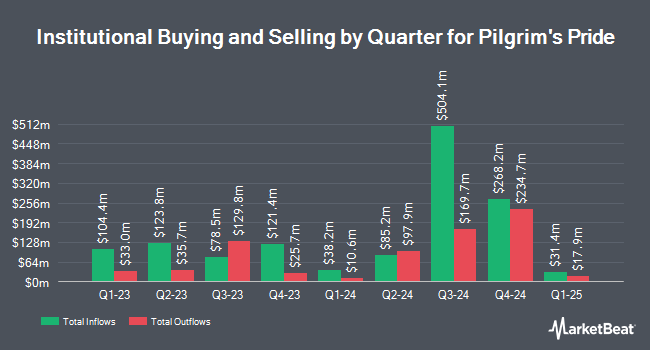

AQR Capital Management LLC lifted its position in shares of Pilgrim's Pride Corporation (NASDAQ:PPC - Free Report) by 25.9% in the first quarter, according to its most recent disclosure with the SEC. The institutional investor owned 2,370,927 shares of the company's stock after buying an additional 487,219 shares during the quarter. AQR Capital Management LLC owned about 1.00% of Pilgrim's Pride worth $128,599,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors also recently modified their holdings of the company. Allspring Global Investments Holdings LLC lifted its holdings in shares of Pilgrim's Pride by 18.2% during the first quarter. Allspring Global Investments Holdings LLC now owns 56,066 shares of the company's stock worth $3,154,000 after buying an additional 8,638 shares in the last quarter. GAMMA Investing LLC lifted its holdings in shares of Pilgrim's Pride by 18.6% during the first quarter. GAMMA Investing LLC now owns 3,189 shares of the company's stock worth $174,000 after buying an additional 501 shares in the last quarter. Wealth Enhancement Advisory Services LLC bought a new position in shares of Pilgrim's Pride in the first quarter worth $355,000. LPL Financial LLC increased its position in shares of Pilgrim's Pride by 135.2% in the first quarter. LPL Financial LLC now owns 98,394 shares of the company's stock worth $5,363,000 after purchasing an additional 56,568 shares during the period. Finally, KBC Group NV bought a new position in shares of Pilgrim's Pride in the first quarter worth $144,000. Institutional investors and hedge funds own 16.64% of the company's stock.

Pilgrim's Pride Price Performance

Pilgrim's Pride stock traded down $1.30 during midday trading on Wednesday, reaching $42.36. The company's stock had a trading volume of 490,548 shares, compared to its average volume of 1,309,585. Pilgrim's Pride Corporation has a 52 week low of $40.09 and a 52 week high of $57.16. The company has a current ratio of 1.63, a quick ratio of 0.88 and a debt-to-equity ratio of 0.83. The business has a 50-day moving average price of $46.43 and a 200-day moving average price of $48.78. The stock has a market cap of $10.06 billion, a PE ratio of 8.16 and a beta of 0.50.

Pilgrim's Pride (NASDAQ:PPC - Get Free Report) last released its earnings results on Wednesday, July 30th. The company reported $1.70 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.54 by $0.16. Pilgrim's Pride had a return on equity of 37.15% and a net margin of 6.81%.The firm had revenue of $4.76 billion for the quarter, compared to analysts' expectations of $4.62 billion. During the same quarter in the previous year, the business posted $1.67 earnings per share. The business's revenue for the quarter was up 4.3% on a year-over-year basis. On average, sell-side analysts predict that Pilgrim's Pride Corporation will post 5.13 EPS for the current year.

Pilgrim's Pride Dividend Announcement

The firm also recently announced a special dividend, which was paid on Wednesday, September 3rd. Shareholders of record on Wednesday, August 20th were given a $2.10 dividend. The ex-dividend date was Wednesday, August 20th.

Wall Street Analyst Weigh In

PPC has been the topic of a number of recent analyst reports. Wall Street Zen upgraded Pilgrim's Pride from a "buy" rating to a "strong-buy" rating in a research report on Friday, September 5th. The Goldman Sachs Group initiated coverage on Pilgrim's Pride in a research report on Monday, June 23rd. They issued a "neutral" rating and a $50.00 price target on the stock. Five equities research analysts have rated the stock with a Hold rating, According to MarketBeat, Pilgrim's Pride has an average rating of "Hold" and an average target price of $47.50.

Get Our Latest Research Report on Pilgrim's Pride

Pilgrim's Pride Company Profile

(

Free Report)

Pilgrim's Pride Corp. engages in the production, processing, marketing, and distribution of fresh, frozen and value-added chicken and pork products to retailers, distributors, and foodservice operators. It operates through the following segments: U.S., U.K. and Europe, and Mexico. The company was founded by Lonnie A.

Further Reading

Before you consider Pilgrim's Pride, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pilgrim's Pride wasn't on the list.

While Pilgrim's Pride currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.