Picton Mahoney Asset Management purchased a new position in shares of Howard Hughes Holdings Inc. (NYSE:HHH - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 20,432 shares of the company's stock, valued at approximately $1,514,000.

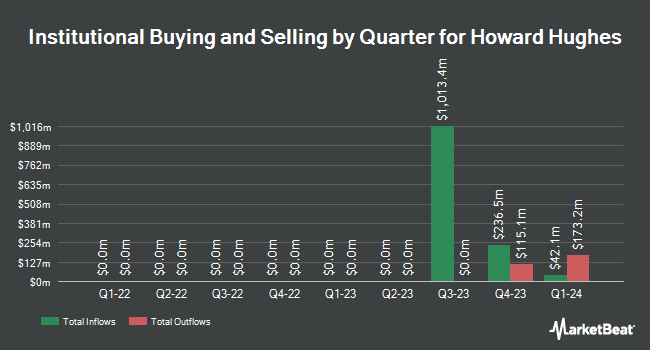

Several other large investors have also modified their holdings of the stock. Larson Financial Group LLC lifted its position in shares of Howard Hughes by 2,290.9% in the first quarter. Larson Financial Group LLC now owns 526 shares of the company's stock valued at $39,000 after acquiring an additional 504 shares in the last quarter. SBI Securities Co. Ltd. grew its stake in shares of Howard Hughes by 14,500.0% in the first quarter. SBI Securities Co. Ltd. now owns 876 shares of the company's stock valued at $65,000 after buying an additional 870 shares in the last quarter. Huntington National Bank grew its stake in shares of Howard Hughes by 335.5% in the fourth quarter. Huntington National Bank now owns 932 shares of the company's stock valued at $72,000 after buying an additional 718 shares in the last quarter. Whittier Trust Co. acquired a new stake in shares of Howard Hughes in the first quarter valued at about $161,000. Finally, Mirae Asset Global Investments Co. Ltd. grew its stake in Howard Hughes by 116.7% during the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,340 shares of the company's stock valued at $174,000 after purchasing an additional 1,260 shares in the last quarter. Hedge funds and other institutional investors own 93.83% of the company's stock.

Analysts Set New Price Targets

A number of equities research analysts have recently weighed in on HHH shares. JPMorgan Chase & Co. downgraded Howard Hughes from an "overweight" rating to a "neutral" rating and lowered their price target for the company from $82.00 to $76.00 in a report on Monday, June 23rd. Piper Sandler cut their target price on Howard Hughes from $105.00 to $85.00 and set an "overweight" rating on the stock in a research report on Friday, May 23rd. Finally, BMO Capital Markets dropped their price target on Howard Hughes from $85.00 to $80.00 and set an "outperform" rating on the stock in a research report on Wednesday, May 7th.

Get Our Latest Stock Analysis on Howard Hughes

Howard Hughes Trading Down 1.5%

HHH traded down $1.06 during mid-day trading on Friday, reaching $67.67. The stock had a trading volume of 455,563 shares, compared to its average volume of 381,942. Howard Hughes Holdings Inc. has a 52 week low of $59.83 and a 52 week high of $87.77. The company has a debt-to-equity ratio of 1.84, a quick ratio of 1.41 and a current ratio of 1.41. The stock has a market capitalization of $3.41 billion, a P/E ratio of 12.99 and a beta of 1.22. The firm's fifty day simple moving average is $68.96 and its two-hundred day simple moving average is $71.10.

Howard Hughes (NYSE:HHH - Get Free Report) last released its earnings results on Wednesday, May 7th. The company reported $0.21 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.13 by $0.08. Howard Hughes had a return on equity of 10.21% and a net margin of 14.27%. The business had revenue of $199.33 million for the quarter, compared to the consensus estimate of $187.43 million. The company's quarterly revenue was up 27.3% on a year-over-year basis. On average, equities analysts predict that Howard Hughes Holdings Inc. will post 3.7 EPS for the current year.

Howard Hughes Company Profile

(

Free Report)

Howard Hughes Holdings Inc, together with its subsidiaries, operates as a real estate development company in the United States. It operates in four segments: Operating Assets; Master Planned Communities (MPCs); Seaport; and Strategic Developments. The Operating Assets segment consists of developed or acquired retail, office, and multi-family properties along with other retail investments.

Further Reading

Before you consider Howard Hughes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Howard Hughes wasn't on the list.

While Howard Hughes currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.