by institutional investors.

Whirlpool Price Performance

NYSE WHR opened at $78.99 on Thursday. Whirlpool Corporation has a 52 week low of $73.72 and a 52 week high of $135.49. The company has a market cap of $4.41 billion, a PE ratio of -29.81 and a beta of 1.17. The company has a quick ratio of 0.46, a current ratio of 0.85 and a debt-to-equity ratio of 2.39. The firm's 50-day simple moving average is $87.96 and its two-hundred day simple moving average is $87.95.

Whirlpool (NYSE:WHR - Get Free Report) last posted its quarterly earnings data on Monday, July 28th. The company reported $1.34 earnings per share for the quarter, missing the consensus estimate of $1.54 by ($0.20). Whirlpool had a positive return on equity of 20.81% and a negative net margin of 0.95%.The company had revenue of $3.77 billion during the quarter, compared to the consensus estimate of $3.88 billion. During the same quarter last year, the company posted $2.39 earnings per share. The firm's revenue for the quarter was down 5.4% on a year-over-year basis. Whirlpool has set its FY 2025 guidance at 6.000-8.000 EPS. Research analysts predict that Whirlpool Corporation will post 9.52 earnings per share for the current year.

Whirlpool Cuts Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, September 15th. Investors of record on Friday, August 29th were paid a $0.90 dividend. The ex-dividend date of this dividend was Friday, August 29th. This represents a $3.60 dividend on an annualized basis and a yield of 4.6%. Whirlpool's dividend payout ratio (DPR) is presently -135.85%.

Analyst Ratings Changes

Several research firms recently commented on WHR. Longbow Research upgraded shares of Whirlpool from a "neutral" rating to a "buy" rating and set a $145.00 target price on the stock in a research report on Monday, June 30th. Bank of America restated an "underperform" rating and issued a $70.00 price target (down previously from $100.00) on shares of Whirlpool in a research report on Tuesday, July 29th. Wall Street Zen lowered shares of Whirlpool from a "hold" rating to a "sell" rating in a research note on Saturday, July 26th. Loop Capital reiterated a "hold" rating and issued a $88.00 price objective on shares of Whirlpool in a research note on Monday, August 4th. Finally, Royal Bank Of Canada lowered their price objective on shares of Whirlpool from $65.00 to $63.00 and set an "underperform" rating for the company in a research note on Wednesday, July 30th. Two analysts have rated the stock with a Buy rating, two have issued a Hold rating and two have assigned a Sell rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus price target of $98.83.

View Our Latest Stock Report on Whirlpool

Whirlpool Company Profile

(

Free Report)

Whirlpool Corporation manufactures and markets home appliances and related products and services in the North America, Europe, the Middle East, Africa, Latin America, and Asia. The company's principal products include refrigerators, freezers, ice makers, and refrigerator water filters; laundry appliances, and commercial laundry products and related laundry accessories; cooking and other small domestic appliances; and dishwasher appliances and related accessories, as well as mixers.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Whirlpool, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Whirlpool wasn't on the list.

While Whirlpool currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.