Martingale Asset Management L P decreased its stake in shares of Philip Morris International Inc. (NYSE:PM - Free Report) by 13.0% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 258,031 shares of the company's stock after selling 38,567 shares during the quarter. Philip Morris International comprises 1.0% of Martingale Asset Management L P's holdings, making the stock its 14th biggest position. Martingale Asset Management L P's holdings in Philip Morris International were worth $40,957,000 as of its most recent filing with the Securities and Exchange Commission.

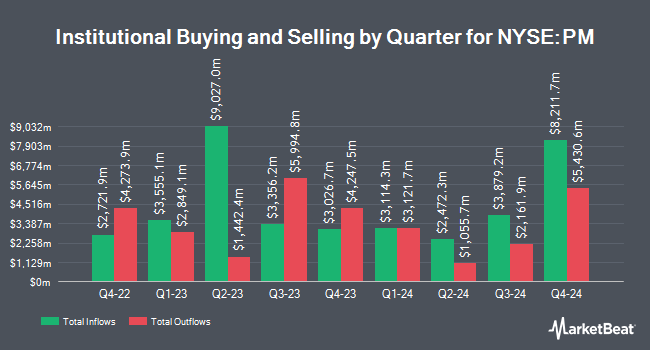

A number of other large investors have also recently made changes to their positions in the stock. Perigon Wealth Management LLC grew its stake in shares of Philip Morris International by 0.4% during the 1st quarter. Perigon Wealth Management LLC now owns 14,087 shares of the company's stock worth $2,236,000 after purchasing an additional 60 shares during the period. TBH Global Asset Management LLC grew its stake in shares of Philip Morris International by 0.9% during the 1st quarter. TBH Global Asset Management LLC now owns 6,932 shares of the company's stock worth $1,100,000 after purchasing an additional 61 shares during the period. NFP Retirement Inc. grew its stake in shares of Philip Morris International by 2.5% during the 1st quarter. NFP Retirement Inc. now owns 2,589 shares of the company's stock worth $411,000 after purchasing an additional 62 shares during the period. Capital Advisors Wealth Management LLC lifted its position in shares of Philip Morris International by 2.1% during the 1st quarter. Capital Advisors Wealth Management LLC now owns 3,005 shares of the company's stock valued at $477,000 after acquiring an additional 63 shares during the period. Finally, Renasant Bank lifted its position in shares of Philip Morris International by 3.3% during the 1st quarter. Renasant Bank now owns 1,994 shares of the company's stock valued at $317,000 after acquiring an additional 63 shares during the period. 78.63% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of equities research analysts have recently issued reports on the stock. Barclays reduced their price target on shares of Philip Morris International from $225.00 to $220.00 and set an "overweight" rating for the company in a research report on Wednesday, July 30th. UBS Group lifted their price target on shares of Philip Morris International from $170.00 to $181.00 and gave the company a "neutral" rating in a research report on Monday, July 14th. JPMorgan Chase & Co. lifted their price target on shares of Philip Morris International from $175.00 to $190.00 and gave the company an "overweight" rating in a research report on Thursday, July 10th. Needham & Company LLC reiterated a "buy" rating and set a $195.00 price target on shares of Philip Morris International in a research report on Wednesday, July 23rd. Finally, Jefferies Financial Group initiated coverage on shares of Philip Morris International in a research report on Wednesday, July 9th. They set a "buy" rating and a $220.00 price target for the company. Twelve equities research analysts have rated the stock with a Buy rating and one has given a Hold rating to the stock. According to MarketBeat, Philip Morris International has an average rating of "Moderate Buy" and a consensus price target of $186.27.

Read Our Latest Research Report on Philip Morris International

Philip Morris International Price Performance

PM stock traded down $4.38 during midday trading on Monday, hitting $167.37. The stock had a trading volume of 3,927,768 shares, compared to its average volume of 6,010,246. The firm has a market cap of $260.53 billion, a PE ratio of 31.82, a price-to-earnings-growth ratio of 2.50 and a beta of 0.48. Philip Morris International Inc. has a 12-month low of $116.12 and a 12-month high of $186.69. The company's 50-day moving average price is $173.69 and its 200 day moving average price is $166.34.

Philip Morris International (NYSE:PM - Get Free Report) last released its earnings results on Tuesday, July 22nd. The company reported $1.91 EPS for the quarter, topping the consensus estimate of $1.86 by $0.05. The firm had revenue of $10.14 billion during the quarter, compared to analysts' expectations of $10.33 billion. Philip Morris International had a net margin of 9.03% and a negative return on equity of 120.86%. Philip Morris International's revenue for the quarter was up 7.1% on a year-over-year basis. During the same period in the previous year, the company earned $1.59 EPS. Philip Morris International has set its Q3 2025 guidance at 2.080-2.130 EPS. As a group, sell-side analysts anticipate that Philip Morris International Inc. will post 7.14 EPS for the current year.

Philip Morris International Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Tuesday, July 15th. Shareholders of record on Friday, June 27th were paid a $1.35 dividend. This represents a $5.40 annualized dividend and a yield of 3.2%. The ex-dividend date of this dividend was Friday, June 27th. Philip Morris International's payout ratio is presently 102.66%.

Philip Morris International Company Profile

(

Free Report)

Philip Morris International Inc operates as a tobacco company working to delivers a smoke-free future and evolving portfolio for the long-term to include products outside of the tobacco and nicotine sector. The company's product portfolio primarily consists of cigarettes and smoke-free products, including heat-not-burn, vapor, and oral nicotine products primarily under the IQOS and ZYN brands; and consumer accessories, such as lighters and matches.

Featured Articles

Before you consider Philip Morris International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Philip Morris International wasn't on the list.

While Philip Morris International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.