Empirical Financial Services LLC d.b.a. Empirical Wealth Management decreased its holdings in shares of Pfizer Inc. (NYSE:PFE - Free Report) by 41.0% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 27,589 shares of the biopharmaceutical company's stock after selling 19,169 shares during the quarter. Empirical Financial Services LLC d.b.a. Empirical Wealth Management's holdings in Pfizer were worth $699,000 at the end of the most recent quarter.

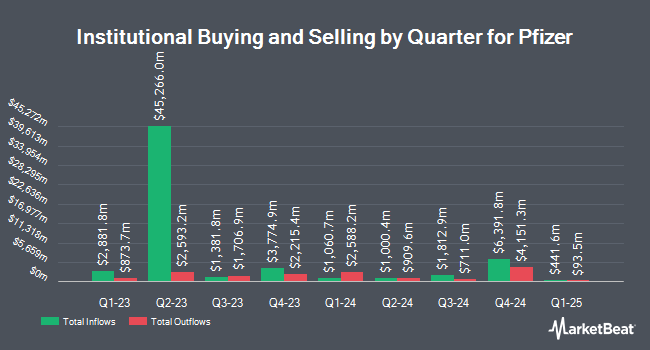

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in PFE. Northern Trust Corp increased its position in Pfizer by 7.7% during the fourth quarter. Northern Trust Corp now owns 58,382,560 shares of the biopharmaceutical company's stock worth $1,548,889,000 after buying an additional 4,167,222 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its position in shares of Pfizer by 3.5% during the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 39,402,619 shares of the biopharmaceutical company's stock worth $1,045,351,000 after acquiring an additional 1,333,740 shares during the last quarter. Invesco Ltd. increased its holdings in shares of Pfizer by 9.6% in the 4th quarter. Invesco Ltd. now owns 29,458,139 shares of the biopharmaceutical company's stock valued at $781,524,000 after acquiring an additional 2,579,455 shares during the period. Pacer Advisors Inc. increased its holdings in shares of Pfizer by 856.8% in the 1st quarter. Pacer Advisors Inc. now owns 20,053,828 shares of the biopharmaceutical company's stock valued at $508,164,000 after acquiring an additional 17,957,928 shares during the period. Finally, Federated Hermes Inc. raised its position in Pfizer by 22.2% in the 1st quarter. Federated Hermes Inc. now owns 17,592,709 shares of the biopharmaceutical company's stock valued at $445,799,000 after purchasing an additional 3,201,087 shares during the last quarter. 68.36% of the stock is owned by institutional investors and hedge funds.

Pfizer Price Performance

Shares of NYSE:PFE traded up $0.20 on Friday, reaching $23.49. 51,287,529 shares of the company were exchanged, compared to its average volume of 40,584,816. The company has a 50-day moving average of $24.36 and a 200-day moving average of $24.55. The company has a current ratio of 1.26, a quick ratio of 0.96 and a debt-to-equity ratio of 0.64. The firm has a market cap of $133.55 billion, a price-to-earnings ratio of 17.02, a price-to-earnings-growth ratio of 0.85 and a beta of 0.52. Pfizer Inc. has a 1-year low of $20.92 and a 1-year high of $31.32.

Pfizer Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, September 2nd. Shareholders of record on Friday, July 25th will be issued a $0.43 dividend. The ex-dividend date of this dividend is Friday, July 25th. This represents a $1.72 dividend on an annualized basis and a yield of 7.3%. Pfizer's dividend payout ratio (DPR) is 124.64%.

Analyst Ratings Changes

Several research analysts have issued reports on PFE shares. TD Cowen lowered their price objective on shares of Pfizer from $32.00 to $28.00 and set a "hold" rating on the stock in a research report on Tuesday, April 22nd. The Goldman Sachs Group raised their price target on Pfizer from $25.00 to $27.00 and gave the stock a "neutral" rating in a report on Wednesday, April 30th. Wolfe Research upped their price objective on Pfizer from $22.00 to $23.00 and gave the company an "underperform" rating in a research note on Wednesday, April 30th. Redburn Atlantic decreased their price objective on Pfizer from $29.00 to $27.00 and set a "neutral" rating for the company in a research report on Wednesday, April 30th. Finally, HSBC dropped their target price on Pfizer from $27.00 to $26.00 and set a "buy" rating on the stock in a report on Monday, May 19th. One investment analyst has rated the stock with a sell rating, eleven have assigned a hold rating, six have assigned a buy rating and three have assigned a strong buy rating to the company. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $28.28.

Check Out Our Latest Report on PFE

Pfizer Profile

(

Free Report)

Pfizer Inc discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States, Europe, and internationally. The company offers medicines and vaccines in various therapeutic areas, including cardiovascular metabolic, migraine, and women's health under the Eliquis, Nurtec ODT/Vydura, Zavzpret, and the Premarin family brands; infectious diseases with unmet medical needs under the Prevnar family, Abrysvo, Nimenrix, FSME/IMMUN-TicoVac, and Trumenba brands; and COVID-19 prevention and treatment, and potential future mRNA and antiviral products under the Comirnaty and Paxlovid brands.

Recommended Stories

Before you consider Pfizer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pfizer wasn't on the list.

While Pfizer currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.