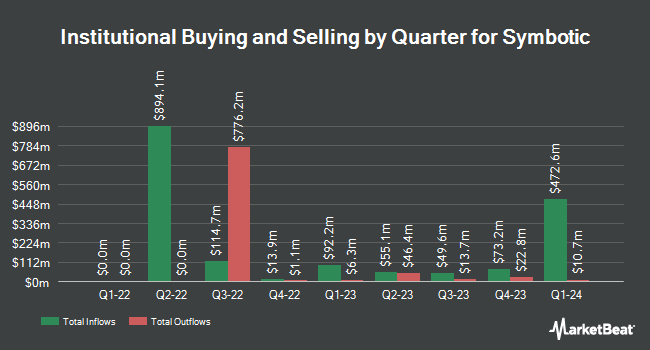

Phoenix Financial Ltd. acquired a new position in shares of Symbotic Inc. (NASDAQ:SYM - Free Report) during the 2nd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund acquired 6,300 shares of the company's stock, valued at approximately $245,000.

Other large investors also recently added to or reduced their stakes in the company. GAMMA Investing LLC increased its stake in Symbotic by 1,812.2% during the first quarter. GAMMA Investing LLC now owns 1,415 shares of the company's stock worth $29,000 after acquiring an additional 1,341 shares during the last quarter. AdvisorNet Financial Inc bought a new stake in Symbotic during the second quarter worth approximately $32,000. CWM LLC increased its stake in Symbotic by 408.2% during the first quarter. CWM LLC now owns 2,602 shares of the company's stock worth $53,000 after acquiring an additional 2,090 shares during the last quarter. AlphaQuest LLC increased its stake in Symbotic by 318.5% during the first quarter. AlphaQuest LLC now owns 2,800 shares of the company's stock worth $57,000 after acquiring an additional 2,131 shares during the last quarter. Finally, Farther Finance Advisors LLC increased its stake in Symbotic by 24.0% during the second quarter. Farther Finance Advisors LLC now owns 1,765 shares of the company's stock worth $69,000 after acquiring an additional 342 shares during the last quarter.

Symbotic Stock Performance

Shares of NASDAQ SYM opened at $64.44 on Thursday. The firm has a market capitalization of $38.05 billion, a price-to-earnings ratio of -920.44, a PEG ratio of 11.77 and a beta of 2.06. The stock has a 50 day moving average price of $55.50 and a 200 day moving average price of $41.96. Symbotic Inc. has a 52-week low of $16.32 and a 52-week high of $79.58.

Symbotic (NASDAQ:SYM - Get Free Report) last announced its quarterly earnings results on Wednesday, August 6th. The company reported ($0.05) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.03 by ($0.08). The firm had revenue of $592.12 million during the quarter, compared to analysts' expectations of $533.55 million. Symbotic had a negative net margin of 0.38% and a negative return on equity of 2.02%. The firm's revenue for the quarter was up 25.9% on a year-over-year basis. During the same quarter in the previous year, the firm posted ($0.02) EPS. Analysts forecast that Symbotic Inc. will post 0.13 earnings per share for the current year.

Analyst Ratings Changes

A number of research analysts have recently commented on the company. Baird R W cut Symbotic from a "strong-buy" rating to a "hold" rating in a research note on Thursday, August 7th. Arete cut Symbotic from a "buy" rating to a "neutral" rating and set a $50.00 target price on the stock. in a research note on Friday, July 25th. Arete Research cut Symbotic from a "strong-buy" rating to a "hold" rating in a research note on Friday, July 25th. Citigroup reaffirmed a "buy" rating on shares of Symbotic in a research note on Monday, July 14th. Finally, Oppenheimer upped their target price on Symbotic from $54.00 to $59.00 and gave the company an "outperform" rating in a research note on Thursday, August 7th. Seven equities research analysts have rated the stock with a Buy rating, thirteen have given a Hold rating and three have assigned a Sell rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus price target of $44.61.

Read Our Latest Analysis on SYM

Insider Transactions at Symbotic

In related news, insider William M. Boyd III sold 2,660 shares of the business's stock in a transaction that occurred on Wednesday, October 15th. The stock was sold at an average price of $75.08, for a total value of $199,712.80. Following the completion of the sale, the insider owned 26,769 shares in the company, valued at approximately $2,009,816.52. The trade was a 9.04% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, major shareholder Millennium Gst Non-Exempt Rbc sold 220,000 shares of the company's stock in a transaction on Friday, August 22nd. The stock was sold at an average price of $46.45, for a total value of $10,219,000.00. The disclosure for this sale can be found here. Insiders have sold 490,348 shares of company stock valued at $25,157,458 in the last ninety days. Corporate insiders own 0.60% of the company's stock.

About Symbotic

(

Free Report)

Symbotic Inc, an automation technology company, engages in developing technologies to improve operating efficiencies in modern warehouses. The company automates the processing of pallets and cases in large warehouses or distribution centers for retail companies. Its systems enhance operations at the front end of the supply chain.

Recommended Stories

Want to see what other hedge funds are holding SYM? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Symbotic Inc. (NASDAQ:SYM - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Symbotic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Symbotic wasn't on the list.

While Symbotic currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.