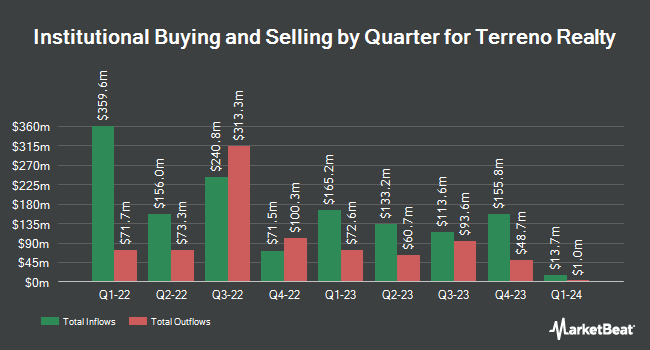

Phocas Financial Corp. cut its position in Terreno Realty Corporation (NYSE:TRNO - Free Report) by 5.5% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 114,922 shares of the real estate investment trust's stock after selling 6,645 shares during the quarter. Phocas Financial Corp. owned 0.11% of Terreno Realty worth $7,265,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors and hedge funds also recently modified their holdings of TRNO. Quarry LP boosted its holdings in shares of Terreno Realty by 613.7% during the fourth quarter. Quarry LP now owns 728 shares of the real estate investment trust's stock worth $43,000 after purchasing an additional 626 shares during the period. Quadrant Capital Group LLC boosted its holdings in Terreno Realty by 94.6% during the fourth quarter. Quadrant Capital Group LLC now owns 761 shares of the real estate investment trust's stock valued at $45,000 after purchasing an additional 370 shares in the last quarter. Blue Trust Inc. boosted its stake in shares of Terreno Realty by 143.6% in the 1st quarter. Blue Trust Inc. now owns 1,111 shares of the real estate investment trust's stock valued at $70,000 after purchasing an additional 655 shares in the last quarter. State of Tennessee Department of Treasury acquired a new position in Terreno Realty during the 4th quarter worth about $71,000. Finally, FIL Ltd lifted its position in Terreno Realty by 45.3% during the 4th quarter. FIL Ltd now owns 1,213 shares of the real estate investment trust's stock valued at $72,000 after purchasing an additional 378 shares during the period.

Analysts Set New Price Targets

A number of analysts recently issued reports on the company. Wall Street Zen raised Terreno Realty from a "sell" rating to a "hold" rating in a research note on Tuesday, May 20th. Piper Sandler decreased their price target on Terreno Realty from $61.00 to $60.00 and set a "neutral" rating on the stock in a research report on Tuesday, April 15th. Barclays reduced their price target on Terreno Realty from $57.00 to $56.00 and set an "equal weight" rating on the stock in a report on Tuesday, May 27th. Finally, Wells Fargo & Company set a $72.00 price objective on Terreno Realty in a report on Sunday, July 13th. One research analyst has rated the stock with a sell rating, nine have issued a hold rating and two have issued a buy rating to the company's stock. According to MarketBeat.com, Terreno Realty presently has an average rating of "Hold" and an average price target of $65.90.

Read Our Latest Stock Report on TRNO

Terreno Realty Price Performance

Shares of NYSE:TRNO traded up $0.51 during trading on Thursday, hitting $55.14. 263,125 shares of the company's stock were exchanged, compared to its average volume of 919,756. The business's 50-day simple moving average is $57.19 and its 200 day simple moving average is $60.18. Terreno Realty Corporation has a 52-week low of $48.18 and a 52-week high of $71.63. The company has a market cap of $5.70 billion, a price-to-earnings ratio of 27.62, a PEG ratio of 2.37 and a beta of 1.02. The company has a debt-to-equity ratio of 0.20, a current ratio of 2.35 and a quick ratio of 2.35.

Terreno Realty Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, October 10th. Stockholders of record on Monday, September 29th will be given a $0.52 dividend. This is a boost from Terreno Realty's previous quarterly dividend of $0.49. This represents a $2.08 dividend on an annualized basis and a dividend yield of 3.8%. Terreno Realty's dividend payout ratio (DPR) is presently 98.49%.

Terreno Realty Company Profile

(

Free Report)

Terreno Realty Corporation (Terreno, and together with its subsidiaries, the Company) acquires, owns and operates industrial real estate in six major coastal U.S. markets: Los Angeles, Northern New Jersey/New York City, San Francisco Bay Area, Seattle, Miami, and Washington, DC All square feet, acres, occupancy and number of properties disclosed in these notes to the consolidated financial statements are unaudited.

Featured Stories

Before you consider Terreno Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Terreno Realty wasn't on the list.

While Terreno Realty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.