Pinnacle Associates Ltd. decreased its position in Sinclair, Inc. (NASDAQ:SBGI - Free Report) by 3.2% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 548,075 shares of the company's stock after selling 17,897 shares during the quarter. Pinnacle Associates Ltd. owned approximately 0.82% of Sinclair worth $8,731,000 at the end of the most recent quarter.

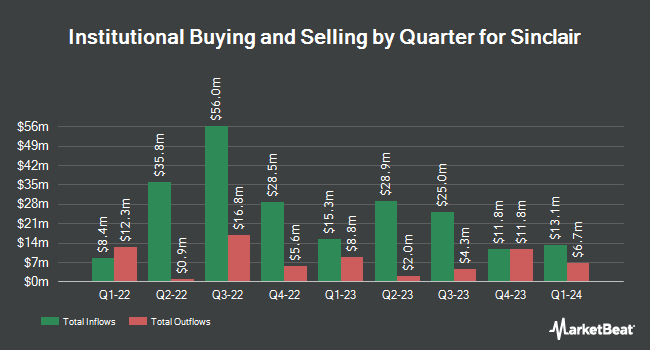

Several other hedge funds and other institutional investors also recently modified their holdings of SBGI. Kennondale Capital Management LLC purchased a new position in Sinclair during the first quarter valued at $1,718,000. DekaBank Deutsche Girozentrale purchased a new position in shares of Sinclair in the 1st quarter worth $58,000. Envestnet Asset Management Inc. lifted its holdings in shares of Sinclair by 9.2% in the 1st quarter. Envestnet Asset Management Inc. now owns 124,298 shares of the company's stock worth $1,980,000 after acquiring an additional 10,485 shares during the last quarter. Kendall Capital Management lifted its holdings in shares of Sinclair by 61.6% in the 1st quarter. Kendall Capital Management now owns 28,075 shares of the company's stock worth $447,000 after acquiring an additional 10,705 shares during the last quarter. Finally, Verity Asset Management Inc. bought a new stake in shares of Sinclair in the 1st quarter worth about $185,000. Hedge funds and other institutional investors own 41.71% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently issued reports on the stock. Benchmark dropped their target price on shares of Sinclair from $30.00 to $29.00 and set a "buy" rating for the company in a report on Tuesday, May 6th. Guggenheim reiterated a "buy" rating on shares of Sinclair in a research note on Thursday, May 15th. Wall Street Zen lowered shares of Sinclair from a "hold" rating to a "sell" rating in a research report on Monday, May 12th. Finally, JPMorgan Chase & Co. cut their price target on Sinclair from $14.00 to $13.00 and set an "underweight" rating for the company in a research note on Wednesday, May 21st. Two investment analysts have rated the stock with a sell rating, two have issued a hold rating and two have given a buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Hold" and an average target price of $18.50.

View Our Latest Report on SBGI

Sinclair Trading Down 0.5%

Shares of Sinclair stock traded down $0.08 on Friday, reaching $14.91. The company had a trading volume of 361,421 shares, compared to its average volume of 436,625. Sinclair, Inc. has a 52-week low of $12.06 and a 52-week high of $18.45. The firm's 50 day moving average price is $14.13 and its two-hundred day moving average price is $14.61. The firm has a market cap of $1.04 billion, a PE ratio of 7.42 and a beta of 1.30. The company has a debt-to-equity ratio of 11.32, a quick ratio of 2.08 and a current ratio of 2.08.

Sinclair (NASDAQ:SBGI - Get Free Report) last issued its earnings results on Wednesday, May 7th. The company reported ($2.18) earnings per share (EPS) for the quarter, missing the consensus estimate of ($1.78) by ($0.40). The company had revenue of $776.00 million during the quarter, compared to analyst estimates of $774.79 million. Sinclair had a net margin of 3.72% and a return on equity of 34.15%. The company's quarterly revenue was down 2.8% on a year-over-year basis. During the same quarter in the previous year, the company posted $0.35 EPS. Sell-side analysts predict that Sinclair, Inc. will post 4.24 earnings per share for the current fiscal year.

Sinclair Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Friday, June 13th. Stockholders of record on Friday, May 30th were paid a dividend of $0.25 per share. The ex-dividend date of this dividend was Friday, May 30th. This represents a $1.00 dividend on an annualized basis and a dividend yield of 6.71%. Sinclair's dividend payout ratio is currently 49.75%.

Sinclair Company Profile

(

Free Report)

Sinclair, Inc, a media company, provides content on local television stations and digital platforms in the United States. It operates through two segments, Local Media and Tennis. The Local Media segment operates broadcast television stations, original networks, and content; provides free-over-the-air programming and live local sporting events on its stations; distributes its content to multi-channel video programming distributors in exchange for contractual fees; and produces local and original news programs.

See Also

Before you consider Sinclair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sinclair wasn't on the list.

While Sinclair currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.